Carnival (CCL -2.26%) (CUK -2.41%) inventory has made an enormous restoration since nearly sinking, and yearly since its rebound is getting higher. In 2023 it accomplished file income, and in fiscal 2024 (ended Nov. 30), income went even upper, and Carnival returned to profitability.

Control and Wall Side road alike are taking a look ahead to even higher information in 2025. Let’s examine the place Carnival may well be in 5 years from now.

Again in motion

Carnival has turn out to be an actual turnaround inventory. Not like different such shares, it had so much going for it previously however used to be going through exceptional demanding situations for its trade. It wasn’t a tender and untested corporate however an industry-leading large, which made the turnaround possible much more likely. That has confirmed to be the case now, as folks return to reserving its world cruises and it navigates again to the highest effectively.

Carnival reported a very good fourth quarter to finish a blowout 12 months. Income larger 15% 12 months over 12 months in 2024 to a file $25 billion, and internet source of revenue used to be $1.9 billion, reversing its losses. Adjusted income earlier than curiosity, taxes, depreciation, and amortization (EBITDA) rose 40% upper than ultimate 12 months, and running source of revenue used to be up 80% to $3.6 billion.

The tempo of expansion is now slowing down, however call for continues to be sturdy. Fourth-quarter quantity used to be even upper than ultimate 12 months, and that used to be doubly spectacular as a result of it is ordinary in an election 12 months. Nearly two-thirds of 2025 occupancy is already booked, and at upper costs than ultimate 12 months. Control expects the sturdy call for to proceed into 2025 and for internet source of revenue to stay emerging. It has already ordered new ships and adjusted some locations to satisfy present call for, and it is making plans new locations to stay alongside of the cruise-going crowd.

In 5 years from now, Carnival must be extremely successful, with income expanding at a slower however secure tempo. Because it will get there, there may well be some lumpiness as call for moderates. Wall Side road is searching for adjusted income in line with proportion (EPS) of $1.76 in 2025, up from $1.42 in 2024, and emerging additional to $2.03 in 2026.

Demanding situations are taking a look much less ambitious

The large chance with Carnival is that call for slows down earlier than the corporate has sufficient cash and a viable plan to pay again its large debt. Because it starts to appreciate this plan, and it has sufficient money coming in to pay down the debt at a gradual and potential tempo, the chance is getting decrease.

Carnival has strategically paid off its highest-interest debt and already has $8 billion much less in general debt than it had at its height. It has most effective $4.2 billion arising for reimbursement over the following two years, and it’s producing expanding loose money glide to hide debt whilst pursuing a expansion time table. It ended 2024 with $3.6 billion in adjusted loose money glide.

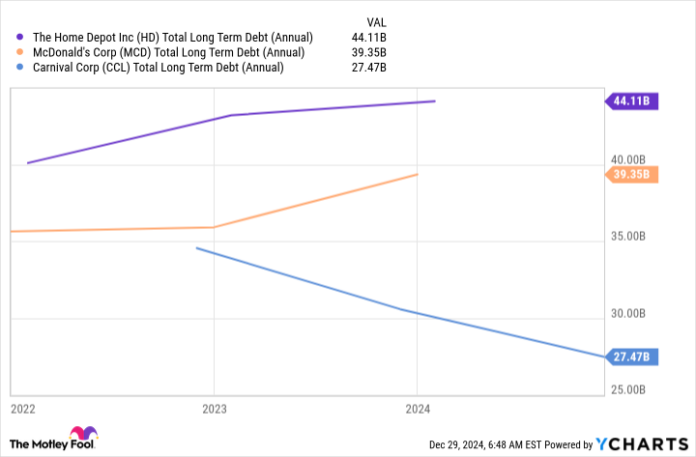

Whilst general debt of $27.5 billion is not one thing to sweep off, it is not as unreasonable as some traders would possibly assume. Many very good, established corporations stay a type of prime debt to hide dividend bills and expenditures whilst they make a lot more than the debt to pay it off on secure phrases. Two examples are McDonald’s and House Depot.

HD Total Long Term Debt (Annual) information via YCharts

Previous to the huge debt that got here on account of remaining its operations, Carnival nonetheless had round $10 billion in debt on reasonable. Whilst $27.5 billion continues to be means above that, bearing in mind it within the context of the traditional operational debt Carnival generally has on its steadiness sheet can lend a hand traders body the full a bit bit otherwise.

5 years from now, Carnival most certainly may not be debt-free, however it is going to be so much nearer to its reasonable. If it can pay off $3 billion yearly, it is going to land at round $12 billion. Because it helps to keep expanding its running money glide, it must be capable to increase operations with out being worried about paying off the debt in a well timed method. It might even get started up its dividend via then.

Carnival has already returned to being a market-beating inventory over the last two years, however that is been extra about its rebound and no more about its alternatives. Going ahead, it might stand out as a market-beating inventory as a result of its stellar and industry-leading trade.

Jennifer Saibil has no place in any of the shares discussed. The Motley Idiot has positions in and recommends House Depot. The Motley Idiot recommends Carnival Corp. The Motley Idiot has a disclosure coverage.