Cryptocurrencies fell this weekend and into these days, as traders grappled with a probably extra hawkish Federal Reserve, which might result in fewer charge cuts than was hoping for in 2025.

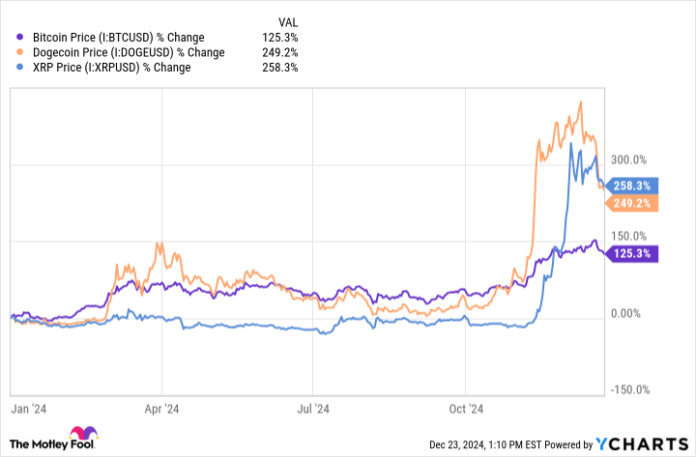

The cost of Bitcoin (CRYPTO: BTC), the sector’s biggest cryptocurrency, traded about 4% decrease from past due afternoon but in addition fell considerably over the weekend. As of one:29 p.m. ET on Monday, Bitcoin traded round $93,260 after topping $102,000 closing Thursday. The cost of Dogecoin (CRYPTO: DOGE) traded 3.2% decrease, whilst XRP (CRYPTO: XRP) had fallen 3.1%.

The macro outlook is vital at this time

The Federal Reserve despatched the marketplace decrease after concluding its ultimate assembly of the yr closing week. The Fed additionally disclosed that it expects best two charge cuts subsequent yr as an alternative of the 4 it projected at its September assembly. Whilst many traders and marketplace pundits gave the impression to be expecting this heading into the Fed’s assembly, the inside track stunned the wider marketplace.

Crypto stakeholders were given extra just right information this morning after President-elect Donald Trump appointed Stephen Miran, an economist and previous U.S. Treasury Division authentic, to chair the president’s influential Council of Financial Advisers. Moran is pro-crypto.

Alternatively, traders gave the impression extra centered at the broader macro outlook. In spite of sturdy items orders in November coming in under expectancies, Treasury yields moved upper, in most cases a bearish indicator for Bitcoin and crypto total.

Many suppose Bitcoin can hedge inflation. Alternatively, the cryptocurrency is impacted through greater than Treasury yields, and gold additionally moved decrease these days. The buck persisted to give a boost to, and Bitcoin, instead forex, has a tendency to have an inverse courting with the buck.

Bitcoin price knowledge through YCharts.

Buyers making a bet on 30-day Fed price range long run costs are more and more counting at the company chopping charges fewer occasions than in the past anticipated in 2025. Greater than 91% of buyers suppose it’s set to pause charge cuts at its January assembly, and 37.5% of buyers see the Fed doing just one charge lower subsequent yr.

Only a week in the past, maximum buyers anticipated two cuts from the Fed subsequent yr, even though remember the fact that those chances can exchange temporarily.

I did not see a lot token-specific information this morning, even though Michael Saylor’s corporate, MicroStrategy, continues to shop for Bitcoin. Ultimate week, the corporate bought any other 5,262 tokens for $561 million at a median worth of $106,662. Saylor has publicly predicted Bitcoin can jump to $13 million through 2045.

Be expecting some turbulence heading into the brand new yr

Bitcoin has risen considerably this yr, so it is extra liable to pullbacks. I be expecting the token to stay unstable because the marketplace seems for hints about inflation and the trajectory of rates of interest.

Maximum buyers now suppose inflation will likely be sticky and keep above the Fed’s most well-liked 2% goal. Traders and the Fed also are bracing for the prospective inflationary have an effect on of Trump’s proposed tax cuts and price lists.

Nonetheless, all of this might exchange course on a dime with a vulnerable studying of the December jobs document or the Shopper Value Index in early January, which is why I be expecting volatility to start out subsequent yr. XRP and Dogecoin are extra unstable than Bitcoin, so the 2 tokens will have to revel in upper good points and worse losses than Bitcoin.

I love Bitcoin and suppose XRP warrants a smaller, speculative place. I don’t these days have any passion in Dogecoin.