Declining USD Amid Weaker Knowledge

Supply: DailyFX

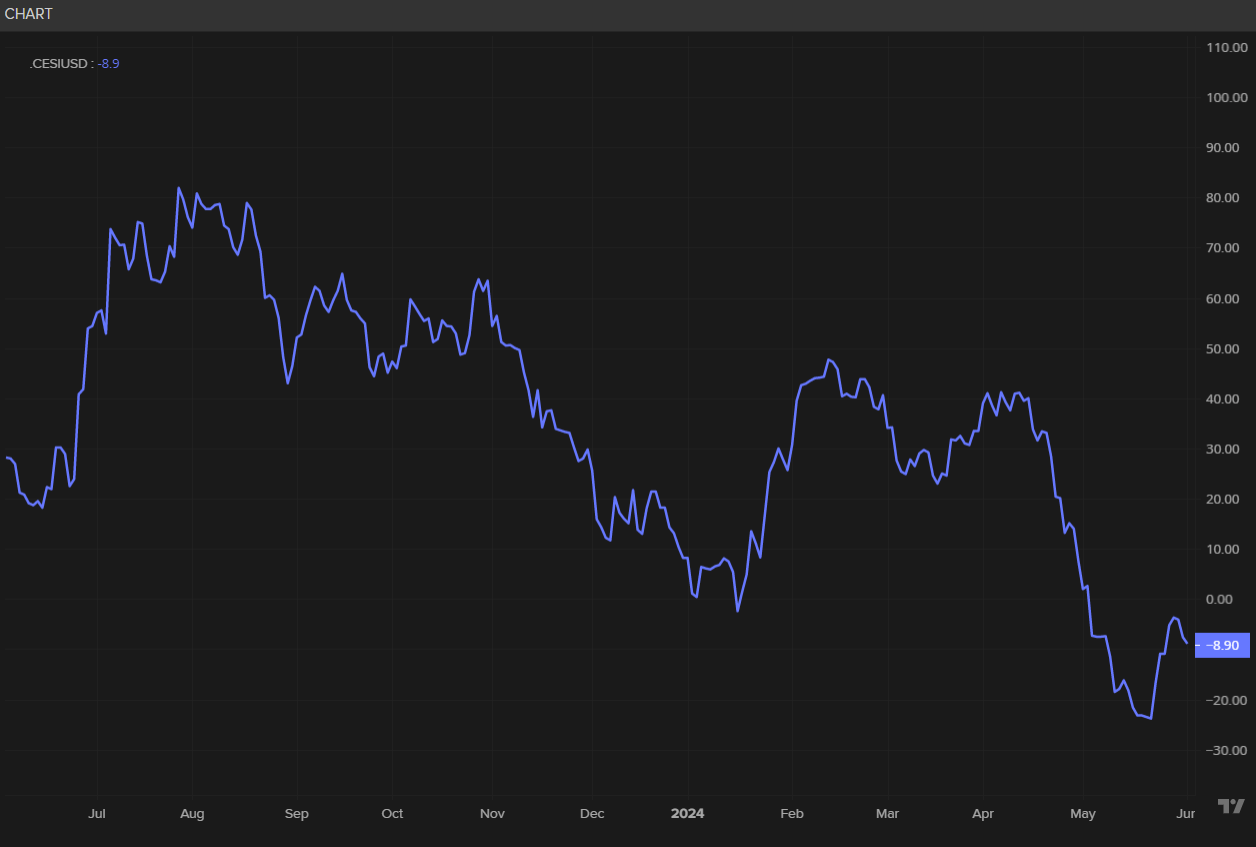

Financial knowledge for the United States displays a notable decline. Financial expansion is slowing, as indicated by way of the Atlanta Fed’s GDPNow forecast, which dropped from over 4% to a trifling 1.8% for Q2. This follows a disappointing Q1 expansion of one.6%, a ways under the predicted 2.5%.

Supply: DailyFX

Supply: DailyFX

Moreover, April’s CPI and PCE inflation knowledge recommend the disinflation development is returning, offering some reduction for the Fed because it plans the timing for reducing rates of interest. Fresh knowledge, together with the ISM production PMI survey, signifies weaker-than-expected effects. The USA financial wonder index has additionally persisted its downward development.

