A inventory marketplace correction refers to a ten% to twenty% pullback from a top. The S&P 500 (^GSPC 0.08%) — an index that incorporates more or less 500 of the rustic’s greatest, winning publicly traded companies — hit correction territory on March 13. It is the first time this has took place since 2022.

All the way through inventory marketplace volatility like corrections, stocks of high quality corporations regularly move on sale, even though the marketplace does not keep within the correction zone. This gives traders with better-than-normal probabilities to shop for stocks of high quality corporations at extra sexy costs. And personally, that incorporates PepsiCo (PEP -1.16%), Ulta Good looks (ULTA 2.86%), and PayPal (PYPL 0.79%) at this time.

1. PepsiCo

Few companies are as iconic as Pepsi. No longer best is the corporate’s beverage portfolio spectacular — a portfolio that now contains upstart prebiotic soda corporate Poppi due to a just about $2 billion acquisition — it additionally owns well known snack manufacturers, together with chips from Frito-Lay. Given its scale and the breadth of its portfolio, the trade is terribly strong and resilient, this means that that Pepsi inventory infrequently is going on sale.

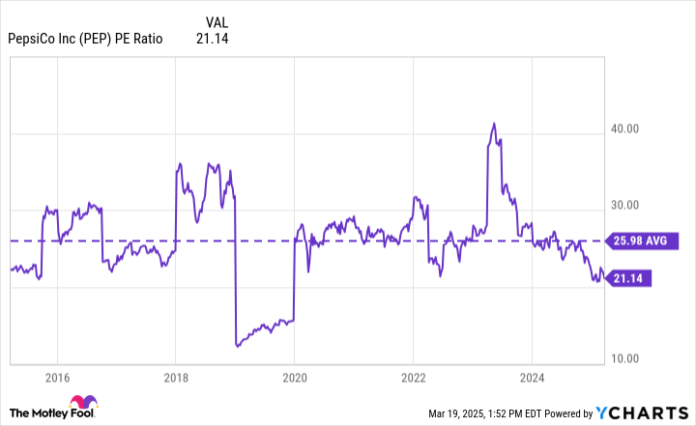

On the other hand, Pepsi inventory is on sale now, down about 25% from 2023 highs. During the last 10 years, Pepsi traded at 26 occasions income, on moderate. At this writing, it trades for simply 21 occasions income, a cast 19% cut price to its same old valuation.

PEP PE Ratio information through YCharts

Pepsi inventory is down as a result of customers appear to be slicing again on discretionary purchases. And so they appear to in the end be pushing again on Pepsi’s value will increase lately. However the corporate controlled to eke out top-line enlargement in 2024, in addition to bottom-line positive factors, however. And it’s going to most likely accomplish that once more in 2025. In brief, issues are not as dangerous as they appear, and traders can nonetheless believe in Pepsi.

As the overall icing at the cake, Pepsi’s dividend yield is readily coming near 4%. That is an all-time top, which is excellent for many who make investments these days. Needless to say this corporate has yearly greater its dividend for 53 consecutive years, making it an elite Dividend King.

2. Ulta Good looks

Whilst no longer as iconic as Pepsi, Ulta Good looks continues to be somewhat an established order. There are greater than 1,400 places offering beauty merchandise, and plenty of be offering salon services and products as smartly.

And within the face of monetary uncertainty, traders must remember the fact that this can be a recession-resistant area. Imagine that Ulta Good looks’s same-store gross sales greater in 2008, 2009, and 2010 — years that have been the center of the Nice Recession.

Ulta Good looks expects some same-store-sales enlargement in 2025, however steerage is so modest that traders are not inspired. The inventory is down just about 40%. And it isn’t simply because enlargement is sluggish. Any other troubling fact is that its working margin is slipping. It had a fifteen% margin in its fiscal 2023, however best expects an 11.8% margin in fiscal 2025.

At Ulta Good looks’s dimension, which means that it expects to earn masses of tens of millions of greenbacks much less in working source of revenue than it could in a different way earn if its margin was once as excellent as 2023. That mentioned, the corporate must nonetheless earn $1.3 billion in working source of revenue on this coming 12 months. Taking into account Ulta is best valued at $16 billion at this time, this can be a affordable inventory.

Ulta Good looks’s control steadily takes benefit of its affordable inventory value. It buys again stocks and has diminished the percentage depend through 18% within the remaining 5 years. It expects to shop for again $900 million extra in 2025 — smartly inside its method — which would cut back the percentage depend through an extra 5%. Over the longer term, that is nice for shareholders who hang tight.

3. PayPal

After all, PayPal inventory remaining hit an all-time top long ago in 2021. It in the end outperformed the S&P 500 once more in 2024 with a just about 40% achieve. However it adopted this up with a disappointing just about 20% slip to start out 2025.

On the other hand, you must be aware that a lot of its drop appears to be as a result of monetary generation (fintech) shares are normally down at this time. Simply evaluate returns for PayPal with returns for the International X FinTech ETF.

PYPL Total Return Level information through YCharts

I consider this sturdy correlation between PayPal and the International X FinTech ETF suggests PayPal stocks are down as a result of traders have soured at the area. However I additionally consider that PayPal inventory was once up in 2024 for legitimately promising causes.

Lately, PayPal’s transaction margin (a metric for fintech corporations very similar to gross margin) slipped. In brief, the gap is aggressive, and the corporate reduced its costs to get trade. However below new control, contracts are being renegotiated, and the transaction margin is making improvements to once more. That is what traders celebrated in 2024.

There is explanation why to stay celebrating. PayPal’s control expects ongoing enhancements thru 2027. And this margin development must result in income enlargement as smartly.

PayPal inventory trades at simply 17 occasions income, with reference to the most cost effective it is ever been. If the corporate manages to make stronger income over the following 3 years because it expects, I consider the inventory could have quite a few upsides for traders who purchase these days.

Pepsi, Ulta Good looks, and PayPal are 3 giant companies that experience traditionally confirmed to be somewhat resilient. The inventory marketplace is down, and those 3 shares dropped as smartly. That is excellent information for traders taking a look to deploy some money, and I consider any of those 3 might be excellent additions to a portfolio at this time.