Carnival (CCL 1.83%) (CUK 1.88%) is the biggest cruise operator on the planet, however this trade chief has had a coarse few years. Its trade has rebounded, however there are some leftover results which can be nonetheless weighing on its monetary statements.

It is in a significantly better position than it used to be ultimate yr at the moment, with upper income, sure internet source of revenue, and decrease debt. It is also taking advantage of decrease rates of interest. Let’s examine the place it may well be in a yr from now.

Atmosphere sail

Carnival continues to document document quarter after document quarter. One of the most data can not move on endlessly, like worth and occupancy, nevertheless it will have to have the ability to continue to grow gross sales and internet source of revenue, although call for moderates.

The fiscal 2024 fourth quarter (ended Nov. 30) used to be the newest instance. Here is a rundown of one of the highlights:

Report income of $5.9 billion, up 10% yr over yr

Report fourth-quarter adjusted income ahead of hobby, taxes, depreciation, and amortization (EBITDA) of $1.2 billion, up 29% yr over yr

Report internet yields, up 6.7% yr over yr

Cumulative complicated booked place used to be at a document for the 2025 complete yr

Booked place for 2026 broke earlier data within the fourth quarter

Web source of revenue wasn’t a document, nevertheless it used to be sure, and that have been escaping Carnival for a number of years. It reported sure internet source of revenue of $303 million within the fourth quarter, up from a $48 million loss the yr ahead of, and $1.9 billion for the overall yr. Carnival is in its best-ever booked place for each worth and occupancy, coming from upper price ticket costs and better on-board spending, and that is exceeding unit value and main to better earnings. For 2025, control is guiding for internet yields to make stronger by means of 4.2% and altered internet source of revenue of $2.3 billion.

Carnival is atmosphere itself as much as meet call for and generate extra. It were given 3 new ships ultimate yr, and it is opening up two new unique locations within the Caribbean. Its promoting campaigns led to a 60% building up in paid seek clicks and a 40% building up in internet visits, which is a method that are supposed to gas additional call for.

In a yr from now, I’d envision upper income, expanding internet source of revenue, and robust call for. It is fully conceivable that the prime call for streak continues into 2026, with bookings out via 2027. It would rely on rate of interest strikes and different financial developments. If rates of interest stay declining, shopper spending may just building up. If issues keep the similar method they’re lately, call for may just start to stabilize.

Coping with debt

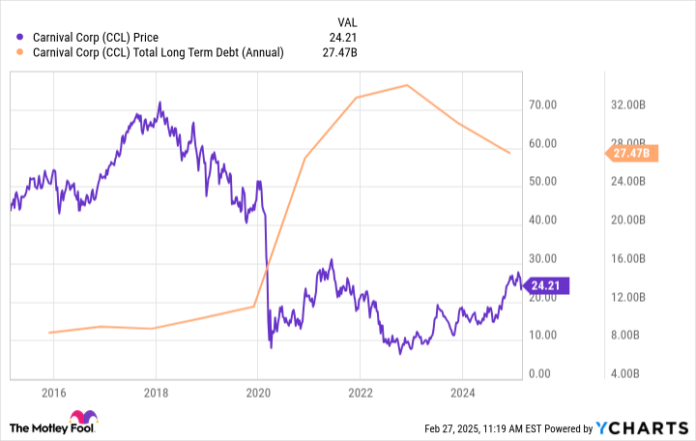

The primary detrimental issue that continues to plague Carnival is its debt. The debt stays smartly above its traditionally standard ranges, finishing 2024 at $27.5 billion. That creates possibility, as a result of call for may just wane ahead of the debt is paid off, proscribing the corporate’s talent to pay it again responsibly.

With this debt degree, Carnival inventory won’t proceed its climb, however it’s more likely to upward push because the debt is diminished. That is how the inventory has moved over the last 5 years, since Carnival assumed the prime debt. Realize how the inventory has moved conversely with the debt degree over the last two years.

CCL knowledge by means of YCharts

The debt is coming down because the trade improves, and the web debt-to-EBITDA ratio stepped forward from 6.7 in 2023 to 4.3 in 2024. Control is anticipating it to additional decline to a few.8 this yr.

12 months from now, the debt might be reduced however now not long past. The inventory worth will have to replicate that. If rates of interest move decrease, the inventory is more likely to upward push upper. Affected person buyers should purchase lately and have the benefit of the inventory’s doubtlessly sluggish however possible eventual upward push again to earlier highs or even upper.