Broadcom (AVGO 3.15%) has been an impressive funding over the last 3 years, as stocks of the semiconductor large have shot up an outstanding 240% all the way through this time and outpaced the 27% beneficial properties clocked through the PHLX Semiconductor Sector index over the similar duration.

Buyers could also be questioning if this chipmaker has sufficient gasoline within the tank to maintain its spectacular rally for the following 3 years as neatly and whether it is value purchasing Broadcom inventory following the cast beneficial properties it has already clocked. On this article, we will be able to read about Broadcom’s catalysts for the following 3 years, test to look if this semiconductor inventory is able to turning in extra upside, and analyze its valuation to determine whether it is nonetheless a excellent guess for buyers taking a look so as to add a chip inventory to their portfolios.

A large catalyst may just energy years of progress for Broadcom

Broadcom not too long ago introduced its effects for the fourth quarter of fiscal 2024 (which ended on Nov. 3). The corporate’s annual income grew 44% from the former yr to a document $51.6 billion. Broadcom’s natural income progress stood at 9% for the yr after, except the contribution from VMware, which used to be obtained in November remaining yr.

The chipmaker’s fiscal 2024 non-GAAP (adjusted) revenue got here in at $4.87 consistent with percentage, an development of 15% from the former yr. The great phase is that Broadcom’s steering for the primary quarter of fiscal 2025 means that it’s on the right track to develop at a quicker tempo this yr. The corporate has guided for $14.6 billion in income for the present quarter, which might be a 22% building up over the year-ago duration.

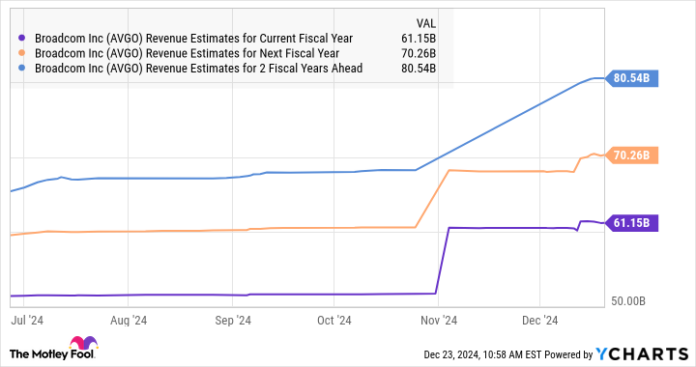

Despite the fact that Broadcom hasn’t issued full-year steering, analysts expect the corporate’s most sensible line to extend through virtually 19% within the present fiscal yr to $61.1 billion. Even higher, the semiconductor specialist’s most sensible line is predicted to clock 15% progress over the following couple of fiscal years as neatly.

AVGO Revenue Estimates for Current Fiscal Year knowledge through YCharts

The vital factor to notice within the chart above is that Broadcom’s income estimates had been hiked sizably for all 3 fiscal years. That may be attributed to the fast-growing call for for Broadcom’s synthetic intelligence (AI) chips, which might be being deployed in knowledge facilities for AI fashion coaching and inference, in addition to to allow quicker connectivity between servers for tackling AI workloads.

Extra in particular, Broadcom’s AI income shot up an improbable 220% in fiscal 2024 to $12.2 billion. The corporate expects forged progress within the AI trade within the present quarter as neatly, forecasting a 65% year-over-year building up in income from gross sales of AI chips to $3.8 billion. On the other hand, do not be stunned to look Broadcom’s AI income progress getting even higher because the yr progresses.

That is as a result of two further hyperscale consumers have decided on Broadcom’s customized AI processors for deployment. Its customized chips are already utilized by primary cloud provider suppliers that want to scale back their dependence on dear graphics playing cards from Nvidia for his or her AI wishes. The growth of the corporate’s buyer base will put it in a more potent place to profit from a large progress alternative.

Broadcom control remarked on the newest revenue convention name that the serviceable addressable marketplace for its customized AI accelerators and networking chips may just vary between $60 billion and $90 billion through fiscal 2027. Assuming the scale of the marketplace lands on the midpoint of $75 billion, and Broadcom manages to maintain even a 50% percentage of the customized chip marketplace at the moment as in comparison to its present marketplace percentage of 55% to 60%, in step with JPMorgan, its AI income may just hit $37.5 billion in fiscal 2027.

That might be just about triple the AI income that Broadcom generated within the earlier fiscal yr. On the other hand, if Broadcom manages to deal with its percentage of the customized chip marketplace at 60%, and the scale of the marketplace certainly hits $90 billion as consistent with the corporate’s estimates, then its income from AI-related gross sales may just simply exceed $50 billion.

If that’s the case, Broadcom’s general income in fiscal 2027 may well be neatly above analysts’ expectancies that we noticed within the chart previous since its incremental AI income may just soar through round $40 billion from remaining yr’s ranges (assuming Broadcom’s different trade segments do not display any progress).

Is the inventory nonetheless value purchasing?

The great phase about Broadcom is that it’s nonetheless buying and selling at a ravishing 35 instances ahead revenue. That’s not very dear once we believe that the Nasdaq-100 index (the use of the index as a proxy for tech shares) has an an identical price-to-earnings ratio.

What is extra, Broadcom’s payment/earnings-to-growth ratio (PEG ratio) is solely 0.63 as consistent with Yahoo! Finance, in keeping with the five-year revenue progress that the corporate is predicted to ship. A PEG ratio of not up to 1 signifies that a inventory is reasonable with appreciate to its estimated revenue progress over the following 5 years, and Broadcom is reasonably sexy in this entrance.

So, buyers taking a look so as to add an AI inventory this is attractively valued and able to turning in sturdy beneficial properties over the following 3 years to their portfolios can believe purchasing Broadcom as it kind of feels neatly positioned to maintain its rally.

JPMorgan Chase is an promoting spouse of Motley Idiot Cash. Harsh Chauhan has no place in any of the shares discussed. The Motley Idiot has positions in and recommends JPMorgan Chase and Nvidia. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.