Stocks of Walgreens Boots Alliance (WBA 2.86%) fell sharply ultimate 12 months as a mix of declining vaccine call for, headwinds on client discretionary spending, and faulty acquisitions ended in a chain of dismal income studies from the corporate.

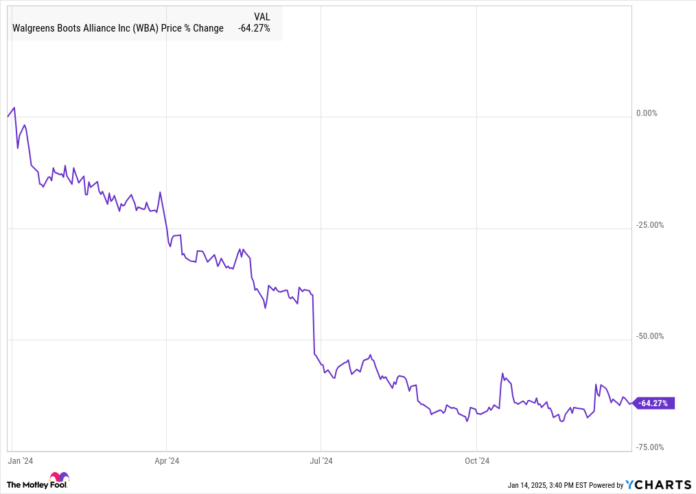

Because of this, Walgreens used to be pressured to chop its dividend, took a multibillion-dollar impairment rate, and misplaced its position within the Dow Jones Business Moderate (^DJI 0.52%). In keeping with knowledge from S&P Global Market Intelligence, the inventory fell 64% over the process 2024. As you’ll see from the chart, the inventory fell often over lots of the 12 months as its possibilities endured to say no.

WBA knowledge by means of YCharts

Why Walgreens collapsed

Walgreens fell often throughout the first 3 quarters of the 12 months as the corporate ignored estimates and reduce steerage, and Wall Boulevard’s view of the inventory soured. By way of the fourth quarter, the inventory gave the impression to stabilize, however it had but to turn indicators of restoration.

The lowlights began early for Walgreens, because it stated it used to be reducing its dividend early in January when it reported first-quarter income. The corporate slashed its dividend by means of 48% to $0.25 1 / 4, which it stated used to be a part of a focal point on right-sizing prices and lengthening money glide. It additionally maintained its adjusted income consistent with proportion steerage on the time at $3.20-$3.50.

Within the second-quarter record, out on the finish of March, Walgreens dropped some other bomb on buyers, taking a $5.8 billion goodwill impairment on VillageMD. It got the main care and pressing care industry in an effort to diversify and vertically combine, however it is turn out to be transparent that it a great deal overpaid the industry. Walgreens paid $5.2 billion in 2021 to extend its stake in VillageMD from 30% to 63%, regardless that its expansion technique within the industry didn’t pan out. It additionally narrowed its adjusted EPS steerage to $3.20-$3.35 within the quarter.

Walgreens’ worst day of the 12 months got here on June 27, when the inventory fell 22% on some other disappointing income record. This time, it slashed its full-year EPS steerage to $2.80-$2.95 because of difficult pharmacy trade traits and a susceptible client atmosphere.

Symbol supply: Getty Pictures.

What is subsequent for Walgreens?

Nearly the whole thing that would pass flawed for Walgreens ultimate 12 months did, however it confirmed indicators of restoration in its first-quarter income record previous this month. Whilst control expects adjusted income consistent with proportion of simply $1.40-$1.80 this 12 months, the industry has gave the impression to stabilize, and the highest line is rising.

For dividend buyers, Walgreens is interesting at this time, providing a dividend yield of 10.9%, which must be secure if the industry has stabilized.

Jeremy Bowman has no place in any of the shares discussed. The Motley Idiot has no place in any of the shares discussed. The Motley Idiot has a disclosure coverage.