Palantir Applied sciences (PLTR 0.44%) inventory is off to a exceptional get started in 2025, emerging greater than 54% as of this writing because of the corporate’s accelerating enlargement and fast-improving earnings pipeline that issues towards a vivid long run.

The tool specialist has established itself as a key participant within the synthetic intelligence (AI) house. Palantir’s Synthetic Intelligence Platform (AIP), which is helping consumers combine generative AI functions into their operations, has change into a runaway hit. That is glaring from the corporate’s impulsively rising buyer base in addition to a bounce in spending by way of present consumers on its choices.

For the reason that Palantir is tapping a marketplace that is simply setting out, it would possibly not be sudden to look the corporate maintaining its spectacular enlargement over the long term. Let’s take a better have a look at Palantir’s potentialities and take a look at whether it is nonetheless value purchasing the inventory in anticipation of extra upside over the following 5 years.

The AI tool marketplace may lend a hand Palantir ship exceptional enlargement

The call for for AI tool is ready to upward thrust remarkably thru 2030 as extra companies and organizations are more likely to undertake this era to pressure potency good points and enhance productiveness. In step with one estimate, international spending on AI tool may bounce just about fourfold between 2024 and 2030, producing annual earnings of greater than $391 billion by way of the tip of the last decade.

Palantir completed 2024 with earnings of $2.87 billion, an building up of 29% from the prior 12 months. Its earnings enlargement charge picked up final 12 months as in comparison to the 17% building up in its best line in 2023 as extra consumers began the usage of AIP. Palantir ended 2024 with 711 consumers, an building up of 43% from the prior 12 months.

Extra importantly, the corporate appears to be construction a top quality buyer base as its present consumers ramp up their spending on Palantir’s choices. That is glaring from the 12-percentage-point building up in its web buck retention charge within the fourth quarter of 2024 to 120%. Palantir calculates the online buck retention charge by way of dividing the trailing 12-month earnings from its consumers on the finish of 1 / 4 by way of the trailing 12-month earnings from those self same consumers within the year-ago quarter. So, a studying of greater than 100% implies that Palantir’s present consumers are spending extra on its answers.

Palantir control identified on the newest revenue convention name that AIP is certainly one of its key enlargement drivers:

AIP continues to gas new buyer acquisition as we now have just about 5 instances the selection of U.S. business consumers as we did 3 years in the past and important enlargement alternatives at present consumers.

Palantir offered many examples at the revenue name about how consumers the usage of AIP have considerably stepped forward the potency in their operations. In consequence, it would possibly not be sudden to look extra consumers adopting this platform, whilst present consumers may signal larger offers with Palantir as they deploy AI into extra spaces.

What is value noting is that Palantir’s overall contract price (TCV) shot up an outstanding 56% 12 months over 12 months within the fourth quarter of 2024 to $1.8 billion, considerably outpacing the 29% bounce in its best line. Every other metric that displays Palantir is environment itself up for long-term good fortune is its closing deal price (RDV), which is the whole closing price of contracts that the corporate is but to meet on the finish of 1 / 4.

This metric jumped 40% from the year-ago length to $5.4 billion. Palantir’s RDV is definitely above the earnings that it generated final 12 months, suggesting that the corporate’s enlargement is most probably to pick out up tempo in 2025 and in the end. Additionally, as Palantir is getting extra trade from its present buyer base, it’s preferably spending much less cash to procure new earnings. That is translating into tough enlargement in its margins and revenue.

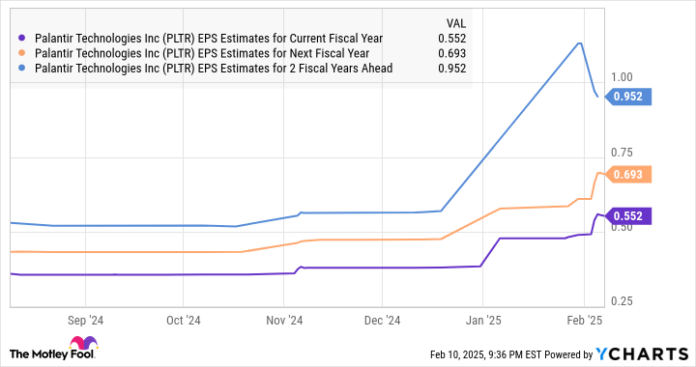

As an example, Palantir’s adjusted working source of revenue jumped by way of 11 proportion issues in 2024. In consequence, its base line shot up an outstanding 64% to $0.41 consistent with proportion final 12 months. Analysts be expecting robust enlargement in Palantir’s revenue for the following couple of years as neatly.

Knowledge by way of YCharts.

The dialogue above signifies that Palantir could possibly outpace Wall Side road’s revenue expectancies over the following 5 years because the spending on AI tool hurries up. That would lend a hand the inventory ship extra upside, although there’s one main problem for somebody taking a look to put money into Palantir at the moment.

The sky-high valuation makes purchasing the inventory a dangerous wager at the moment

Palantir inventory trades at a large top rate following its implausible rally previously 12 months. It trades at greater than 102 instances gross sales and has a trailing price-to-earnings ratio of 633. There’s no doubt that Palantir is on target to profit from the large alternative within the AI tool marketplace. Its numbers are evidence that it’s certainly gaining floor on this house, however the valuation turns out just a little indifferent from fact.

The one means Palantir can justify this valuation is by way of often outperforming consensus expectancies and exhibiting additional acceleration in its enlargement. The nice section is that Palantir does appear able to doing that given the tempo of its buyer additions and an building up within the measurement of contracts that it’s signing, all of that have helped it construct an important earnings pipeline and give a contribution towards wholesome unit economics.

Additionally, the corporate turns out set to develop at a quicker tempo than the AI tool marketplace over the following 5 years, taking into consideration the bounce in its RDV final quarter and its place as one of the crucial main dealers of AI tool platforms. All this would translate into extra upside in Palantir inventory in the end, however buyers who wish to purchase the inventory would do neatly to evaluate their possibility profile as its sky-high valuation opens up the opportunity of a pointy dip within the inventory fee in case any cracks seem in its enlargement tale.

Harsh Chauhan has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a disclosure coverage.