A big portion of businesses within the inventory marketplace without delay care in regards to the well being of the American user, but it’s exceedingly tough to get a learn at the user as a result of such a lot of the information turns out to war. Customers are concurrently the richest they’ve ever been on some metrics, whilst slightly escaping poverty on different metrics.

Thus, the million-dollar query for these kind of consumer-facing corporations is: What’s the precise state of the American user?

I am not completely in a position to reply to the query, however this text will duvet the subject from plenty of angles to offer as a lot perception as we will be able to. We will start with knowledge suggesting the shopper is robust:

Robust Shopper

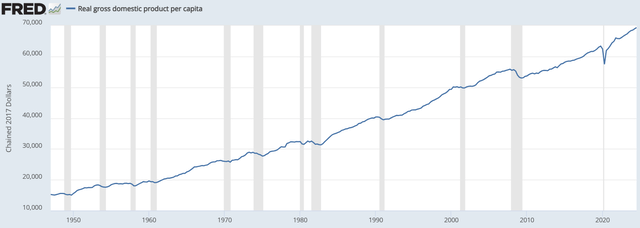

Actual GDP in step with capita is the best possible it has ever been.

FRED

It is a actual determine, which means it’s already inflation adjusted.

GDP is fascinating from a countrywide stage, however no longer as related to particular person shoppers. The typical user’s well being goes to be extra carefully tied to median family source of revenue.

There are 2 number one variations between median family source of revenue and GDP in step with capita.

This can be a median determine relatively than the imply, which removes the sure skew of the extraordinarily prime earners. Family source of revenue has families as a denominator relatively than inhabitants, and the selection of families has greater as a share of the inhabitants.

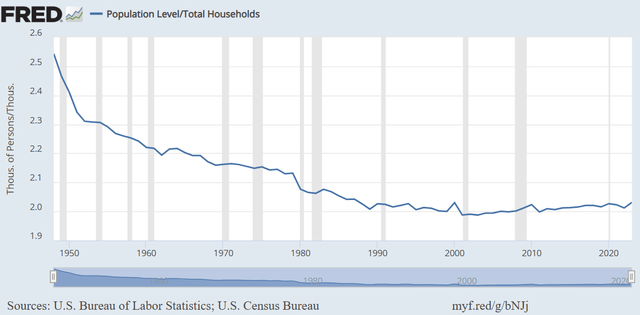

A family now averages about 2 folks, down continuously from 2.5 in 1950.

FRED

So, through the usage of the median, we’ve in large part accounted for source of revenue disparity, and through adjusting for a decrease selection of folks in step with family, we’ve accounted for the greater bills that include it. Either one of those changes make median actual family source of revenue much less steep of an building up than GDP in step with capita.

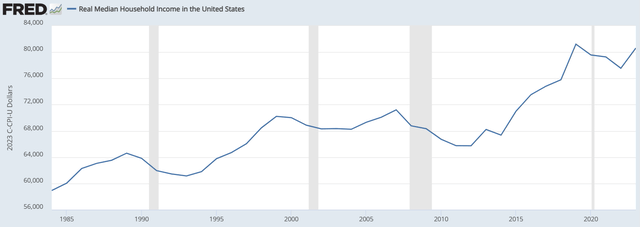

Alternatively, even after those changes, actual family source of revenue is soaring close to all-time highs and is way upper than a decade in the past.

FRED

So, if the common user has extra source of revenue in inflation-adjusted greenbacks, they must be sturdy, proper?

Neatly, there may be some conflicting knowledge indicating a susceptible American user.

Vulnerable Shopper

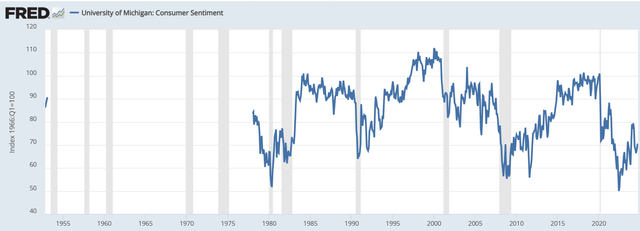

Shopper sentiment is easily beneath standard ranges, consistent with the College of Michigan learn.

FRED

For the previous few years, user sentiment has been at ranges which might be generally most effective observed all over recessions.

It is a survey, so there may be some subjectivity to it. In all probability shoppers are in fact doing smartly however for some mental, social or different causes, they really feel like they’re suffering.

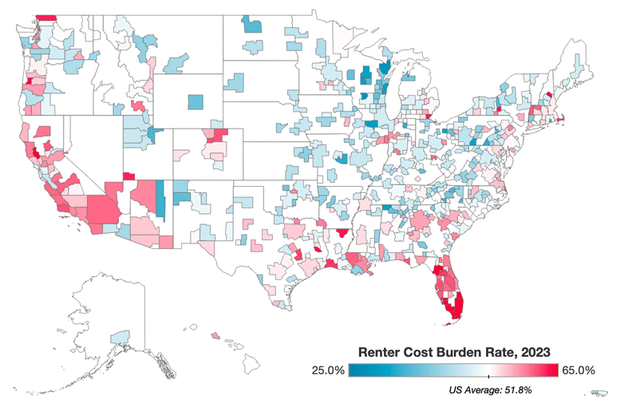

That may be the case, however there could also be knowledge indicating actual monetary difficulties. In November 2024, Rental Checklist reported cost-burdened families achieving a brand new file:

52% of the country’s renters are cost-burdened, which means they spend greater than the advisable 30% in their source of revenue on housing. This charge burden charge has been trending up continuously since 2019, as enlargement in rents has outpaced enlargement in earning. In general, as of late there are over 22 million rent-burden families throughout the USA, a brand new file”

Traditionally, charge confused families were very region-specific. Sure towns have been undersupplied with housing and folks have been getting priced out. Lately, then again, it’s a lot more in style.

