The Nasdaq-100 Index is all about enlargement shares — it holds the highest nonfinancial shares indexed at the Nasdaq inventory replace. That enlargement focal point has enabled the index to ship awesome funding returns: It has greater than doubled the go back of the S&P 500 during the last 15 years.

If there is one downside to the Nasdaq-100, it is that it does not produce a lot source of revenue (the index’s dividend yield is recently 0.8%). Alternatively, there’s a method to have your proverbial cake and devour it too.

The JPMorgan Nasdaq Fairness Top class Source of revenue ETF (JEPQ 0.18%) provides lower-volatility publicity to the Nasdaq-100, and per 30 days source of revenue. Here is a have a look at how this distinctive exchange-traded fund (ETF) can flip a $10,000 funding into more or less $1,000 of source of revenue every yr.

A top rate source of revenue circulation

The JPMorgan Fairness Top class Source of revenue ETF has a twofold funding way:

Underlying fairness portfolio: The fund’s managers use information science and basic analysis to build an fairness portfolio.

Disciplined choices overlay technique: The ETF writes out-of-the-money name choices at the Nasdaq-100 Index to generate distributable source of revenue every month. (Out-of-the-money name choices are above the present marketplace worth.)

The fund’s technique of writing choices generates a large number of source of revenue. It writes (sells) name choices at the Nasdaq-100 Index, enabling it to assemble source of revenue from choices premiums. An choice top rate is the fee paid by means of the choice purchaser to the vendor. As an choices dealer, the ETF will get to stay 100% of this source of revenue if the choice expires nugatory. That source of revenue fluctuates as a result of choices premiums are upper all over extra risky classes.

The fund’s technique of writing calls at the Nasdaq-100 index may be very profitable: Its ultimate per 30 days distribution had an annualized yield of 12.4%. During the last three hundred and sixty five days, the yield is 9.9%. That is a lot upper than different high-yielding asset categories. As an example, high-yield U.S. bonds have a yield of round 7% presently, whilst actual property funding trusts (REITs) and 10-year Treasury bonds are beneath 4%.

To position this ETF’s yield into standpoint, a $10,000 funding would produce about $990 of annual source of revenue on the trailing-12-month charge. That compares to just $80 of dividend source of revenue on a equivalent funding in a Nasdaq-100 ETF like Invesco QQQ Consider.

Fairness marketplace upside publicity

Source of revenue is best a part of the go back generated by means of this ETF. It additionally provides fairness marketplace publicity by means of conserving a portfolio of fine quality shares. Its most sensible holdings come with notable Nasdaq-100 names Nvidia (7.7% allocation), Apple (7.2%), Amazon (4.6%), and different well known generation and shopper corporations.

The fund does not have an identical allocation to the Nasdaq-100. The ETF’s managers actively allocate the portfolio for optimum risk-adjusted returns. As an example, it did not cling stocks of vaccine massive Moderna within the 3rd quarter; that added to its effects for the reason that inventory underperformed all over the length because of considerations about a few of Moderna’s merchandise and pipeline. The fund had a better weighting on Oracle, which boosted its leads to the 3rd quarter after the cloud massive equipped long-term objectives smartly forward of expectancies.

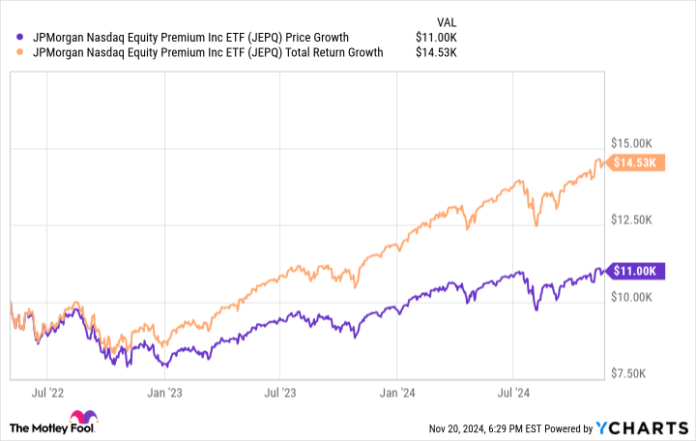

The ETF’s twin technique allows buyers to each generate source of revenue and seize some price appreciation because the underlying portfolio’s price will increase. Here is a have a look at what would have took place to a $10,000 funding made on the fund’s inception in Would possibly 2022:

JEPQ information by means of YCharts.

As that chart presentations, our hypothetical investor has accrued about $3,500 in source of revenue. In the meantime, their preliminary funding has grown by means of about 10% to $11,000. Upload it up, and the whole go back is 43% (15.3% annualized). That is a robust general go back from a fund providing significant source of revenue and decrease volatility.

Source of revenue and extra

JPMorgan Nasdaq Fairness Top class Source of revenue ETF can come up with an excessively profitable per 30 days source of revenue circulation from choices premiums. For added go back doable, the fund provides much less risky equity-market publicity to the highest shares within the Nasdaq-100. Those options could make it an excellent ETF to generate passive source of revenue whilst proceeding to develop your wealth.

John Mackey, former CEO of Complete Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Matt DiLallo has positions in Amazon, Apple, JPMorgan Nasdaq Fairness Top class Source of revenue ETF, and Moderna and has the next choices: brief February 2025 $275 calls on Apple. The Motley Idiot has positions in and recommends Amazon, Apple, Nvidia, and Oracle. The Motley Idiot recommends Moderna and Nasdaq. The Motley Idiot has a disclosure coverage.