Stocks of Ulta Good looks (ULTA -3.07%) had been mountaineering larger final month after the wonder superstore chain posted better-than-expected leads to its third-quarter income record, appearing growth on the base line, and that the worst of its market-share losses gave the look to be in the back of it.

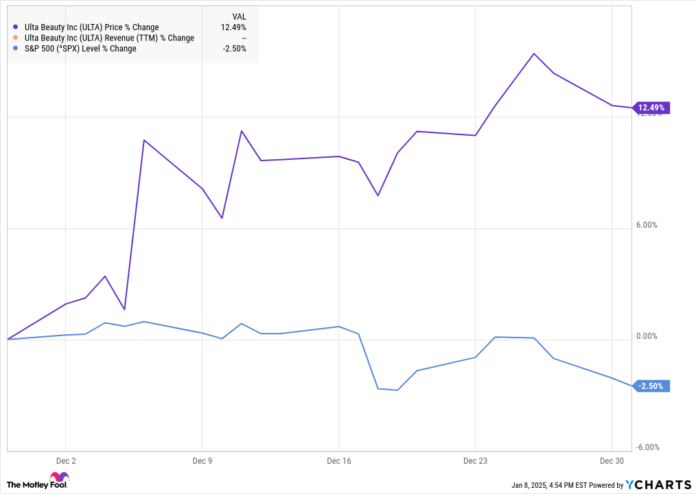

In step with information from S&P Global Market Intelligence, the inventory completed the month up 13%. As you’ll see from the chart, the inventory jumped early within the month at the income record and controlled so as to add on positive factors later within the month, even because the huge marketplace pulled again.

ULTA information by way of YCharts

Ulta presentations indicators of a comeback

Ulta’s third-quarter income record wasn’t precisely stellar, however confirmed the corporate shifting previous earlier demanding situations and doing a greater process of managing prices. The inventory jumped 9% at the information.

Similar gross sales within the quarter rose 0.6%, lifting earnings up 1.7% to $2.53 billion, which beat estimates at $2.5 billion. Similar gross sales had been pushed by way of a zero.5% building up in transactions, indicating that site visitors used to be fairly advanced.

Internet source of revenue used to be down fairly from $249.5 million to $242.2 million, even though income according to percentage rose from $5.07 to $5.14 as the corporate’s lowered stocks remarkable by way of greater than 4% during the last yr from percentage buybacks. That used to be a lot better than estimates at $4.52, appearing that traders had been pleased with mainly flat enlargement.

Ulta additionally raised its full-year steerage. The corporate now expects earnings of $11.1 billion to $11.2 billion, up from a prior vary of $11 billion to $11.2 billion, and sees adjusted income according to percentage of $23.20 to $23.75, in comparison to its previous forecast of $22.60 to $23.50.

The replace turns out to replicate the luck of its turnaround plan, which contains making improvements to its product collection and buyer enjoy, and leveraging its loyalty program.

Wall Boulevard most often cheered the income record, elevating its worth goals at the inventory, and it constructed on that momentum over the remainder of the month — even after the marketplace used to be rattled by way of the Federal Reserve’s higher-for-longer rate of interest forecast.

Symbol supply: Getty Pictures.

What is subsequent for Ulta?

The wonder chain dealt traders any other wonder in January, pronouncing on Jan. 6 that CEO Dave Kimbell is retiring, to get replaced by way of Kecia Steelman, who up to now served as COO.

The corporate additionally gave a bullish replace at the fourth quarter, announcing that it now expects similar gross sales to extend modestly in This fall and running margin shall be above its up to now forecasted vary of eleven.6% to twelve.4%, sending the inventory in short larger.

In line with the momentum in This fall, the cosmetics inventory may well be in retailer for a powerful restoration in 2025.

Jeremy Bowman has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Ulta Good looks. The Motley Idiot has a disclosure coverage.