Warren Buffett’s Berkshire Hathaway (BRK.A -0.57%) (BRK.B -0.71%) inventory portfolio is without doubt one of the global’s maximum carefully adopted collections of shares. The reason being easy: Buffett has led Berkshire to market-crushing positive aspects over a protracted time frame. A $1,000 funding in Berkshire Hathaway at its IPO can be price $2.4 million as of late.

Berkshire Hathaway’s good fortune is because of a number of components, however the phase that almost all buyers be aware of is Buffett’s stock-buying selections. Of passion in recent years has been the corporate’s stake in Apple (AAPL 0.11%), which it’s been promoting off all the way through the 12 months. Within the 3rd quarter of 2024, Buffett bought much more, lowering the location via an extra $23 billion.

All informed, Buffett and Berkshire have booked $95 billion in Apple inventory positive aspects in 2024. This has led many to invest on the cause of the marketing. Traders might get some insights on the Berkshire Hathaway annual assembly within the spring, however within the period in-between, here is what buyers want to learn about Buffett’s Apple inventory gross sales.

Buffett nonetheless believes in Apple

The least most likely situation for the sale is that Buffett has misplaced self assurance within the corporate. On a number of events prior to now, Buffett has heaped reward on each Apple and its CEO, Tim Cook dinner. On the Berkshire annual assembly in 2024, Buffett mentioned that he would personal Apple “except one thing in point of fact peculiar occurs.” It is tricky to argue that the corporate is considerably other now than it was once in Might.

Buffett values emblem and management very extremely. Apple continues to be some of the recognizable manufacturers on this planet, and Tim Cook dinner has a protracted observe file of good fortune on the corporate. Buffett has referred to as Cook dinner “sensible” and praised his managerial contact. Since management at Apple has remained solid and constant, it is simple to conclude that Buffett nonetheless thinks extremely of the corporate.

Valuation might play an element

When Buffett first bought Apple in 2016, it stunned many buyers, since Buffett had no longer invested in lots of tech shares over his storied profession. Taking a look at Apple as of late, it is laborious to consider the longtime price investor discovered Apple compelling. However it is price remembering that on the time of Berkshire’s preliminary acquire, Apple was once buying and selling for round 11 instances trailing income and was once coming near all-time lows.

As of late, Apple is without doubt one of the biggest firms on this planet, trades for 37 instances income, and is close to all-time highs. There is no doubt Buffett has strict standards for getting a inventory, making sure he feels he is shopping stocks for a cut price to intrinsic price. It’s, due to this fact, cheap to suppose he would imagine promoting as soon as an organization exceeds intrinsic price.

Apple’s position within the Berkshire portfolio

In the similar 2021 annual letter the place he referred to as Tim Cook dinner a genius, Buffett identified that even if Berkshire most effective won $785 million in dividends that 12 months, its Apple stake grew well past that because of Apple’s competitive proportion repurchases. That is an instance of the way Apple’s inventory appreciation, dividend bills, and inventory repurchases compounded to make Apple the biggest a part of Buffett’s portfolio.

On the finish of 2023, Apple accounted for almost 50% of the price of Berkshire’s fairness portfolio. Buffett to begin with trimmed the location all the way through the fourth quarter of 2023. By means of the top of probably the most lately reported quarter, Q3 2024, the Apple stake most effective represented 26% of the portfolio. This important aid will have been simply to cut back the publicity to Apple inside the general portfolio.

Construction the money pile

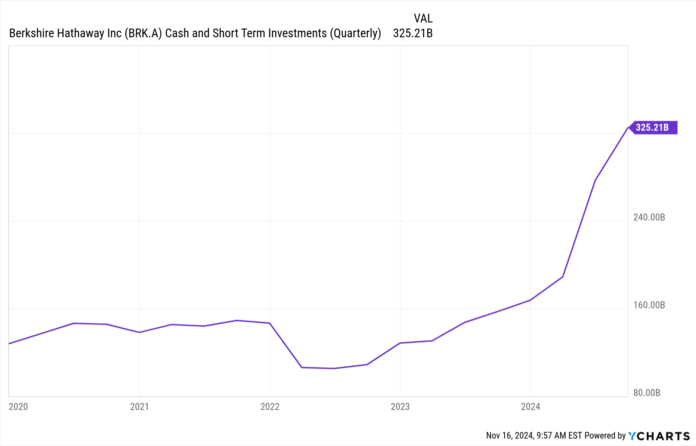

Berkshire Hathaway is rarely brief on money, however Buffett turns out to consider it is prudent to have much more. Imagine its building up in money and momentary investments during the last few years.

BRK.A Cash and Short-Term Investments (Quarterly) knowledge via YCharts.

Buffett has expressed his trust that taxes have been prone to building up at some point, so it is conceivable the Apple sale was once in part to steer clear of paying extra to Uncle Sam. Or it may well be that Buffett is build up the defenses for each time the following marketplace downturn comes. That is when he desires to position Berkshire’s money reserves to paintings — be grasping when others are nervous. A 3rd chance is that the money from the Apple sale may well be utilized in a long run acquisition.

Without reference to the explanation, there is no doubt that Berkshire’s money hoard provides Buffett monumental optionality it doesn’t matter what the long run holds. Till Buffett addresses his plans at once, buyers might by no means know precisely why he is bought such a lot of his stake in Apple. Then again, the verdict was once most likely extra about warning and versatility for Berkshire than it was once about any fear about Apple’s trade.

Jeff Santoro has positions in Apple and Berkshire Hathaway. The Motley Idiot has positions in and recommends Apple and Berkshire Hathaway. The Motley Idiot has a disclosure coverage.