Gold shares might be one of the crucial few techniques to hedge your portfolio amid the continued tariff turmoil.

Gold shares had been a few of the height gainers within the markets nowadays, with stocks of a few gold miners even rallying by way of double-digit percentages right through the day. Listed here are some top-performing gold shares and their intraday highs as of two p.m. ET Wednesday.

Team spirit Gold Mining (HMY 14.57%): Up 15.3%

Iamgold Corp (IAG 12.31%): Up 13.8%

AngloGold Ashanti (AU 10.37%): Up 11.6%

Whilst those 3 shares have a marketplace capitalization below $20 billion each and every, stocks of the second-largest gold corporate, Newmont Company (NEM 8.36%), traded on heavy volumes nowadays and logged an intraday prime of 8.8% as of this writing. With a marketplace cap of $52.2 billion, Newmont Company is the sector’s second-largest gold corporate.

Gold costs had been up greater than 3% this morning as worried buyers flocked to the yellow steel amid the tariff-induced inventory marketplace sell-off. In case you are questioning why price lists are sending gold costs and gold shares upper, all of it boils all the way down to gold’s enchantment as a safe-haven asset all through instances of uncertainty.

Why gold shares are rallying on price lists

President Donald Trump caused a business warfare ultimate week when he introduced reciprocal price lists on greater than 180 international locations and adopted them up with further price lists on international locations like China. With China already pronouncing hefty retaliatory price lists, buyers around the globe worry this may get uglier and cause a recession.

Gold usually plays neatly all through a recession and even unstable instances when inventory markets fall, as buyers continuously flock to gold and gold shares to hedge their portfolios.

Since gold costs at once have an effect on gold miners’ height and backside traces, gold shares rallied nowadays. Significantly, maximum of nowadays’s top-performing gold shares have delivered robust operational performances in recent years and are fortifying their stability sheets.

2025 is usually a giant yr for some gold shares

Team spirit Gold, for example, operates in South Africa, Papua New Guinea, and Australia. Regardless of a 4% drop in manufacturing, Team spirit Gold’s earnings rose 19%, web source of revenue surged 33%, and coins move from operations (CFO) jumped 46% yr over yr all through the six months ended Dec. 31, 2024. The gold miner additionally will pay a dividend that yields 1.3%.

With regards to dividends, AngloGold Ashanti is one step forward, due to a brand new dividend coverage below which it’s focused on a free-cash-flow (FCF) payout of fifty% yearly on height of a base annual dividend of $0.50 consistent with percentage. So, in 2024, it declared a complete dividend of $0.91 consistent with percentage. Out of doors of the U.S., AngloGold has operations in Africa and Australia. AngloGold’s earnings jumped 26% in 2024, pushed by way of upper gold costs, and its coins flows surged because it became a web benefit of $1 billion within the yr as opposed to a web lack of $222 million in 2023. AngloGold inventory yields a cast 4.1%.

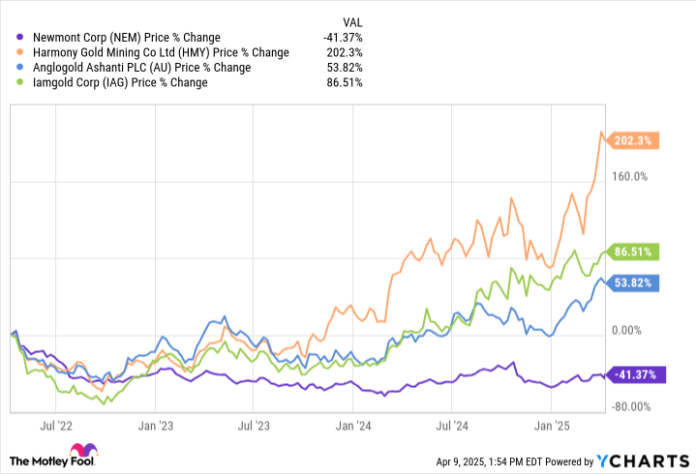

NEM knowledge by way of YCharts.

Iamgold is a moderately smaller gold miner, however 2024 was once a banner yr for the corporate with mines in North The united states and West Africa. Iamgold’s gold manufacturing surged 43%, and earnings jumped 65% to a file prime of $1.6 billion in 2024. The miner tasks 10% to 22% enlargement in gold manufacturing for 2025 because it ramps up its Cote gold challenge mine, anticipated to be one in every of Canada’s biggest gold mines at complete capability.

Newmont Mining is the sector’s biggest gold manufacturer, however prime prices stay a priority for the gold miner. Nevertheless, Newmont earned a web source of revenue of $3.4 billion in 2024 as opposed to a web lack of $2.5 billion in 2023 and generated $6.3 billion in CFO. Its overdue 2023 acquisition of Newcrest has added considerably to Newmont’s gold and copper reserves. Newmont expects to generate as much as $4.3 billion from the sale of noncore property in 2025. The inventory will pay a dividend yielding 2.2%.

With gold costs emerging considerably this yr and in a transparent uptrend amid the tariff and business wars, 2025 is usually a giant yr for some of these gold mining corporations. Subsequently, purchasing some gold shares now amid the inventory marketplace volatility is usually a good wager.

Neha Chamaria has no place in any of the shares discussed. The Motley Idiot has no place in any of the shares discussed. The Motley Idiot has a disclosure coverage.