Robinhood (HOOD 8.28%) has had its justifiable share of scrutiny, however the corporate has grew to become issues round lately, and its development used to be onerous to forget about in 2024. Throughout that 12 months, Robinhood inventory jumped 192.5%, in keeping with information from S&P Global Market Intelligence.

The corporate has accomplished a just right activity diversifying its choices and attracting extra buyers to its platform. Here is what buyers want to find out about its efficiency and what is subsequent for the fintech.

Robinhood has accomplished a stellar activity attracting capital

Thru November, Robinhood had 24.8 million funded shoppers, a forged building up of 6% 12 months over 12 months. However what is extra spectacular is the volume of capital it has drawn to its platform. In simply 365 days, Robinhood’s property below custody (AUC), the property it holds on behalf of shoppers, ballooned to $194.6 billion, a 106% building up from 365 days previous.

Robinhood has succeeded in attracting shoppers to its platform with its interesting annual share yield, which crowned out round 5% closing 12 months. This prime yield is to be had simplest to its Robinhood Gold shoppers, who pay a $5 per month subscription.

Robinhood prefers Gold individuals as a result of the routine earnings and since those customers are a lot more lively on its platform. In step with CFO Jason Warnick, Gold subscribers have 8 instances extra property, generate considerably extra reasonable earnings in keeping with consumer, and undertake retirement accounts 5 instances as regularly.

The corporate has additionally taken steps to draw extra property through providing conventional person retirement accounts (IRAs) and Roth IRAs. It additionally fits contributions, 1% for purchasers or as much as 3% for the ones with Robinhood Gold.

Retirement accounts were a large draw. The selection of shoppers with those accounts has grown from 390,000 within the 3rd quarter of 2022 to 940,000 in the newest 3rd quarter. In the meantime, the AUC in retirement accounts ballooned from $1.1 billion to $9.9 billion.

What is subsequent for Robinhood?

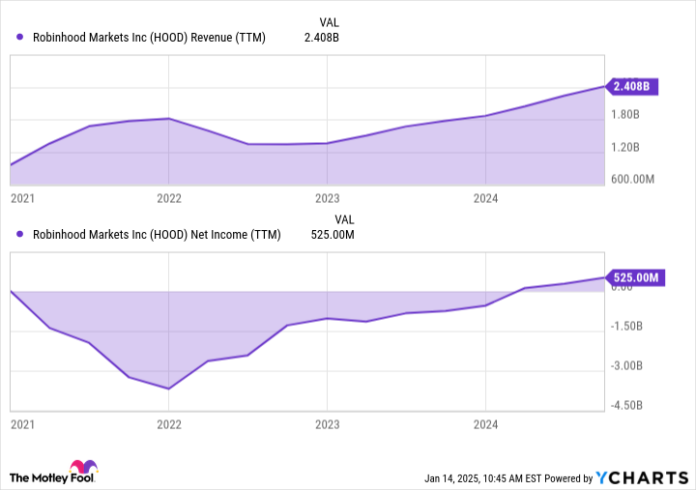

Robinhood has navigated tough instances and posted 4 consecutive quarters of benefit in keeping with typically permitted accounting rules. It’ll proceed to concentrate on rising its retirement account choices and AUC, which is able to lend a hand supply it with a powerful capital base.

HOOD Revenue (TTM) information through YCharts

And the corporate continues to innovate. It has presented Robinhood Legend, a desktop suite of making an investment equipment, and introduced that it’s going to get started providing index choices and futures.

Following the inventory’s surge, it’s priced at 73 instances income and 29.5 instances this 12 months’s forecasted income. Whilst the inventory seems dear, it’s rising at a pleasing clip and attracting more youthful consumers, making it an intriguing inventory for competitive, growth-focused buyers.

Courtney Carlsen has no place in any of the shares discussed. The Motley Idiot has no place in any of the shares discussed. The Motley Idiot has a disclosure coverage.