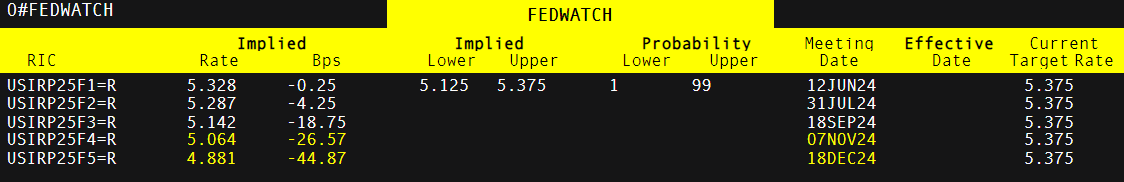

Marketplace-Implied Foundation Level Cuts into 12 months-Finish Supply: DailyFX

Marketplace-Implied Foundation Level Cuts into 12 months-Finish Supply: DailyFX

Markets expect no less than one charge lower this 12 months, in all probability two. On the other hand, the timing is unsure because of the impending elections, making September and December the in all probability months for charge changes.

EUR/USD Eyes ECB Fee Choice

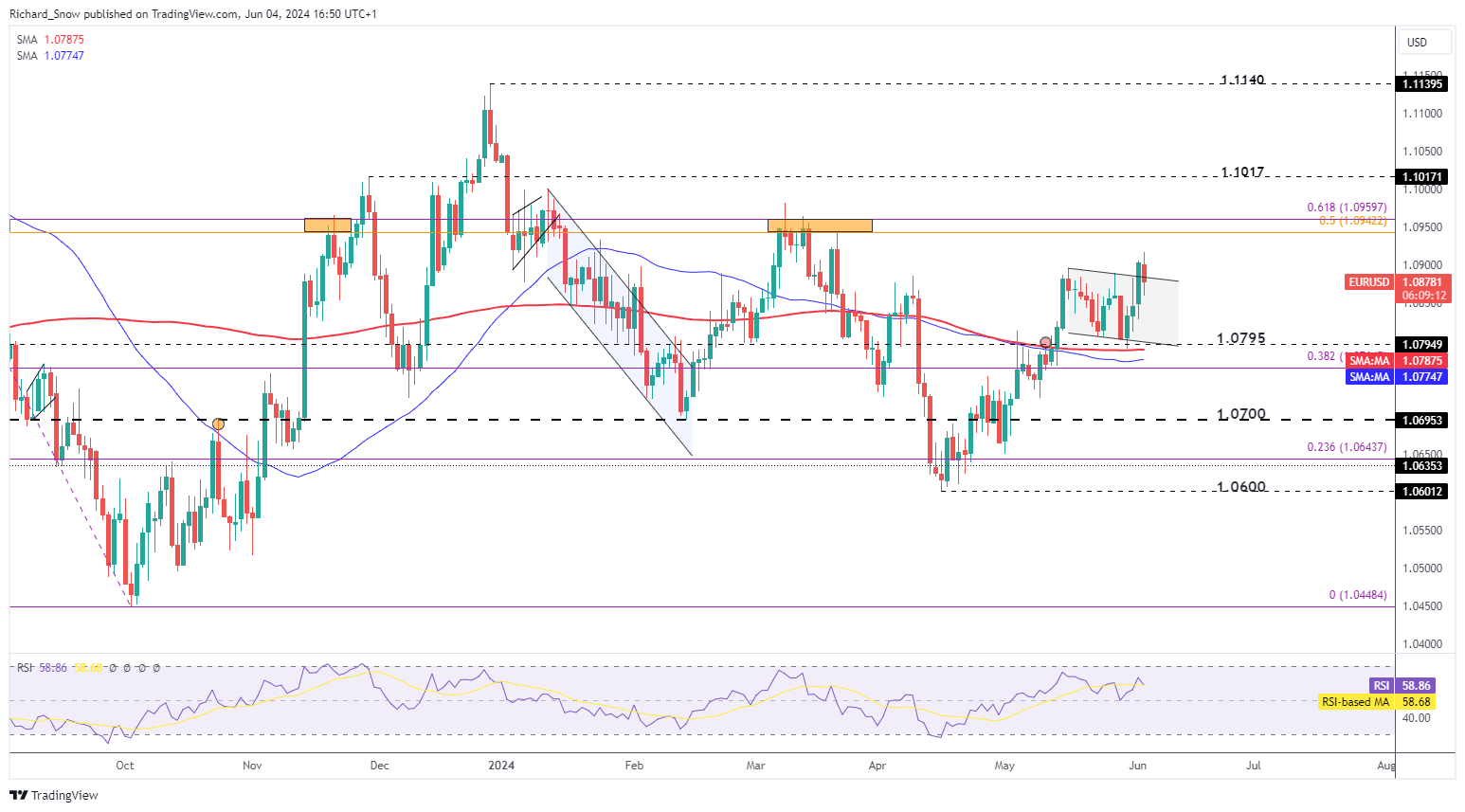

Supply: TradingView

Supply: TradingView

The ECB is making ready for its first charge lower after a duration of fast charge hikes. Marketplace reactions may well be muted, as many officers have already pointed to June as a most probably date for charge discounts. The point of interest can be at the long term trail of charge cuts, although the ECB has communicated a wary way, fending off the expectancy of successive cuts.

EUR/USD has been making an attempt a bullish breakout, supported by way of softer US knowledge. For a sustained transfer upper, US knowledge must weaken additional. A hawkish ECB lower may just spice up EUR/USD, although this can be a difficult technique. Problem dangers for EUR/USD come with a possible go back to at least one.0800 and channel give a boost to.

