Nio (NIO -4.21%) has at all times been an intriguing inventory. It is a massive participant within the Chinese language electrical automobile (EV) marketplace, but in addition positions itself as a way of life logo with recreational shops and its personal line of smartphones, whilst additionally creating applied sciences equivalent to solid-state batteries. The corporate additionally pioneers battery swapping stations as a approach to keep away from charging.

Nio has at all times been a roller-coaster experience, and 2024 wasn’t a lot other because the inventory shed 51% of its worth all the way through the yr, in accordance to information equipped by means of S&P Global Market Intelligence. However the query is why? And was once the sell-off warranted? Let’s dig in.

What have you ever completed for me in recent times

The corporate overlooked estimates right through the primary quarter with profits according to proportion checking in a long way beneath Wall Boulevard forecasts. That was once in fact adopted by means of a 2d quarter the place the corporate posted record-high EV deliveries, won marketplace proportion, and crowned profits estimates. After which, would not you comprehend it, Nio reported weaker-than-expected third-quarter profits however its inventory controlled to sneak a small achieve for the day anyway.

It serves a excellent reminder to buyers that Nio stays a speculative inventory and can have wild swings in financials in addition to inventory worth actions.

What is the actual downside?

However a short lived recap of the corporate’s monetary effects would possibly not provide you with solutions for why the inventory is down 51% right through 2024. That resolution will include a better have a look at its house marketplace, China, the place there is a vicious price cutting war and automakers are racing to the ground to stay aggressive.

The price cutting war is so vicious that during a notice leaked from Chinese language EV juggernaut BYD confirmed that it was once pressuring providers to chop costs by means of 10% in 2025, as marketplace festival was once anticipated to develop into much more intense.

Let’s additionally encompass this price cutting war with context. China closely backed its EV makers, which gave them a leg up on creating EV generation, and it is paying off in many ways as the rustic has produced one of the vital maximum inexpensive and complicated EVs in the world.

It is even pushed electrified cars to account for greater than part the automobile marketplace in July. The contest is so intense that Financial institution of The usa analyst John Murphy stated at his annual “Automobile Wars” presentation, “I feel it’s a must to see the [Detroit Three] go out China once they in all probability can.”

However Nio’s issues in 2024 did not finish with its home price cutting war. The corporate additionally exports its cars, and Europe’s price lists introduced an important hurdle. Imagine that Nio’s cars in Europe now meet a 31% tariff within the Eu Union, up from the former 10%.

What all of it way

There’s a silver lining in Nio’s third-quarter effects and December gross sales. In spite of the vicious price cutting war, which hindered the corporate’s third-quarter automobile gross sales earnings by means of 4%, in comparison to the prior yr, its automobile margin in fact larger over the similar period of time from 11% as much as 13%. If the corporate can proceed to offset margin drive, it’s going to pass a protracted strategy to convincing buyers it is a long-term purchase.

Additional, December gross sales gave buyers a sneak peek on the subsequent section of enlargement that may come with its Onvo logo, which simply started logging deliveries. And do not overlook it simply introduced its 0.33 logo, Firefly, in past due December, which will even upload incremental gross sales in 2025.

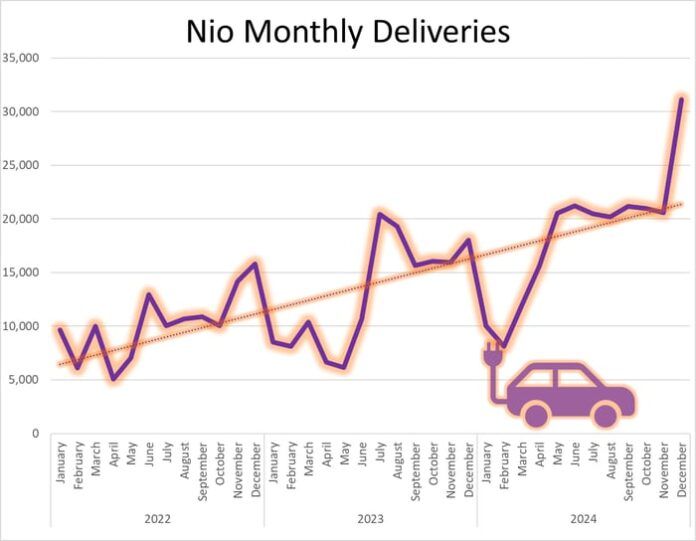

Knowledge supply: Nio press releases. Chart by means of creator.

In the long run, buyers can be expecting extra swings within the corporate’s financials because it drives towards long term profitability — no less than buyers hope — and that may carry extra huge worth swings together with 2024’s 51% decline. Traders having a look at Nio as a possibility to shop for at the dip have a compelling argument with its top-line and automobile gross sales poised to increase within the yr forward, most likely doubling to kind of 440,000 cars in 2025. However buyers have to know this inventory would require a lot near-term endurance because it navigates a difficult price cutting war and tariff situations. Keep tuned, 2025 will perhaps be any other roller-coaster experience for the inventory.

Financial institution of The usa is an promoting spouse of Motley Idiot Cash. Daniel Miller has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Financial institution of The usa. The Motley Idiot recommends BYD Corporate. The Motley Idiot has a disclosure coverage.