The brand new yr is usually a time to reevaluate your portfolio. Did you purchase too many high-risk shares that did poorly in 2024? Now could be the easiest time to modify issues up and construct a sturdy portfolio that may maintain and develop your wealth over the lengthy haul.

Many people look forward to the brand new yr to speculate extra money into our retirement accounts. Perhaps you had a pleasing bonus on the finish of 2024 that you wish to have to tuck away as financial savings. When you’ve got $10,000 able to spend money on 2025, there are many cheap-looking shares you’ll be able to purchase and cling for the lengthy haul.

Listed below are 3 shares mythical investor Warren Buffett owns at Berkshire Hathaway to shop for in 2025.

1. American Categorical: A sturdy bank card massive

One among Buffett’s biggest and longest-held positions is American Categorical (AXP 0.87%). The bank card massive has been an incredible long-term performer, particularly since Buffett began purchasing it in 1991. With its vertically built-in bills community, American Categorical has a aggressive place over different bank card firms. And with giant commute perks like commute lounges, lodge offers, and cash-back financial savings with companions comparable to Uber, American Categorical has an enviable place with rich shoppers all over the world.

This price proposition is why American Categorical will have to durably develop over the lengthy haul, and why Buffett hasn’t ever bought a percentage since first of all purchasing the inventory. The logo continues so as to add new bank cards to its community — 3 million added ultimate quarter by myself — which is able to force extra spending and earnings over the longer term.

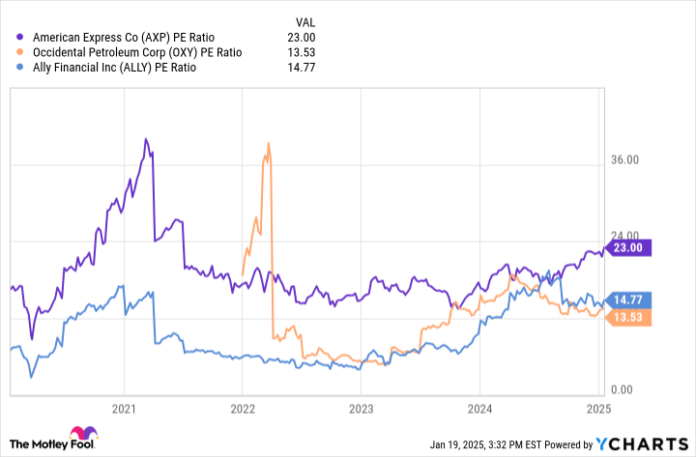

Control sees earnings rising 10% once a year and revenue in keeping with percentage (EPS) rising even sooner. Nowadays, the inventory trades at a price-to-earnings ratio (P/E) of 23. That is moderately above the corporate’s long-term reasonable, however remains to be sexy for a industry that plans to develop EPS on the mid-teens degree once a year. Purchase some American Categorical inventory in your portfolio in 2025 and sit down tight with the location.

2. Occidental Petroleum: Homegrown fossil gasoline manufacturing

The arena nonetheless consumes oil and herbal fuel. Fossil fuels were a large a part of our power image and shall be for many years. Even puts like Norway — which has abruptly followed electrical automobiles — nonetheless eat an identical ranges of oil in comparison to a couple of many years in the past.

America is some distance in the back of in electrical car adoption and is in a transition of fast commercial build-out because of the federal government’s reshoring coverage. One giant beneficiary of those developments will have to be Occidental Petroleum (OXY -0.18%), one of the crucial biggest oil and herbal fuel manufacturers in the US. Ultimate quarter, the corporate was once generating 1.4 million barrels of oil (or herbal fuel identical) in keeping with day, which was once a file. Even with oil costs neatly under highs set a couple of years in the past, Occidental Petroleum generated $1.5 billion in unfastened coins glide ultimate quarter.

During the last twelve months, Occidental Petroleum has generated $4.5 billion in unfastened coins glide. This seems to be slightly reasonably-priced as opposed to a marketplace cap of $49 billion, and most probably why Buffett has piled into the inventory. Until oil costs crash, this inventory will do neatly over the longer term and is usually a everlasting power hedge in your portfolio in 2025 and past.

AXP PE Ratio information by means of YCharts

3. Best friend Monetary: Banking for the twenty first century

The ultimate inventory on my record is so much smaller than Occidental Petroleum and American Categorical, making it a smaller place within the Berkshire Hathaway portfolio. Nonetheless, the conglomerate is the corporate’s biggest shareholder and owns round 10% of its not unusual inventory. Input Best friend Monetary (ALLY 5.76%), one of the crucial biggest virtual banks on this planet.

Spun out from Normal Motors all through the monetary disaster, the automobile lending massive grew to become itself into an online-only client financial institution, with over $100 billion in deposits. Shoppers have flocked to the financial institution as a result of the excessive rates of interest it can pay on deposits, one thing legacy banks cannot fit with upper overhead prices.

Buyers are tepid about Best friend Monetary as a result of emerging loss charges within the automobile sector and the headwinds introduced by means of emerging rates of interest on its mortgage e-book. With the Federal Reserve decreasing rates of interest and the automobile sector stabilizing, I believe Best friend Monetary can get again at the proper footing in 2025. Buffett and his group most probably agree, which is why they have not bought a unmarried percentage all through this downturn.

As of this writing, Best friend Monetary has a P/E of round 15 in accordance with a web source of revenue determine this is neatly off of its all-time excessive. As revenue get well in 2025 and 2026, Best friend’s P/E will have to shrink to dust reasonably-priced ranges, which is able to most probably result in a emerging inventory charge, emerging dividend payouts, and percentage repurchases. This formulation will have to make buyers who purchase and cling Best friend inventory fairly glad over the lengthy haul.

Best friend is an promoting spouse of Motley Idiot Cash. American Categorical is an promoting spouse of Motley Idiot Cash. Brett Schafer has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Berkshire Hathaway and Uber Applied sciences. The Motley Idiot recommends Normal Motors and Occidental Petroleum and recommends the next choices: lengthy January 2025 $25 calls on Normal Motors. The Motley Idiot has a disclosure coverage.