Taiwan Semiconductor Production (TSM -3.59%), popularly referred to as TSMC, is the arena’s biggest semiconductor foundry, which fabricates chips for the highest client electronics corporations and chip designers around the globe. That explains why it’s been rising at an excellent tempo over the last couple of years.

The sector’s main corporations, similar to Nvidia, AMD, Broadcom, Sony, and Apple, faucet TSMC’s crops for production chips that continual non-public computer systems (PCs), smartphones, knowledge facilities, and gaming consoles, amongst others. In consequence, TSMC is in a cast place to have the benefit of the secular enlargement of the worldwide semiconductor marketplace, which is anticipated to hit $2 trillion in annual earnings in 2032.

That will be greater than triple the $656 billion in earnings that the semiconductor business generated closing yr. Alternatively, TSMC inventory has been stuck within the tariff turmoil of past due, and is the reason why it’s down greater than 20% in 2025 as of this writing. However this pullback has made TSMC an incredible discount.

Let us take a look at the the reason why purchasing TSMC looks as if a no brainer at this time.

TSMC is making the best strikes to deal with its dominance

TSMC enjoys an enormous lead within the foundry marketplace with an estimated percentage of 67%, in line with Counterpoint Analysis. That determine has been heading upper in fresh quarters. Particularly, TSMC’s foundry marketplace percentage greater via six proportion issues in 2024. In the meantime, second-placed Samsung misplaced floor on this marketplace as its percentage shrank via 3 issues to 11%.

A key reason TSMC has been in a position to open one of these massive hole over opponents within the foundry marketplace is as a result of its technological merit. TSMC’s complicated procedure nodes permit its shoppers to fabricate robust and power-efficient chips. For instance, TSMC’s 3-nanometer (nm) node is regarded as to be essentially the most complicated chip production era.

This procedure node is getting used to fabricate smartphone chips and PC processors via the likes of AMD, MediaTek, Apple, and Qualcomm. Now, it looks as if Nvidia will faucet TSMC’s 3nm procedure node to fabricate its next-generation Rubin graphics processing devices (GPUs). Taking a look forward, TSMC is having a look to push the envelope additional in chip production era with the 2-nanometer procedure.

The corporate is anticipated to begin mass-producing its 2nm processors in the second one part of this yr, which might put it forward of opponents Samsung and Intel. In the meantime, TSMC could also be having a look to diversify its international presence. The corporate has pledged an funding of $165 billion within the U.S. to construct complicated chip production amenities that may continual synthetic intelligence (AI) programs.

It’s value noting that TSMC already fabricates chips for the main AI semiconductor corporations similar to Nvidia, Broadcom, and Marvell, and its center of attention on boosting investments in complicated applied sciences must permit it to deal with its dominant place within the international foundry marketplace. Moreover, TSMC’s process of diversifying its international production footprint in nations similar to Japan, the U.S., and Europe may just become a smart decision ultimately as it will lend a hand it mitigate the demanding situations coming up out of attainable trade-related conflicts, similar to the only we’re witnessing at this time.

So, it may not be unexpected to peer TSMC closing the highest semiconductor foundry for a very long time to come back, and that’s the reason anticipated to translate into tough monetary enlargement for the corporate.

An enormous addressable marketplace suggests TSMC is constructed for wholesome enlargement

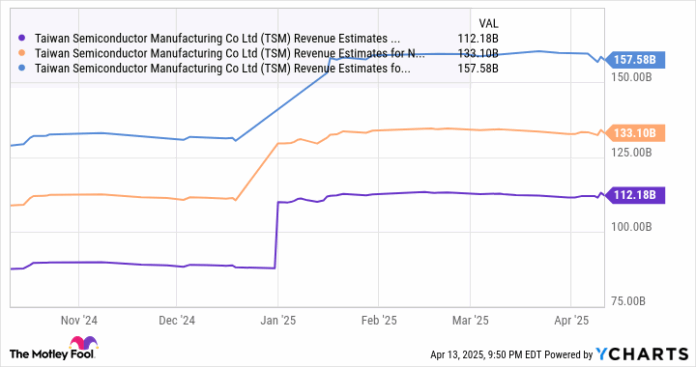

TSMC completed 2024 with $90 billion in earnings, an development of 30% from the prior yr. The corporate has were given off to a more potent get started in 2025, recording a cast 42% leap in earnings within the first 3 months of the yr to $25.6 billion. That is higher than what the marketplace was once expecting. Analysts be expecting TSMC’s enlargement to realize momentum because the yr progresses, as obvious from the chart under.

TSM Revenue Estimates for Current Fiscal Year knowledge via YCharts

What is extra, the chart above additionally tells us that TSMC is on course to ship tough enlargement over the following couple of years as neatly. Importantly, it may not be unexpected to peer the corporate maintaining its cast enlargement for a for much longer length in gentle of the issues mentioned within the article. The semiconductor marketplace is about to develop at an excellent tempo, and TSMC itself sees a complete addressable marketplace value nearly $250 billion in its foundry and packaging services and products.

That determine may well be larger sooner or later as the dimensions of the semiconductor marketplace helps to keep rising. Now not strangely, TSMC control expects to deal with an annual earnings enlargement price of 20% for the following 5 years, which must translate into tough bottom-line enlargement as neatly. All this makes TSMC a most sensible semiconductor inventory to shop for at this time as it’s buying and selling at simply 22 instances trailing income and 17 instances ahead income, which is a pleasing bargain to the tech-laden Nasdaq-100 index’s ahead income more than one of 27 (the usage of the index as a proxy for tech shares).

Harsh Chauhan has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Complex Micro Units, Apple, Intel, Nvidia, Qualcomm, and Taiwan Semiconductor Production. The Motley Idiot recommends Broadcom and Marvell Era and recommends the next choices: brief Might 2025 $30 calls on Intel. The Motley Idiot has a disclosure coverage.