Swiss Franc Good points Regardless of Overheating Alerts

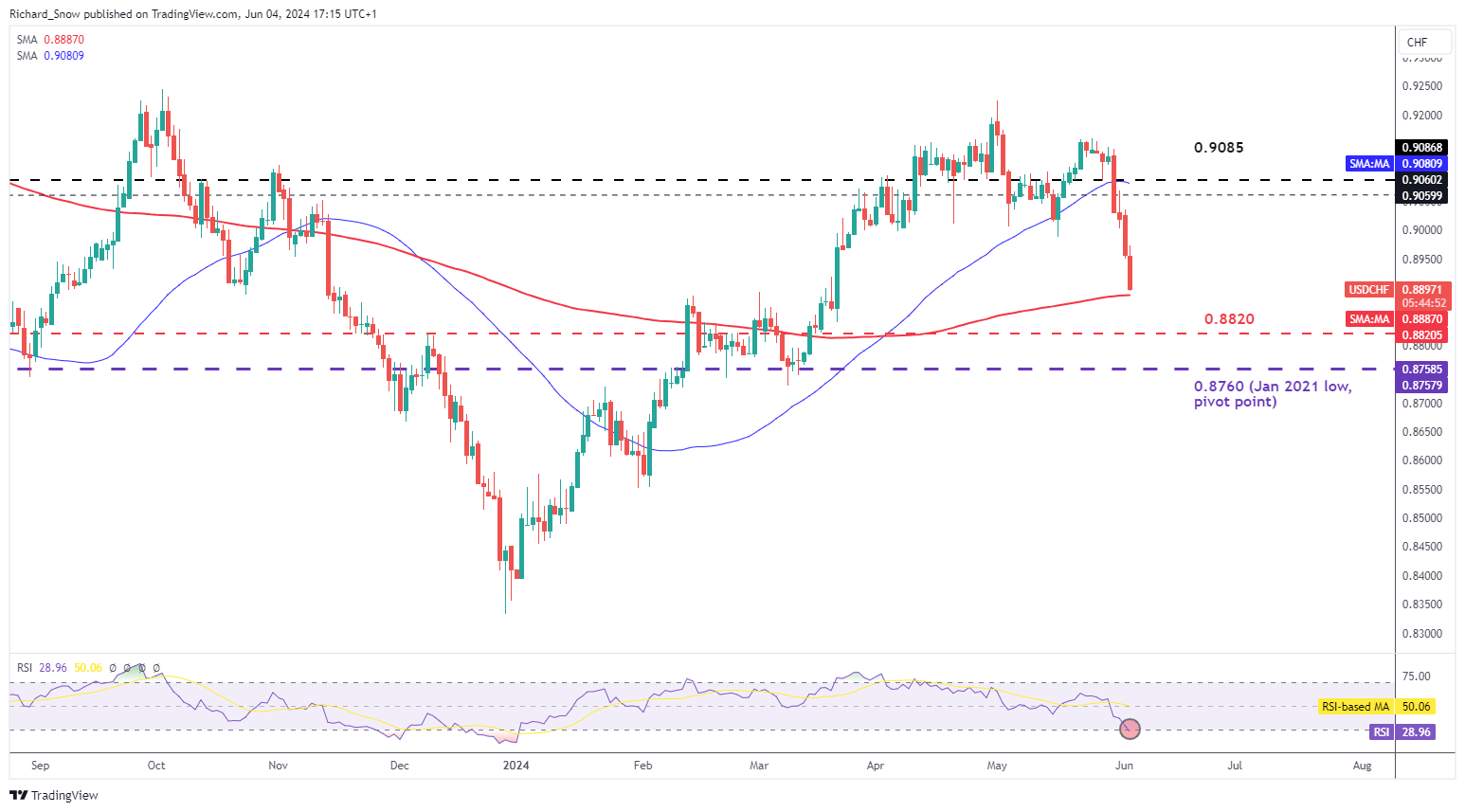

Supply: TradingView

Supply: TradingView

USD/CHF has observed important declines, with the 200-day easy shifting moderate (SMA) and the RSI indicating oversold stipulations. The Swiss franc has reinforced after feedback from Swiss Nationwide Financial institution Chairman Thomas Jordan, who warned of the dangers posed by way of a weaker franc to inflation. The SNB had already lower charges in March, resulting in a depreciation in opposition to G7 currencies.

