The S&P 500 (^GSPC -1.71%) is arguably the inventory marketplace’s maximum necessary index. It tracks the five hundred biggest U.S. firms available on the market, and it has change into the benchmark for U.S. and global buyers.

Whilst the S&P 500 itself is somewhat huge in taste, diversifications of the index lean towards explicit making an investment kinds. A kind of is the S&P 500 Worth Index, which specializes in the worth firms throughout the S&P 500. Even though it won’t enjoy hypergrowth, it generally is a nice possibility as many start to fear in regards to the top valuations of many progress shares.

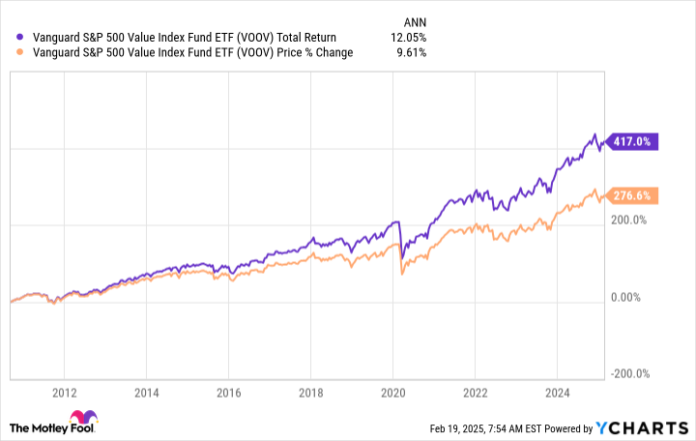

When you’ve got $500 to speculate and are already uncovered to the wider marketplace by means of an S&P 500 exchange-traded fund (ETF), now generally is a excellent time to lean on extra of the worth shares throughout the index by way of making an investment within the Leading edge S&P 500 Worth ETF (VOOV -0.97%).

VOOV Total Return Level knowledge by way of YCharts.

How does the ETF outline “worth”?

Whether or not or now not a inventory is thought of as a worth is quite subjective. To have a look at it extra objectively, Leading edge defines worth by way of taking a look on the following 3 metrics: Value-to-book (P/B) ratio, price-to-earnings (P/E) ratio, and price-to-sales (P/S) ratio. Here is a fast rundown of what every ratio measures:

P/B ratio: An organization’s marketplace worth to its ebook worth (property minus liabilities on its stability sheet).

P/E ratio: How a lot you are paying according to $1 of an organization’s income.

P/S ratio: How a lot you are paying according to $1 of an organization’s income.

The decrease the above ratios are, the “inexpensive” a inventory is noticed as being. For viewpoint, underneath is how the Worth ETF’s P/B ratio and P/E ratio examine to the usual S&P 500’s ratios (in keeping with the Leading edge S&P 500 ETF (VOO -1.70%)):

Metric

S&P 500 Worth

S&P 500 Usual

P/B ratio

3.3

5.0

P/E ratio

22.4

27.5

Information supply: Leading edge. Numbers as of Jan. 31, 2025.

The Worth ETF’s numbers are not precisely low, however it is a noticeable sufficient distinction from the usual S&P 500.

This ETF is predicated a lot much less at the tech sector

One factor raised with the usual S&P 500 is how a lot of it’s made up of the tech sector (that is because of it being marketplace cap weighted).

Happily, the worth nature of the Worth ETF method it is extra lightly unfold throughout sectors. Tech continues to be essentially the most represented sector, however it is extra balanced, as proven within the desk underneath.

Sector

S&P 500 Worth

S&P 500 Usual

Verbal exchange products and services

3.7%

10%

Shopper discretionary

9.1%

11.4%

Shopper staples

7.7%

5.5%

Power

5.9%

3.2%

Financials

15.9%

14.1%

Well being care

15.6%

10.5%

Industrials

8.3%

8.3%

Data generation

23.7%

30.7%

Fabrics

3.5%

1.9%

Actual property

3%

2.1%

Utilities

3.6%

2.3%

Information supply: Leading edge. Percentages as of Jan. 31, 2025.

The excellent news is that the Worth ETF nonetheless exposes you to flourishing tech giants like Apple, Microsoft, and Amazon (its best 3 holdings). Alternatively, its best holdings are rounded out by way of firms corresponding to UnitedHealth Workforce, ExxonMobil, Procter & Gamble, and JPMorgan Chase.

The Worth ETF will nonetheless be influenced by way of the tech sector’s luck (or lack thereof), however different sectors are there to tug extra of the burden.

The S&P 500 Worth ETF will have to be one piece of the puzzle

I don’t have the Worth ETF as my number one S&P 500 fund or the root of my portfolio, however it may be an excellent supplement for the ones already invested in the usual S&P 500 or different progress shares.

There is not any approach to are expecting how the inventory marketplace will carry out, but when there’s a correction with the top valuations of many growth-focused shares, this ETF may give some steadiness or coverage towards primary drops. That does not imply this ETF is correction- or downturn-proof; it simply method it will cling up higher right through marketplace down sessions.

A $500 funding generally is a best possible begin to serving to you upload some worth publicity on your inventory portfolio.

John Mackey, former CEO of Complete Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. JPMorgan Chase is an promoting spouse of Motley Idiot Cash. Stefon Walters has positions in Apple, Microsoft, and Leading edge S&P 500 ETF. The Motley Idiot has positions in and recommends Amazon, Apple, JPMorgan Chase, Microsoft, and Leading edge S&P 500 ETF. The Motley Idiot recommends UnitedHealth Workforce and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.