If you’re in poor health of listening to about synthetic intelligence (AI) on Wall Boulevard, I’ve some dangerous information. This theme is not likely to depart anytime quickly. The marketplace is amazingly vast, spanning applied sciences like voice popularity, robotics, device studying (ML), herbal language processing, self reliant cars, and extra.

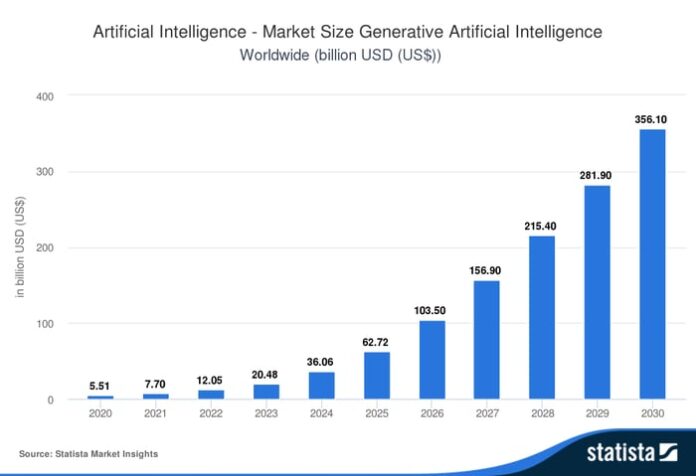

The sector of man-made intelligence will have a blended annual marketplace of over $800 billion by way of 2030, in line with Statista. Generative AI — as utilized in ChatGPT, Perplexity, and Alphabet’s Gemini — could also be anticipated to develop at a breakneck tempo. For viewpoint, Microsoft and Nvidia had blended gross sales of $367 billion over the past one year.

Symbol supply: Statista.

It is simple to look why firms are scrambling for a bit of this marketplace, and buyers are following go well with. The keenness despatched some shares hovering in 2024. As I write this, Palantir Applied sciences (PLTR 2.09%) inventory is up 335% yr to this point, whilst SoundHound AI (SOUN -0.93%) has received an astounding 811%.

Will this proceed in 2025? Right here are some things to imagine.

Why SoundHound AI inventory is hovering

Automatic ordering on the drive-thru and fast-casual eating places is coming to a the city close to you. There are too many cost-saving incentives for companies to not make the transition now or within the close to long term. Extra refined voice-recognition digital assistants also are going into new cars. The generation lets in for conversational conversation and pulls solutions from an unlimited database.

For example, you’ll ask for instructions to the highest-rated within reach Italian eating place inside 10 miles, what the elements might be like at 5 p.m. on Saturday, or what probably the most scenic course is.

SoundHound’s proprietary generation powers those platforms, and the corporate continues to win new consumers, riding the inventory to all-time highs. In December by myself, Church’s Hen piloted the generation at some places, and Torchy’s Tacos carried out SoundHound’s Voice AI telephone ordering device in any respect places.

Income larger 89% yr over yr in Q3 to $25 million. SoundHound expects overall gross sales of $82 million to $85 million in 2024, probably doubling this to $155 million to $175 million in 2025.

The expansion is improbable, however SoundHound isn’t successful or generating sure money go with the flow from its operations. The corporate reported an running lack of $84 million and a $76 million running money go with the flow loss via 3 quarters of 2024. Losses are not odd for a fast-growing tech corporate, however buyers must know the chance.

SoundHound inventory’s improbable run is pushing valuation obstacles to an excessive point. As proven under, the inventory trades for over 90 occasions gross sales and 45 occasions the 2025 analyst forecast.

SOUN PS Ratio knowledge by way of YCharts

Those ratios are extremely excessive for any corporate — and undoubtedly for an unprofitable one. This does not make SoundHound a nasty inventory to possess longer term, however echoes of the 2021 tech bubble are showing out there. I used to be bullish at the inventory lately, however a lot much less so after the terrific run. Patrons of SoundHound on the present value must be expecting some drastic swings in the cost over the following couple of years.

Is Palantir inventory a excellent purchase now?

Palantir, every other AI highflier, noticed a vital spice up because of its Synthetic Intelligence Platform (AIP). AIP makes use of generative AI to assimilate knowledge and help with making high-level choices by way of interacting with other folks in protection and the personal sector conversationally.

One instance that Palantir offers is a wholesale corporate that may revel in downtime in a single location because of inclement climate. AIP assists with figuring out the optimum rerouting and appearing the have an effect on on income. In every other instance for the protection sector, suppose a adverse pressure is collecting close to a border. AIP can display the assets to be had to the commander and counsel imaginable enemy formations.

Those spectacular options spurred Palantir’s industrial and overall buyer expansion, as proven under.

Symbol supply: Palantir.

Overall gross sales reached $726 million in Q3, a 30% build up, and Palantir’s running source of revenue soared from $40 million to $113 million yr over yr, appearing the luck of the AIP product.

The inventory has a marketplace capitalization of $169 billion, or 60 occasions gross sales steering for 2024. Whilst the valuation is extra palatable than SoundHound’s, it’s certainly not a worth. Each firms are doing thrilling issues in AI and seem like long-term winners. Even if there may be substantial drawback chance, the shares may proceed to upward push in 2025 — however do not be expecting the similar exponential features as this yr.

Do not agonize if you happen to neglected the impressive features, there are heaps of superb firms to spend money on. An important dip may come anytime, and AI has a protracted runway.

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Bradley Guichard has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Alphabet, Microsoft, Nvidia, and Palantir Applied sciences. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.