monsitj

Marketplace Assessment

The rally that began in past due October, 2023, persevered this quarter as we witnessed appreciation throughout more than one asset categories. Actually, on the finish of the quarter the S&P 500 (SP500, SPX) posted its largest year-to-date (“YTD”) advance of the twenty first century. And in spite of the new extremely publicized “demise of the normal 60/40 portfolio,” Bloomberg’s world mixture bond index is on target for its fourth perfect quarter of the twenty first century. To connect some numbers to it, the S&P 500 used to be up 5.9% for the quarter and 22.1% YTD, the Russell 1000 Enlargement (“R1000G”) used to be up 3.2% for the quarter and 24.6% YTD, and the Dow used to be up 8.2% for the quarter and up 12.3% YTD. The sturdy 3Q returns marked a vital turnaround from previous within the quarter when US recession fears and the unwinding of the yen elevate industry brought about vital marketplace turmoil, throughout which the S&P 500 misplaced 8.5% over 14 buying and selling days (Jul 16 – Aug 5). In the long run chance property recovered due to a dovish central financial institution pivot (see extra under), more potent financial information, and a large stimulus bundle from the Chinese language Communist Birthday celebration (“CCP”).

Supply: Haver Analytics, Deutsche Financial institution.

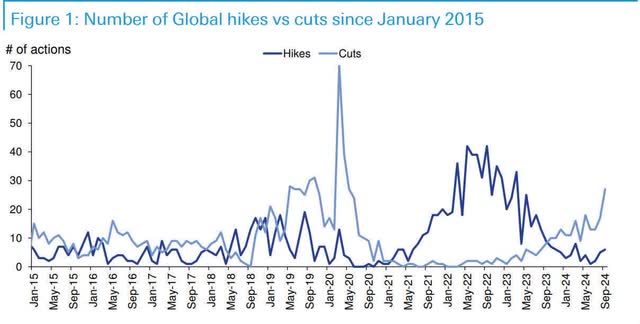

The 2022-2023 Federal Reserve rate of interest mountain climbing cycle concluded this quarter, following 11 will increase over a 30-month length that introduced borrowing charges from a low of ~0% to a top of five.25-5.50%. The Fed kicked off its easing cycle with a much-debated 50 foundation level lower at the again of weaker information from the Hard work Division, which revealed a disappointing jobs document adopted by means of a knowledge revision that confirmed the U.S. added 818K fewer jobs within the 12-month length ended March 2024 than at first reported. This lower triggered a fury of world central financial institution job, with September seeing a vital step-up in rate of interest cuts from different central banking our bodies (see chart above). The marketplace’s knee-jerk response to the oversized Fed lower used to be to worth in additional constant, competitive cuts on a world foundation. This idea has since been walked again, with the United States 10-year (US10Y) yield emerging from a low of three.64% on September seventeenth to its present ~4.1%. Because it stands as of late, the pricing-in of extra vital charge cuts seems competitive, absent a US or Eu recession, however now not competitive sufficient if the lengthy awaited recession does in spite of everything arrive. Including gasoline to the global-liquidity fireplace used to be the past due September announcement from China’s central financial institution that it could be unveiling its largest stimulative spice up because the Covid-19 pandemic, which consisted of 20%-30% cuts in key coverage charges, an building up in liquidity within the banking machine, and loan charge decreases, all in an try to pull the economic system out of its deflationary spiral and push expansion again in opposition to the CCP’s said expansion goal of ~5%. Time will inform if those measures will stimulate bad credit report call for to spice up home intake and improve the rustic’s flailing assets markets. Right here at house, we is also at a tenuous level within the financial cycle. US inflation seems to be underneath regulate, thus warranting looser financial coverage. Then again, loosening too speedy may result in a step-up in borrowing and intake, thus risking a re-acceleration of inflation. Time will inform if the Fed has certainly orchestrated its first cushy touchdown up to now 30 years, or if the speed and magnitude of its previous rate-hiking choices will in spite of everything tip the United States right into a extensively forecasted financial recession.

3Q24 Efficiency

PERFORMANCE (%)

3Q24

1 YR

3 YR

5 YR

ITD 1

Ithaka US Enlargement Technique (Gross)

0.4

42.3

6.1

17.7

17.7

Ithaka US Enlargement Technique (Internet)

0.2

41.4

5.5

17.1

17.2

Russell 1000 Enlargement (“R1000G”)

3.2

42.2

12.0

19.7

17.5

S&P 500 TR Index

5.9

36.4

11.9

16.0

14.7

1 ITD = inception-to-date, annualized. Inception date is 1/1/2009.

Click on to magnify

All the way through the 3rd quarter Ithaka’s portfolio underperformed in an up marketplace, emerging 0.4% (gross of charges) vs the R1000G emerging 3.2%. Ithaka’s 280bps of underperformance used to be fully because of inventory variety, with a negligible tailwind from sector allocation. Our portfolio demonstrated modest breadth and intensity, with 16 of 31 shares held for all the quarter, representing 49% of the names and 52% of the overall portfolio’s weighting, outperforming our benchmark. This used to be now not unexpected given the narrowness of the marketplace’s returns of past due.

