I wrote so much about Rivian Automobile (RIVN -2.13%) previous this yr, arguing that stocks are criminally undervalued as opposed to their long-term doable. After a protracted stretch of percentage worth weak spot, the marketplace has in spite of everything began to shift its sentiment. For the reason that starting of November, as an example, Rivian’s inventory worth has higher by means of more or less 40%.

Are stocks nonetheless undervalued? Learn on, and the solution would possibly marvel you!

Simplest scratching the outside but

As an rising electrical automotive inventory, Rivian’s long term is a ways from settled. Lower than 10% of automobiles bought within the U.S. this yr were electrical cars (EVs). The corporate has handiest two fashions available in the market these days: the R1T and the R1S. Each promote for round $100,000 apiece — way more dear than maximum customers can have the funds for. So with regards to trade enlargement and Rivian’s talent to develop inside that trade, it is simply getting began.

The largest tournament to get eager about is not going on this yr. It would possibly not even happen subsequent yr. Someday most likely in 2026, Rivian may just start deliveries on 3 mass marketplace cars: the R2, R3, and R3X. All 3 fashions are anticipated to debut for only $50,000, permitting Rivian to faucet the mass marketplace like by no means sooner than. When Tesla debuted its mass marketplace cars — the Type 3 and Type Y — gross sales hit an enormous inflection level, doubling after which tripling within the years that adopted. Rivian’s mass marketplace cars may just do the similar for its gross sales base, vastly bettering the corporate’s valuation.

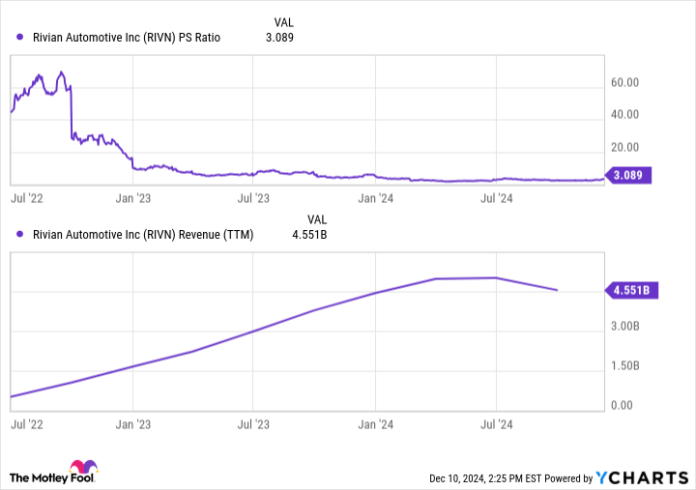

RIVN PS Ratio knowledge by means of YCharts.

This is the issue: This inflection level remains to be a number of years away. Within the interim, Rivian’s percentage worth — even supposing nonetheless reasonably affordable at 3.1 instances gross sales — will stay unstable. The new percentage worth surge is testomony to this truth. I nonetheless love Rivian as an funding long-term given the potential for its mass marketplace fashions, even at these days’s upper valuation. However in the event you leap in now, be ready to double down if stocks display weak spot once more — a robust chance given few primary catalysts will arrive till 2026.

Ryan Vanzo has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a disclosure coverage.