Donald Trump’s new buying and selling machine is right here. “Liberation Day” price lists went into impact in the dark Japanese time, enforcing steep new taxes on items from Asia, the sector’s production heart. Asian inventory markets most commonly fell on Wednesday, finishing a temporary “useless cat soar” around the area’s fairness markets.

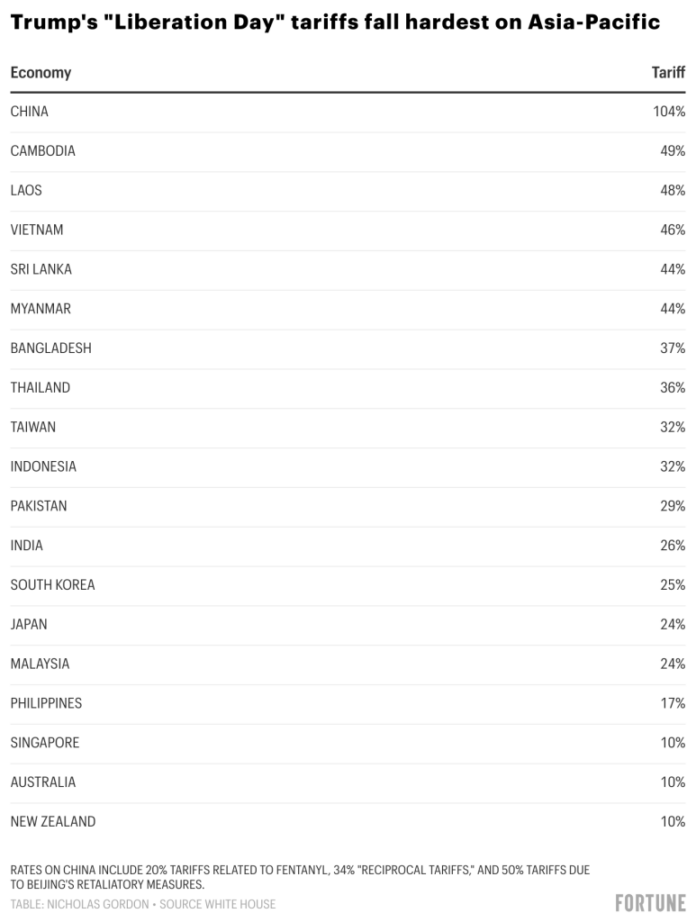

Trump’s steepest price lists fall on China, one of the crucial U.S.’s biggest buying and selling companions. Tariff charges on China now general a minimum of 104%: 20% price lists associated with fentanyl, 34% “reciprocal price lists,” after which a briefly imposed 50% tariff in line with China’s retaliatory measures.

The steep price lists will hit China’s exports to the U.S., which can harm the rustic’s financial enlargement. On Tuesday, Citi cut its GDP growth forecast to 4.2%, down from 4.7%.

China will impose a flat 34% tariff on all U.S. imports on April 10, as a part of a broader set of retaliatory measures in opposition to Trump’s price lists. Chinese language officers have held company, pledging to “struggle to the tip” in opposition to Trump’s price lists.

The U.S. president has flip-flopped on his openness to a care for China. In his social media submit pronouncing a brand new 50% tariff on Chinese language items, Trump said that each one negotiations with China had been off. But past due on Tuesday, he affirmed that “China additionally desires to make a deal, badly, however they do not know the best way to get it began. We’re looking ahead to their name!”

Nonetheless, Chinese language markets carried out smartly on Wednesday. The CSI 300, which covers firms buying and selling in Shanghai and Shenzhen, rose by means of 1.0%, as Chinese language officers promised measures to reinforce the inventory marketplace, deploying the “national team”—a nickname for sovereign wealth fund Central Huijin Funding—to the Chinese language ETF marketplace. Regulators also are encouraging state-owned firms to start share buybacks.

Hong Kong’s benchmark Dangle Seng Index rose round 1.0%, including to a slight restoration following the marketplace’s large inventory drop, the worst since 1997, on Monday.

Japan and South Korea, which were given price lists of 24% and 25% respectively, did not win exemptions in time, regardless of each primary economies being prioritized by means of the White Area for tariff negotiations.

Japan’s benchmark Nikkei 225 index sunk by means of 3.9%, whilst South Korea’s KOSPI dropped by means of 1.7%.

Trump officers have signaled some optimism that industry negotiations with Japan and South Korea will proceed. “Issues are having a look excellent,” Trump wrote on social media, following a decision with Korea’s performing president, Han Duck-soo.

Seoul is already getting ready to strengthen its auto business, already reeling from 25% U.S. price lists on imported vehicles. The federal government has promised $10.2 billion in strengthen for the business, and can inspire better exports to the “World South”, or markets in Africa, Latin The united states and Asia.

Taiwan’s Taiex index dropped by means of 5.8% on Wednesday, the 3rd directly day of sharp declines after Trump introduced 32% price lists in opposition to the island. Stocks in Apple provider Foxconn dropped by means of 10%, the day-to-day prohibit, for the 3rd time this week. (Foxconn closely is determined by Chinese language factories, like its “iPhone Town” complicated in Zhengzhou.)

The island has presented to chop its price lists to 0 and spice up funding within the U.S.; it’s additionally promised to not retaliate. On Tuesday, the island’s executive promised to tap into its $15 billion inventory stabilization fund to revive investor self belief.

Southeast Asia

Top U.S. price lists on Southeast Asian nations additionally went into impact on Wednesday. Trump reserved a few of his best tax charges for the area, with Vietnam, Cambodia, Laos, and Myanmar all getting price lists upwards of 40%.

Southeast Asian economies, specifically Vietnam, have benefited from “China plus one” approaches to offer chain diversification. However that’s now threatened by means of “Liberation Day” price lists. GDP enlargement in Vietnam, which is determined by U.S. exports for 30% of its economic system, would possibly drop by means of a complete 1.5 proportion issues, Goldman Sachs estimated closing week.

Vietnam has presented to chop its personal price lists on U.S. imports, however Trump officers like industry consultant Peter Navarro have already rejected the be offering, because it received’t cope with the underlying industry deficit. Economists argue that nations like Vietnam and Cambodia are simply no longer sufficiently rich to shop for sufficient U.S. items to totally rebalance industry.

Leaders throughout Southeast Asia are actually talking out in opposition to Trump price lists. Singapore high minister Lawrence Wong on Tuesday blasted the price lists as “no longer movements one does to a chum,” and reaffirmed its standing as a unfastened buying and selling hub. Previous this week, Malaysia high minister Anwar Ibrahim said he will “lead efforts to offer a united regional entrance” a number of the Affiliation of Southeast Asian Countries.

This tale was once in the beginning featured on Fortune.com