Kyndryl Holdings (KD -9.01%) seems like a dear inventory. The IT infrastructure specialist trades at 61 instances GAAP income, and its loose money flows had been adverse around the previous 4 quarters. That is a lofty price-to-earnings (P/E) ratio, and plenty of price traders will simply stroll clear of Kyndryl’s fresh money intake behavior.

However then you are lacking the large image. Kyndryl’s separation from former father or mother corporate IBM (IBM -1.26%) left the corporate with loads of low-margin consumer contracts, leading to deficient benefit margin. The corporate has been busy restructuring its offers, boosting the profitability of about part its inherited long-term earnings streams within the first 3 years of standalone operations.

Kyndryl’s monetary makeover

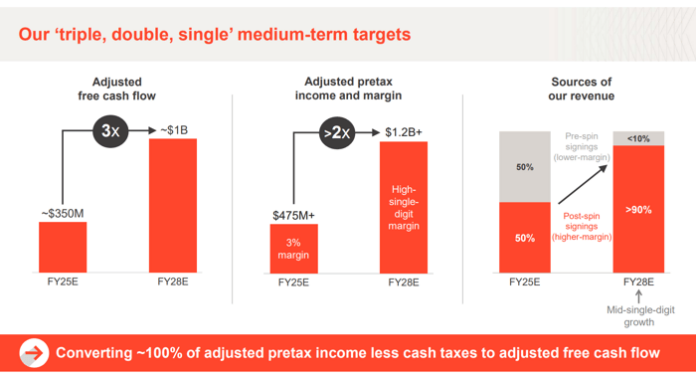

That ratio must upward thrust to 90% renegotiated offers by way of fiscal 12 months 2028. Unfastened money glide is predicted to succeed in $300 million in 2025, after which triple over the following 3 years. By way of then, the sliding top-line earnings must stabilize at mid-single-digit annual enlargement, surroundings Kyndryl as much as be a shareholder-friendly money device with beneficiant buybacks and in all probability a tight dividend, too.

Here is how Kyndryl’s control likes to visualise those “triple, double, unmarried” ambitions:

Symbol supply: Kyndryl Holdings Q3 2025 income presentation.

All of it begins with a little bit of fancy monetary engineering. That is par for the route, since CEO Martin Schroeter spent 13 years in high-level monetary control roles at IBM. Backing clear of unprofitable carrier contracts led to falling gross sales, however it’ll additionally generate richer benefit margin and direct benefit through the years.

Exploring Kyndryl’s valuation from a long run viewpoint

Kyndryl’s inventory does not glance pricey anymore while you account for the corporate’s long-term benefit enlargement. If the corporate reaches its $1 billion goal totally free money flows in 2028 and the inventory stayed flat, Kyndryl can be price simply 8 instances the ones estimated 2028 money flows. The inventory charge may just double from right here and nonetheless glance inexpensive subsequent to IT control products and services opponents equivalent to Accenture (ACN -0.34%) and WiPro (WIT 1.61%).

So Kyndryl’s inventory is not as pricey as it kind of feels. The corporate is restructuring its order guide on a basic point, surroundings traders up for cast long-term returns.

Anders Bylund has positions in World Trade Machines. The Motley Idiot has positions in and recommends Accenture Plc, World Trade Machines, and Kyndryl. The Motley Idiot has a disclosure coverage.