On the portfolio sector stage Ithaka discovered sure relative returns in some of the 4 main expansion sectors by which we dangle lively bets, particularly Monetary Products and services. Inside of Monetary Products and services, our outperformance used to be concentrated in a single identify, greater than offsetting slight weak point in one among our fee networks. Including to returns used to be our vital obese to the sphere. We discovered modest returns within the Era sector, with simplest six of fifteen holdings outperforming our benchmark. A vital bite of our underperformance used to be because of our holdings around the semiconductor provide chain, with worries surrounding chip delays and geopolitics harming the trade.

Our slight underperformance in Well being Care used to be pushed by means of one protecting that noticed a vital sell-off following its 2d quarter profits announcement (see peak detractors). Shopper Discretionary used to be our biggest supply of underperformance, with 4 of our 8 holdings underperforming within the quarter. Weak point used to be concentrated in our brick-and-mortar shops, with considerations surrounding the well being of the patron and company-specific occasions resulting in the relative weak point.

Members and Detractors

3Q24 TOP 5 CONTRIBUTORS (%)

RETURN

IMPACT

ServiceNow (NOW)

13.7

1.0

Mastercard (MA)

12.1

0.7

Blackstone (BX)

24.8

0.5

MercadoLibre (MELI)

24.9

0.5

Apple (AAPLL)

10.8

0.4

Click on to magnify

3Q24 TOP 5 DETRACTORS (%)

RETURN

IMPACT

DexCom (DXCM)

(40.9)

(1.0)

e.l.f. Attractiveness (ELF)

(48.3)

(1.0)

ASML (ASML)

(18.4)

(0.6)

CrowdStrike (CRWD)

(26.8)

(0.6)

Chipotle Mexican Grill (CMG)

(8.0)

(0.3)

Click on to magnify

Most sensible Members

ServiceNow, Inc. (NOW)

Based in 2004, ServiceNow has turn into the main supplier of cloud-based instrument answers that outline, construction, arrange and automate workflow products and services for world enterprises. ServiceNow pioneered the usage of the cloud to ship IT carrier control (“ITSM”) packages. Those packages permit customers to regulate incidents and to devise new IT tasks, provision clouds, arrange utility efficiency and construct packages themselves. The corporate has since expanded past the ITSM marketplace to offer workflow answers for IT operations control, buyer improve, human sources, safety operations and different endeavor departments the place a patchwork of semi-automated processes were used with various luck up to now. ServiceNow’s inventory preferred within the quarter at the again of robust profits that beat Side road estimates at the peak and final analysis, with the corporate pointing to energy in subscription revenues, cRPO, running margins, and persevered call for for the corporate’s AI merchandise.

Mastercard, Inc. (MA)

Mastercard is one among two main firms (together with Visa, which we additionally personal) that is helping fit data and budget between banks that experience relationships with card-carrying customers and banks that experience relationships with traders, thus making sure fee transactions are dependable and safe. Because the corporation’s founding in 1966, Mastercard has benefited from the expansion in private intake expenditure, the sturdy secular shift from money and tests to credit score and debit playing cards, and a extremely successful trade type that generates top incremental running margins and therefore considerable and rising loose money waft according to percentage. All the way through the 3rd quarter Mastercard’s inventory outperformed as an in-line profits announcement and robust world credit score expansion helped pull the inventory out of a six- month consolidation.

Blackstone Inc. (BX)

Blackstone is likely one of the international’s main choice asset control companies with general property underneath control (“AUM”) now in way over $1 trillion. During the last few many years Blackstone has advanced into some of the monetary carrier trade’s biggest asset gatherers, managing cash on behalf of pension budget, insurance coverage firms, and particular person traders. The corporate stays at the vanguard of economic innovation, ceaselessly broadening its product providing over the years. Nowadays, Blackstone invests purchasers’ capital throughout 4 trade segments: (a) Actual Property, (b) Personal Fairness, (c) Hedge Fund Answers, and (d) Credit score & Insurance coverage. The inventory’s relative outperformance within the quarter used to be basically because of investor expectancies that the non-public markets are starting to un-freeze, which must result in a step up in deal crystallizations (gross sales) for the corporate.

