Palantir Applied sciences (PLTR 1.56%) has been one of the vital top-performing shares this yr. The corporate’s robust effects ended in the inventory’s inclusion at the S&P 500, and now it has moved to the Nasdaq inventory change, the place it will quickly sign up for the much more unique Nasdaq 100 index.

May this change into but every other catalyst that pushes this high-powered synthetic intelligence (AI) inventory even upper?

Why the transfer may well be massively sure for Palantir’s inventory

To start with look, Palantir’s transfer from the New York Inventory Trade to Nasdaq would possibly not appear to be a large transfer since many peak enlargement shares are on each exchanges.

However what has buyers excited is the potential of it to be added to the Nasdaq 100 index, which incorporates the biggest nonfinancial shares at the change. And with many shares at the Nasdaq 100 buying and selling with marketplace caps of not up to $100 billion, it will have to be a slam dunk for Palantir, which is value greater than $145 billion, to make it onto the index.

That is important as a result of if it is within the index, it is going to imply the inventory is incorporated in additional exchange-traded budget and portfolios. All that purchasing may just inevitably ship the inventory’s price even upper. The addition to the index can also be a super signal of the knowledge analytics corporate’s mammoth good fortune over time, and validation of its efforts and robust enlargement.

As a peak era and AI inventory, Palantir may just additionally change into extra well liked by any individual who is probably not that conversant in its trade. It is exhausting to believe many buyers no longer being acutely aware of one in every of the most up to date enlargement shares at the markets this yr, however being on a extremely recognizable index can draw in much more consideration to Palantir.

Why it isn’t a lock for Palantir to proceed rallying upper

Whilst extra buyers might understand Palantir, what a lot of them may even pay shut consideration to is the inventory’s extraordinarily excessive valuation. With any such huge marketplace cap, the inventory is buying and selling at 58 instances the income it has generated over the last 365 days and greater than 320 instances the benefit it posted. There is not any valuation a couple of that stands proud with Palantir that may assist justify its present ticket.

Many buyers seem to be keen to shop for it only for the expectancy that it is going to move upper, simply because this can be a scorching AI inventory. It is a speculative reason why and in all probability one of the vital highest examples of the Better Idiot Concept in impact presently.

However consideration will also be each sure and unfavourable. And as Palantir crosses extra buyers’ radars they usually understand its excessive valuation, their handiest transfer is not essentially to shop for the inventory. They may quick it as neatly — and quick passion in Palantir has been selecting up of past due.

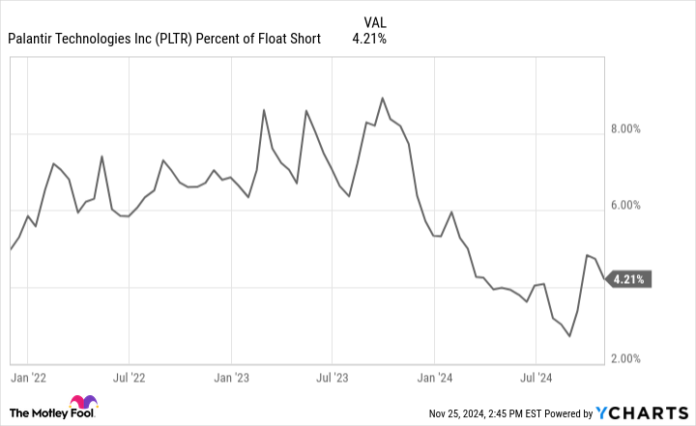

PLTR percent of float short; information via YCharts.

Brief passion has been coming down lately as the corporate has became a benefit and sped up its enlargement. However now, with its valuation spiking to egregious ranges, short-selling has been emerging once more, and it would not be sudden to peer extra buyers guess in opposition to Palantir within the close to long term.

And via including any such extremely priced inventory into the Nasdaq 100, the index turns into costlier, which might flip some buyers away.

So do not think that via gaining extra visibility, Palantir will generate surefire positive factors for individuals who purchase it nowadays.

Forget about Palantir’s excessive valuation at your individual chance

Even though the corporate appears to be proving each doubter unsuitable this present day with its hovering proportion value, the chance is that anybody purchasing the inventory with out regard for its basics may well be left protecting an overly pricey bag.

Palantir’s trade is doing neatly; there is not any query about that. But if put into context with its profits and income numbers, the valuation simply does not make any sense at this level.

And when that occurs, you might be in dangerous territory as a result of all it’s going to take is for one domino to fall — whether or not it is within the tech sector or the AI global, or an underwhelming profits record from the corporate — and stocks of this extremely valued inventory may just briefly come crashing down.

David Jagielski has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot recommends Nasdaq. The Motley Idiot has a disclosure coverage.