ApartmentList

The sunbelt was once a beacon of affordability, however now it has joined the coasts in being burdensomely dear, no less than from a housing point of view.

Causes for the information discrepancy

It kind of feels contradictory that family source of revenue has been rising properly even after inflation adjustment, and but folks really feel deficient and in all probability are deficient in terms of affording necessities like housing and meals.

The commonest argument for this contradiction is wealth inequality.

Whilst there may be some reality in the concept source of revenue disparity has widened, it mathematically can’t be the entire tale. The largest supply of rising source of revenue disparity is the tail at the rich aspect of the bell curve. Whilst a small share of the inhabitants is making excessive quantities of cash, that has little bearing at the median.

The median family has considerably grown their web of inflation source of revenue, and but 51.8% of families are lease confused (which means greater than 30% of source of revenue spent on lease).

51.8% comprises the median. Due to this fact, even the families that experience grown actual source of revenue significantly are nonetheless by hook or by crook feeling this burden.

What provides?

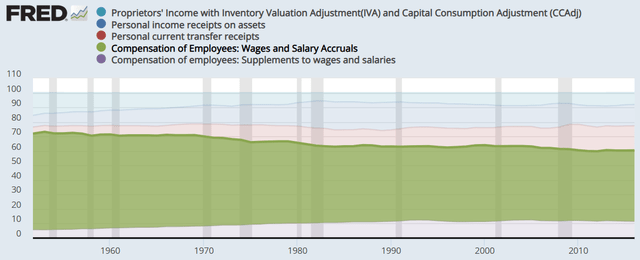

Neatly, there were vital adjustments to the composition of family source of revenue. Particularly, the portion of source of revenue that comes from wages and wage has declined significantly, proven in inexperienced beneath.

FRED

Those 5 classes upload as much as 100%, so the place is the remainder of source of revenue coming from?

2 classes have greater materially:

Dietary supplements to wages Executive assessments

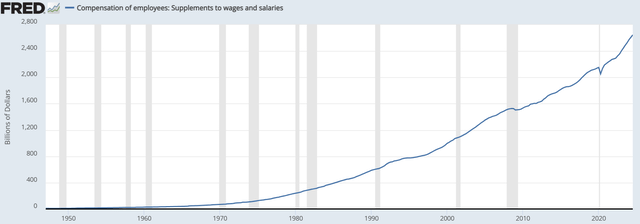

Dietary supplements are techniques by which employers pay their staff who are not without delay thru wages. It may well be advantages reminiscent of insurance coverage or such things as employer contributions to 401ks. The mixed dietary supplements have risen sharply.

FRED

Those dietary supplements supply very actual advantages to staff, however you’ll’t use them to pay for lease or groceries.

Thus, although they’re a part of source of revenue, they really feel extra like decreasing sure prices, reminiscent of the price of independently purchasing medical health insurance.

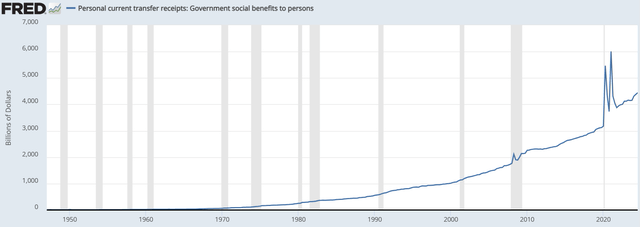

Executive stimulus and different advantages shot up all over COVID and feature remained at an above development stage since.

FRED

This supply of source of revenue, not like employer supplementary advantages, can also be and has been used to pay for lease and groceries.

I believe this can be a massive supply of the extraordinarily low user sentiment.

Long run executive advantages/stimulus are unknown. So folks were in a position to pay lease and feature been in a position to shop for their groceries, however to the level those have been funded through the stimulus, it creates a undeniable uneasiness about affordability going ahead.

Salary/wage funded bills really feel relatively a bit of higher. When anyone can have enough money day by day residing bills thru their wage and wages, it feels sustainable and of their keep an eye on. They are able to forecast the cheap and really feel assured that they are able to make ends meet.

As such, I posit that the low user sentiment is a results of:

Wages/salaries being a smaller portion of source of revenue Stimulus being the next portion of source of revenue

I haven’t any opinion on whether or not stimulus and different such executive task is just right or dangerous. In all probability it was once important all over the pandemic, that’s not for me to come to a decision, and it’s out of doors the scope of this text.

The funding related level this is that user sentiment has lengthy been considered as a ahead indicator of user spending. Every time a brand new low learn comes out on user sentiment, retail and different without delay user comparable shares have a tendency to dump.

This may not be proper. Shopper spending has been sturdy lately, simultaneous with user sentiment being extraordinarily low.

Retail and different consumer-facing corporations do not in reality care if the shopper feels just right about their skill to spend, they simply care that the shopper in fact does spend.

With all that stated, my learn at the energy of the American user is that ahead user spending is more likely to stay reasonably prime, even though there’s a rising and in all probability rational sense of economic lack of confidence.