The U.S. buck is down just about 9%, yr up to now. Yields on Treasuries have stayed top although the inventory marketplace has long gone down — the other of what traders usually be expecting. Some are blaming Japan and China for promoting U.S. bonds, which might harm the buck. Others consider hedge finances unwinding leveraged positions in bonds could also be accountable. However analysts and economists inform Fortune that so long as the White Space continues to generate financial uncertainty, everybody goes to escape the buck.

The worth of the U.S. buck ticked up the day prior to this after President Trump did a U-turn and stated he had no purpose of firing Jerome Powell, chair of the Federal Reserve. It used to be an extraordinary piece of fine information for the arena’s “reserve foreign money,” whose price has fallen 9% year-to-date in opposition to the DXY index of foreign currency.

That raises a query: Who’s promoting the buck—or promoting belongings that force down the buck—and why?

Preliminary suspicions focused Japan and China. In the end, they’re each seeing their export markets harm by way of Trump’s business warfare, and they’re the primary and moment greatest international holders of U.S. Treasuries. Most likely the ones international locations have been seeking to ship a message to Trump: Have in mind, we will harm you too!

Alternatively, assets inform Fortune that there’s little to no proof that both nation is intentionally tanking the buck.

And, possibly unusually, there isn’t a substantial amount of proof that hedge finances with liquidity problems have been all of sudden pressured to unwind levered bets on U.S. bonds, forcing the hot selloff that dragged the buck down with it, those assets say.

Reasonably, the blame lies with everybody else

Trump’s chop-change financial pronouncements have generated such a lot international uncertainty that traders throughout all belongings — shares, bonds, and foreign money — are merely chickening out from the U.S. till some more or less simple task reappears.

Japan is promoting numerous all its international bond holdings — it dumped $20 billion lately — “now not simply U.S. Treasuries,” in line with Oxford Economics’ Lead Analyst John Canavan. “As a result of Treasuries make up this type of huge portion of Eastern international bond holdings, it’s in most cases observed as a just right proxy.”

However, he says, “it’s now not transparent China and/or Japan had been liable for the level of the hot Treasury marketplace selloff and volatility. Proof is hard to return by way of both approach. Knowledge on international transactions and holdings of Treasury debt have a tendency to be launched with a lag, so they might have performed a job, but it surely doesn’t seem in the beginning blush that they have been the main issue.”

Now not the hedge finances

Canavan could also be now not willing at the hedge fund idea.

“Early suspicions that an unwinding of enormous leveraged foundation trades have been a significant component seem to have been flawed. The Commitments of Buyers knowledge from the CFTC over the last two weeks presented no proof of any foundation business unwinds,” he instructed Fortune.

His colleagues at Goldman Sachs agree, partially.

In a notice to purchasers revealed April 22, analysts Kamakshya Trivedi and Dominic Wilson stated: “We didn’t see a lot give a boost to both within the ‘footprint’ throughout markets or within the go with the flow knowledge for the theories of important international promoting, although there’s extra proof that levered unwinds (specifically the pointy transfer in change spreads) could have performed a job.”

China and Japan in reality have a vested hobby in now not promoting U.S. bonds as a result of that handiest hurts their want for strong belongings and would make their currencies upward thrust, which in flip would harm their export markets.

“Take China, as an example,” says Kevin Ford, FX & macro strategist at Convera.

“As The us’s second-largest international creditor after Japan, it holds round $780 billion in Treasury securities. Whilst their marketplace strikes are intently watched, an enormous sell-off turns out not going, as it will improve the Yuan because of repatriation results, and Beijing is recently leveraging its foreign money to counter tariff affects.”

“Hedge finances, however, would possibly have added gasoline to the hearth. Because the bond sell-off won momentum, margin calls can have pressured finances to liquidate Treasuries to boost money, particularly the ones using bond-basis trades,” he instructed Fortune.

Everybody needs to get the hell out of Dodge

If truth be told, there’s a more effective clarification: The buck is in decline and yields on U.S. bonds are staying top as a result of everybody — actually everybody in the world — needs to get the hell out of Dodge Town presently.

That incorporates shares, bonds, and foreign money. With Trump converting his thoughts by way of the hour on business coverage and bullying his leader central banker every day, traders of a wide variety are merely restricting their publicity to a country they now regard as a possibility asset slightly than a secure haven.

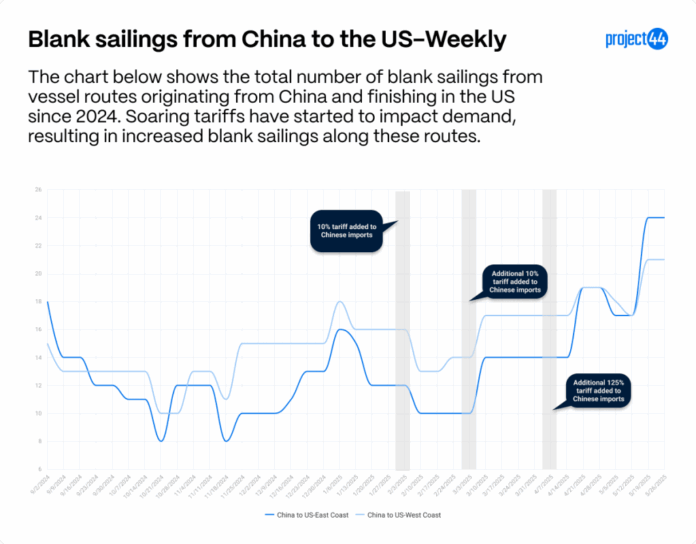

This aversion to the U.S. has even began appearing up in transport routes. With price lists limiting business, the collection of “clean sailings” to the U.S. by way of ocean freighters has doubled since February, in line with knowledge tracked by way of Project44, a provide chain platform. Clean sailings happen when a transport line schedules a course after which cancels it altogether or skips a port on that course.

“The East Coast is ready to look a top of 24 clean sailings within the final week of Might, a 100% building up since new price lists started in February, with the West Coast shut at the back of at 21, or a 31% building up,” the corporate says.

Whilst transport doesn’t at once impact the buck, it’s—arguably—a visual symptom of an international chickening out from doing industry with the U.S.

Wedbush analyst Daniel Ives, who covers the tech marketplace, even has a reputation for it. In a notice to purchasers dated April 22, he referred to as it the “Promote The us Business.”

“This tariff/business warfare is slicing US tech on the knees and serving to steamroll China tech forward,” he wrote.

And so long as the business warfare continues, be expecting the buck to proceed to say no, in line with Goldman Sachs.

“We consider the re-think of the chance and praise of Buck belongings has room to run and be expecting the USD to increase its declines through the years,” Goldman’s Trivedi and Wilson stated.

This tale used to be at the beginning featured on Fortune.com