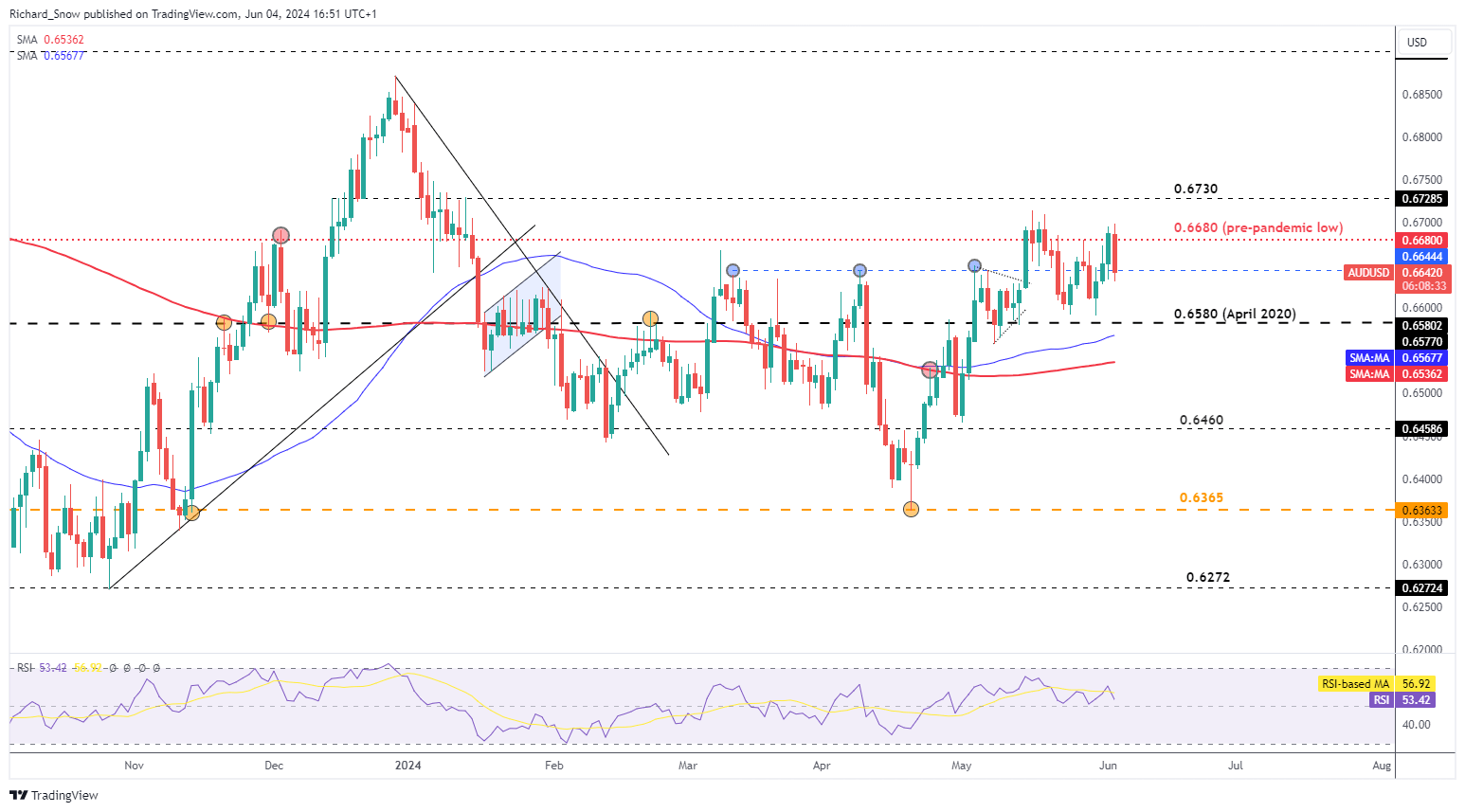

USD Bulls Goal Decrease AUD/USD Amid Vulnerable Possibility Urge for food

Supply: TradingView

Supply: TradingView

In a more potent USD state of affairs, AUD/USD is price looking at. The Australian buck may lose momentum as chance urge for food declines. The foreign money continuously correlates with the S&P 500, which has began the week decrease. This may well be because of a wary marketplace forward of Friday’s NFP knowledge.

Metals, together with gold, silver, copper, and iron ore, have observed declining costs. Iron ore, Australia’s major export to China, is dealing