Most sensible Detractors

DexCom, Inc. (DXCM)

DexCom is a clinical instrument corporation centered at the design, building, and commercialization of continuing glucose tracking (CGM) programs, basically for other folks with diabetes.

Diabetes is a protracted, life-threatening illness for which there’s no identified treatment. DexCom’s CGM machine is awesome to conventional finger-stick exams as it supplies customers with steady information (together with glucose traits and time spent in hyper or hypoglycemia) as opposed to a snapshot in time. Dexcom’s inventory suffered following its 2Q24 profits announcement.

The corporate ignored at the peak line and lower ahead earnings steerage from $4.20-$4.35B to $4.00-$4.05B. The lower used to be because of a step-down in earnings according to buyer in the United States in addition to a lack of marketplace percentage within the corporation’s sturdy clinical apparatus (“DME”) channel. Control plans to refocus its gross sales efforts within the DME channel to win again misplaced percentage and in addition expects the earnings according to affected person headwinds to minimize as its new product, the G7, abruptly overtakes its prior era merchandise and turns into a majority of corporation revenues.

e.l.f. Attractiveness, Inc. (ELF)

e.l.f. Attractiveness is a multi-product-line attractiveness corporation that provides inclusive, available, blank, vegan and cruelty-free cosmetics and skincare merchandise that concentrate on savvy Gen Z and Millennial shoppers. The corporate’s moat stems from providing a product this is top quality at inexpensive costs, using an trade main 13-week manufacturing cycle, and using a disruptive advertising and marketing engine, which is closely interested in viral expansion thru virtual/social media. ELF’s underperformance within the quarter used to be because of its F1Q25 profits announcement that featured an anticipated beat at the peak and backside strains, coupled with an impulsively tepid ahead steerage. The steerage “pass over” blended with the inventory’s tough valuation more than one supplied temporary traders with a rationale to promote the inventory.

ASML Preserving N.V. (ASML)

ASML is a number one provider of photolithography apparatus utilized in semiconductor production, enabling the manufacturing of microchips at ever-smaller line widths. The corporate’s cutting- edge applied sciences, specifically excessive ultraviolet (EUV) lithography, play a important function in generating probably the most complicated chips for packages like smartphones, information facilities, and AI. ASML’s programs are essential for the semiconductor trade, serving to to push the limits of Moore’s Legislation and force innovation in electronics. Like maximum gamers within the world semiconductor house, ASML suffered from more than a few executive restrictions put on gross sales of programs to nations thought to be opposed to US pursuits. Particularly, throughout the quarter ASML’s sturdy profits document used to be overshadowed by means of the Biden management telling its allies the United States used to be bearing in mind enforcing critical industry restrictions to restrict ASML from promoting/servicing lithography programs in China.

Transactions

All the way through the quarter we initiated a brand new place in Palantir Applied sciences (PLTR) and eradicated each Align Applied sciences (ALGN) and Snowflake (SNOW). Our trailing 12-month turnover reduced to 11.8% whilst our trailing 3-year reasonable annual turnover reduced to twelve.1%. 1

Marketplace Outlook

Ithaka claims no experience in financial or marketplace predictions, and top-down research simply performs a supporting function in our technique to making an investment. We in most cases take our cues at the economic system and the markets from our firms’ control groups as they talk about their trade possibilities, and trade outlooks, throughout quarterly calls. All the way through the 3rd quarter 90% of our portfolio holdings beat top-line expectancies and 81% beat bottom-line expectancies, which resulted within the reasonable inventory falling ~1% , 8 shares expanding >5%, and 9 shares falling >5%. There used to be little skew within the quarter, however as standard it incorporated fats tails. On their profits calls, control groups persevered to talk about the well being of the patron, AI roadmaps, and extremely scrutinized (continuously pared again) capital spending plans, which has been the case since mid 2023. Out of doors of those prevalent issues, the marketplace’s pastime within the pending presidential election and the go with the flow trail of central financial institution rate of interest strikes have gained heightened pastime.

Presidential election years have a tendency to be risky instances for the markets as traders attempt to bargain: 1) who the winner might be, 2) the chance that management’s insurance policies get carried out, and three) the have an effect on those aforementioned insurance policies would have on particular person firms in a given trade. As you’ve gotten heard us say sooner than, we don’t seem to be macro economists and we consider making such prognostications is problematic, at perfect. In an try to speculate as to the result, given what we lately know, apparently most probably that Donald Trump might be our subsequent president.

