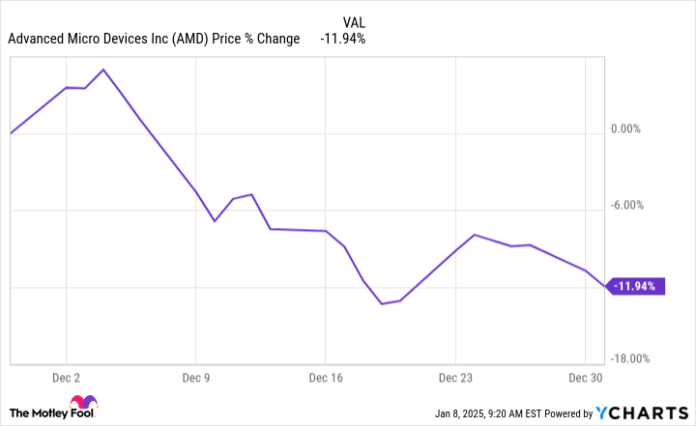

Complicated Micro Units (AMD -4.67%) inventory noticed vital sell-offs in December’s buying and selling. The semiconductor corporate’s percentage payment closed out the month down 11.9%, in step with information from S&P Global Market Intelligence.

AMD information by way of YCharts.

With December’s buying and selling concluded, AMD inventory closed out 2024 down more or less 18%. The chip specialist’s percentage payment fell within the ultimate month of 2024 as analysts turned into extra wary in regards to the inventory and issued downward share-price and revenue-outlook objectives.

Analysts turned into much less bullish on AMD inventory closing month

On Dec. 9, Financial institution of The united states printed protection of AMD, downgrading the inventory’s score from purchase to impartial. The financial institution additionally reduced its one-year payment goal at the inventory from $180 in line with percentage to $155 in line with percentage. Then, Truist printed a word decreasing its payment goal on Dec. 16. The funding corporate cuts its one-year payment forecast from $180 in line with percentage to $155 in line with percentage and maintained a hang score at the inventory.

The following day, Wolfe Analysis printed a a brand new document at the corporate and mentioned it anticipated AMD’s 2025 profit to come back in more or less $3 billion underneath the typical Wall Boulevard estimate. In step with Wolfe, AMD’s growth in synthetic intelligence (AI) seems to be weaker than expected.

In consequence, the funding company expects the corporate will most effective file $7 billion in AI profit this yr. With those dynamics in thoughts, Wolfe’s analysts see the corporate having bother heading into its expected quarterly document this month.

In any case, Morgan Stanley printed a word keeping up an equal-weight score at the inventory on Dec. 20. The funding corporate reduced its one-year payment goal at the inventory from $169 in line with percentage to $158 in line with percentage, bringing up the potential of difficult pageant from Nvidia to restrict the corporate’s expansion alternatives within the AI area.

What is up with AMD inventory in 2025?

After a month of double-digit sell-offs, AMD inventory began the brand new yr with some rebound buying and selling momentum. The corporate’s percentage payment were up more or less 4% heading into the beginning of buying and selling on Jan. 8, however contemporary bearish protection and investor attention of macroeconomic chance components have burnt up the ones positive factors. The chip-specialist’s inventory is now more or less flat in 2025’s buying and selling.

Sooner than the marketplace opened this morning, HSBC printed new protection on AMD and issued a unprecedented double downgrade for its score at the inventory. The financial institution reduced its score from purchase to scale back and reduce its one-year payment goal from $200 in line with percentage to $110 in line with percentage. HSBC’s analysts cited AMD’s loss of aggressive power towards Nvidia as a key reason why for the rankings downgrade and worth reduce.

AMD is heading into 2025 with reduced expectancies. Nvidia has persevered to dominate the marketplace for complicated processors for information facilities, and a few analysts are apprehensive that AI may not change into the robust near-term catalyst for the industry that had up to now been anticipated. Alternatively, it is a ways too early to write down off AMD — and it is imaginable that fresh pressures for the inventory will assist set the degree for an explosive comeback rally.

HSBC Holdings is an promoting spouse of Motley Idiot Cash. Financial institution of The united states is an promoting spouse of Motley Idiot Cash. Keith Noonan has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Complicated Micro Units, Financial institution of The united states, Nvidia, and Truist Monetary. The Motley Idiot recommends HSBC Holdings. The Motley Idiot has a disclosure coverage.