with lowered call for from the industrial large. AUD/USD did not retest its fresh prime of 0.6714 and has since eased decrease, with key ranges at 0.6644 and zero.6580 in focal point.

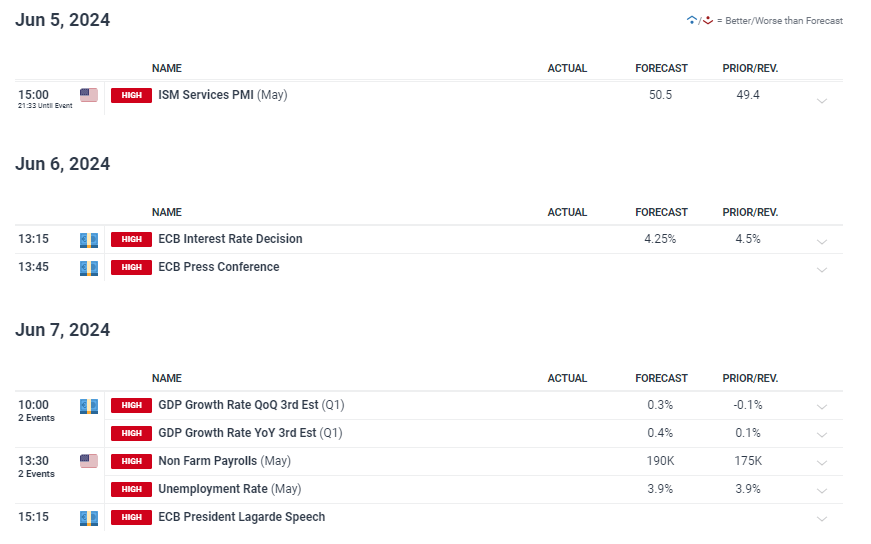

Key Upcoming Occasions

Supply: DailyFX

Supply: DailyFX

Upcoming US products and services PMI knowledge can be an important, with the ECB’s charge lower announcement on Thursday and the United States NFP and moderate hourly profits knowledge on Friday being the primary highlights.

The publish USD Worth Motion: EUR/USD, AUD/USD, USD/CHF Key Ranges gave the impression first on Dumb Little Guy.