This hypothesis is supported by means of more than one polls of past due appearing Trump with a lead within the majority of the swing states and therefore the electoral faculty. Extra importantly, in our minds, the making a bet web site, Polymarket, has noticed $1.6B wagered, which signifies Trump lately has a 54% likelihood of profitable. As they are saying, other folks do have a tendency to “put their cash the place their mouth is.” As for Trump’s financial insurance policies, the primary tenets come with extending the expiring 2017 tax cuts, lowering company source of revenue taxes to fifteen%, some type of further industry price lists, and getting rid of taxes on more than a few sorts of source of revenue, the biggest being pointers, time beyond regulation, and Social Safety advantages. The near-term have an effect on of those financial insurance policies would most probably put extra money into the economic system at a value of even better executive deficits and rising nationwide debt, which as of late stands at ~$35.7T and rising speedy. What we do know is that till we get readability on who the following president might be, marketplace volatility, as measured by means of the VIX, will most probably ceaselessly building up. Actually, the common per 30 days volatility for US election years ceaselessly will increase from July and peaks in November, sooner than falling back off to a extra commonplace stage in December.

Our marketplace outlook phase would not be entire with out our mandatory musings at the Fed’s long run coverage choices. The 30-month saga of emerging and peaking rates of interest has ended, with the Fed beginning its easing cycle with a supersized 50bp lower in mid-September. Apparently, since that lower the bond marketplace has carried out not anything however dump, with the ten yr yield emerging 50bps over the last month. Mr. Marketplace, who used to be determined for charge cuts, appears to be having 2d ideas concerning the inflation struggle being gained. Inflation hawks were given some additional ammunition when the September CPI quantity used to be launched, which confirmed Core CPI expanding 10bps to three.3% following two flat months at 3.2%. Couple an unsure inflation image with preliminary filings for unemployment hitting the very best since August 2023, and you’ll see why the Fed is still caught between a rock and a troublesome position. As at all times, we finish this letter acknowledging that one’s skill to digest, forecast, and appropriately bargain the above macro elements is just about an workout in futility, and we subsequently make a selection to stick absolutely invested and interested in our project of earning profits for our purchasers by means of proudly owning, in dimension, the good expansion tales of our day.

1 Turnover Fee signifies the frequency of adjustments to the portfolio, and is calculated because the higher of the buys or the sells throughout the length as a share of the property underneath control on the time of every transaction. The calculation removes the impact of client-directed money flows. Reasonable Annual Turnover is calculated in response to a trailing 3 yr length.

Possibility Disclosure

Previous efficiency isn’t indicative of long run effects. The efficiency proven is for the Ithaka US Enlargement Technique Composite. All absolutely discretionary taxable and non-taxable accounts are added to the composite following the primary quarter by which their finishing marketplace values equivalent or exceed $0.5 million. Result of particular person accounts might range from the composite relying on account dimension, timing of transactions and marketplace prerequisites prevailing on the time of the transaction. The gross-of-fee efficiency does now not replicate the fee of control charges and different bills which might be incurred within the control of an account. The online-of-fee efficiency contains the fee of such charges and bills. Gross-of-fee efficiency and net-of-fee efficiency each come with the reinvestment of all distributions, dividends and different source of revenue.

The efficiency proven is in comparison to the Russell 1000 Enlargement Index and the S&P 500 TR Index. The Russell 1000 Enlargement Index measures the efficiency of the vast expansion phase of the U.S. fairness universe. It contains the ones firms from the Russell 1000 Index with top price-to-book ratios and top forecasted expansion as in comparison to different firms indexed within the Russell 1000 Index. The S&P 500 TR Index is a market-capitalization- weighted index that measures the efficiency of 500 main publicly traded firms within the U.S. The index tracks each the capital good points in addition to any money distributions, comparable to dividends or pastime, attributed to the parts of the index. Those broad-based securities indexes are unmanaged and don’t seem to be matter to charges and bills in most cases related to controlled accounts. People can not make investments at once in an index.

The guidelines supplied on this document must now not be thought to be a advice to buy or promote any specific safety. There is not any assurance that any securities mentioned herein will stay in an account’s portfolio on the time you obtain this document or that securities offered have now not been repurchased. The securities mentioned don’t constitute an account’s whole portfolio and within the mixture might constitute just a small share of an account’s portfolio holdings. It must now not be assumed that any of the securities transactions or holdings mentioned had been or will turn out to be successful, or that the funding suggestions or choices Ithaka makes someday might be successful or will equivalent the funding efficiency of the securities mentioned herein. Making an investment in securities includes chance and might lead to lack of major.

Touch: information@ithakagroup.com 3811 N Fairfax Pressure | Suite 720 | Arlington, VA 22203 Ph: 240.395.5000 | www.ithakagroup.com

Click on to magnify

Editor’s Observe: The abstract bullets for this text had been selected by means of Looking for Alpha editors.

Editor’s Observe: This newsletter discusses a number of securities that don’t industry on a big U.S. trade. Please pay attention to the hazards related to those shares.