BigBear.ai has captured investor consideration with unbelievable beneficial properties in 2024. Is it a wise purchase for the approaching 12 months, although?

Information analytics knowledgeable BigBear.ai (BBAI -7.48%) has been hovering in 2024. At the morning of New Yr’s Eve, the inventory used to be up through 128% in 52 weeks. Inquisitive minds (and growth-hungry buyers) wish to know if the beneficial properties can proceed in 2025 and past.

So let’s check out BigBear.ai and its progress potentialities. Is that this a super synthetic intelligence (AI) inventory to shop for in early 2025?

What’s BigBear.ai?

BigBear.ai is not a mythical family identify, although its core trade has been round for the reason that Eighties.

The present type of this corporate got here in combination in 2020, when a unique objective acquisition corporate (SPAC) named Lake Acquisition obtained a number of AI-based trade intelligence corporations. This preliminary splurge incorporated the makers of well known tool such because the ProModel procedure simulation bundle, along the Open Answers Crew’s tech consulting products and services. A few of these operations had been based within the overdue Eighties and early Nineties.

The ensuing group supplies AI-driven information analytics products and services for healthcare, executive, and heavy development companies. The U.S. Military, Army, and Air Drive are 3 of the corporate’s biggest purchasers. Its programs assist folks organize and prepare apparatus and different assets on a big scale, continuously on tight time schedules.

If my description of BigBear.ai sounds so much like C3.ai (AI -2.44%) or Palantir Applied sciences (PLTR -2.01%), you are on track. Those corporations are continuously discovered bidding at the similar contracts. Automated fortify for the protection sector is a big and thriving marketplace, and BigBear.ai is a diverse corporate with vital pursuits in different progress sectors.

BigBear.ai and its leader opponents, through the numbers

The direct comparability to C3.ai and Palantir raises some essential questions on BigBear.ai. The corporate addresses some essential markets, however how huge and a hit is the trade to this point?

Here is how BigBear.ai compares to its core competition at the moment:

Metric

BigBear.ai

Palantir

C3.ai

Marketplace cap

$1.14 billion

$174.5 billion

$4.56 billion

One-year inventory efficiency

114%

347%

23%

Revenues (TTM)

$155.0 million

$2.65 billion

$346.5 million

Adjusted web source of revenue (loss)

($57.5 million)

$476.6 million

($274.4 million)

Information supply: Amassed from Finviz and YCharts on Dec. 31, 2024. TTM = trailing three hundred and sixty five days.

BigBear.ai is the smallest identify on this staff. The inventory has soared lately, however could not stay tempo with Palantir’s large beneficial properties.

You must observe that BigBear.ai’s fresh payment beneficial properties were not motivated through robust trade effects or new contract bulletins. Certainly, the inventory fell just about 11% within the days after its newest income record, which met Wall Boulevard’s bottom-line expectancies however fell quick towards their consensus income objectives.

As an alternative, the inventory has surged principally because of sure developments out there for trade intelligence and AI gear as an entire. A few of BigBear.ai’s largest jumps in fresh months had been in fact impressed through just right information from Palantir.

Is BigBear.ai a purchase as of late?

Would I dare to shop for or counsel BigBear.ai’s inventory as of late? The stocks glance inexpensive at 7.2 instances gross sales (a long way under C3.ai’s stocks buying and selling at 13.2x and Palantir at 66.1x gross sales), however the corporate could also be deeply unprofitable and saddled with a heavy debt load.

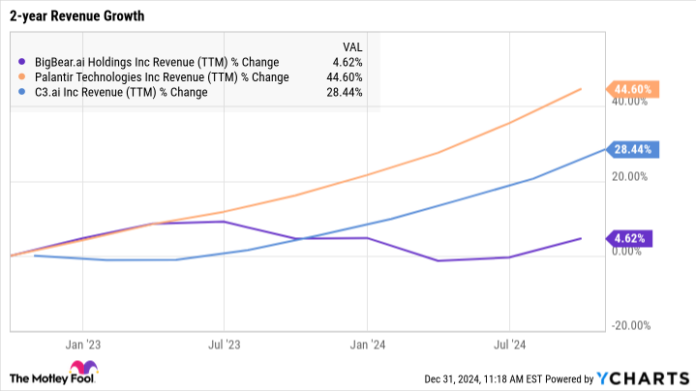

It is truthful to mention that the entire sector is riddled with profit-based dangers, as even Palantir’s money device trades at extraordinarily lofty price-to-earnings ratios. However it is typically as much as the underdog in such situations to earn its shareholder returns thru stellar top-line progress, and BigBear.ai trails in the back of its higher competition on this class, too:

BBAI Revenue (TTM) information through YCharts

All issues thought to be, I would quite steer clear of BigBear.ai inventory at the moment. The corporate is suffering in tactics I would quite watch from the sidelines, no less than throughout the spring of 2025. Palantir and C3.ai is also extra smart choices for AI-focused progress buyers, and there are lots of alternative ways to faucet into the AI alternative on this marketplace.

Anders Bylund has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot recommends C3.ai. The Motley Idiot has a disclosure coverage.