Micron Era (MU -0.77%) is having a woeful April as stocks of the reminiscence specialist have dropped 20% up to now this month, and the tariff-fueled turmoil has so much to do with the inventory’s contemporary pullback. Reviews counsel that Micron may just building up the costs of its reminiscence merchandise amid the continuing tariff battle. That is as a result of Micron has a world production footprint, together with factories within the U.S., Japan, Taiwan, and China.

On the other hand, semiconductors were exempted from price lists through each the U.S. and China (a minimum of up to now). Moreover, the Trump management has put a 90-day pause on implementing reciprocal price lists on maximum of its business companions who would have in a different way been subjected to better tariff charges. Additionally, the management has exempted imports of reminiscence chips and tough drives from China.

As such, Micron would possibly not wish to carry the costs of its choices, a transfer that can have harm the call for since its shoppers would have needed to deal with greater prices. What is extra, Micron’s reminiscence merchandise are witnessing such robust call for that the corporate is discovering it tough to supply sufficient of them. This was once obvious from the corporate’s spectacular numbers within the earlier quarter, in addition to its brilliant outlook for the present one.

Let’s take a more in-depth take a look at the explanation why purchasing Micron inventory following its newest pullback turns out like a sensible factor to do.

Micron is simply too affordable to forget about presently

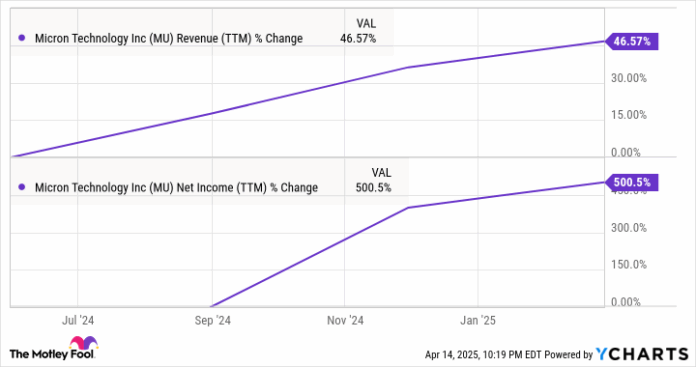

For an organization that delivered a 38% year-over-year building up in income within the earlier quarter, together with a three.7x bounce in income, Micron’s valuation makes it price purchasing quit fist immediately. The corporate is buying and selling at lower than 17 instances trailing income. Its ahead income a couple of of 10 is even less expensive.

The tech-laden Nasdaq-100 index, in the meantime, has a trailing price-to-earnings ratio of 27 and ahead income a couple of of 23. Micron, due to this fact, is considerably less expensive presently, bearing in mind the exceptional progress that it’s been turning in in contemporary quarters.

MU Revenue (TTM) knowledge through YCharts

Even higher, Micron is amazingly affordable once we take its possible income progress under consideration. The inventory has a worth/earnings-to-growth ratio (PEG ratio) of simply 0.15 in line with the projected income progress it would ship over the following 5 years, consistent with Yahoo! Finance. The PEG ratio is calculated through taking an organization’s long run income progress possible under consideration, and a studying of lower than 1 signifies {that a} inventory is undervalued.

So, Micron’s PEG ratio means that it is extremely affordable, bearing in mind the predicted progress it would clock over the following 5 years, pushed through the deployment of AI infrastructure and gadgets able to operating AI workloads.

AI proliferation is ready to power wholesome progress in reminiscence call for

Micron is taking advantage of the fast-growing call for for high-bandwidth reminiscence (HBM) chips utilized in graphics processing devices (GPUs) to run synthetic intelligence (AI) workloads in knowledge facilities. The corporate’s knowledge middle income tripled yr over yr, with HBM by myself accounting for a file $1 billion in quarterly income.

Micron says that its HBM shipments exceeded expectancies. What is extra, the corporate has offered its whole HBM capability for 2025, and it’s these days “thinking about increasing HBM capability in our present production amenities to satisfy necessities thru 2026.” Some other issue price noting this is that Micron has raised its general addressable marketplace (TAM) estimate for HBM to $35 billion for 2025.

That determine is prone to head upper ultimately, with one third-party estimate striking the dimensions of the HBM marketplace at virtually $86 billion in 2030. So, Micron’s knowledge middle trade nonetheless has a large number of room for progress ultimately at the again of forged HBM call for. However this is not the place the corporate’s AI-related catalysts finish.

Micron’s reminiscence merchandise also are utilized in smartphones and private computer systems (PCs). The use of reminiscence in each those programs is emerging due to AI. In particular, Micron says that the dynamic random get entry to reminiscence (DRAM) content material in AI-enabled PCs is a 3rd greater than the common content material utilized in PCs ultimate yr. In the meantime, flagship AI smartphones are the use of 50% extra DRAM than the 8 gigabytes (GB) of DRAM noticed in 2024 fashions.

It’s price noting that the shipments of each AI-capable smartphones and PCs are anticipated to leap at an annual tempo of virtually 35% thru 2029. This might pave the best way for more potent progress in Micron’s reminiscence shipments ultimately, complementing the wholesome progress within the corporate’s knowledge middle trade.

As such, Micron Era’s potentialities appear tough, and the semiconductor inventory’s valuation signifies that buyers should buy it at very sexy ranges presently, and so they would possibly not need to omit this chance for the reason that corporate’s remarkable progress may just lend a hand it triumph over its contemporary stoop and fly upper ultimately.