andresr

This fall 2024 Small-Cap Marketplace Replace: Surprise and Awe

Small-Cap Returns in 2024: Breaking a 46-Yr Trend

Small caps logged first rate returns in 2024, however like a damaged file, took some other flip and lagged in the back of their huge cap brethren. This is neither awe inspiring nor surprising given small caps’ 14-year relative underperformance run. What’s actually surprising is that the Russell 2000’s (RTY) 11.5% go back in 2024 marked the primary time within the index’s 46-year historical past that it had a go back between 6% and 14%. Previous to this, the Russell 2000 had noticed returns more than 14% in 27 years, and returns underneath 6% in 18 years, however by no means a go back within the 6-14% vary till this previous yr. Surprising for the reason that index’s reasonable go back is 11%.

Why a Small-Cap Cycle Would possibly Be at the Horizon

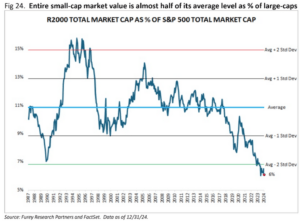

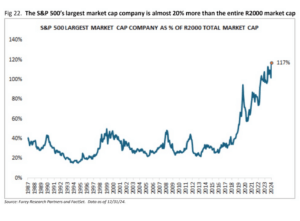

In prior commentaries, we’ve lined why we expect we’re with reference to seeing a small cap cycle. First, the entirety is inherently cyclical and massive cap management is lengthy within the enamel. 2nd, small cap valuations are close to the low finish in their vary in comparison to huge. (Furey Analysis, 2024 Yr Finish Letter. pg. 51). 3rd, small caps kick butt within the yr after presidential elections with reasonable returns of 17.6% and no destructive years (Furey Analysis, 2024 Yr Finish Letter. pg. 5). And finally, the arena’s biggest corporations can’t develop to the moon!

Financial Surprise and Awe: Implications for Small-Cap Firms in 2025

Surprise and awe is an army technique that overwhelms an enemy’s belief of the battlefield. It makes use of fast, concentrated moves to create confusion and disarray. This method, popularized right through the Gulf Struggle, is dependent upon the part of wonder and the swift execution of drive to incapacitate the opponent psychologically, and bodily. As we glance forward, incoming President Trump has signaled plans for daring, sweeping movements that would reshape now not simply the geographic panorama–suppose Panama and Greenland–but in addition the commercial panorama. Insurance policies comparable to vital tariff will increase on our closest allies, Canada and Mexico, and stringent immigration reforms may just ship an financial “Surprise and Awe,” profoundly affecting many industries.

How Financial Insurance policies May just Spark Small-Cap Enlargement

Whilst those insurance policies would possibly appear disruptive to start with look, their broader financial implications may just create sudden alternatives, specifically for small-cap corporations poised to thrive in a domestic-focused panorama. Upper price lists would most probably lift the price of imported items, using inflationary pressures around the economic system. In a similar fashion, insurance policies geared toward decreasing the immigrant body of workers may just exacerbate hard work shortages in key sectors, additional pushing wages and prices upward. Whilst those measures would possibly create near-term turbulence, they may additionally ignite alternatives for small-cap corporations higher situated to evolve to a moving domestic-focused economic system.

The ripple results of such insurance policies may just set the level for a revitalized technology of enlargement for small caps.

Taking a look Forward: Small-Cap Marketplace Alternatives in 2025

At Riverwater, our center of attention stays on figuring out fine quality small-cap corporations with sustainable trade fashions and sturdy aggressive benefits, and we really feel assured that we will proceed to discover alternatives regardless of the place the commercial and geopolitical cycle takes us.

Small-Cap Funding Highlight: Nationwide CineMedia (NCMI)

One corporate that highlights the resilience and enlargement attainable of small caps is Nationwide CineMedia (NCMI). Recognized for its pre-movie commercials that includes primary manufacturers like Coca-Cola (KO) and AT&T (T), NCMI constructed a strong trade type that thrived till the disruptions of COVID.

COVID came about and many of us stopped going to the flicks; the corporate in reality declared chapter as advertisers stopped promoting with nobody round to observe. So what is superb about that for brand new shareholders is that they burnt up one billion bucks of debt and left the corporate in a web money place.

As soon as COVID pressures eased, there used to be sadly a author and an actor’s strike in 2023. So we in reality haven’t had as many nice motion pictures for the remaining couple of years as we did pre-Covid. This is now converting. We imagine if we will simply get again to 85 p.c of attendance as opposed to the place we have been in 2019, the wheels will in reality begin to activate money flows for Nationwide CineMedia. We did “boots at the flooring” due diligence in December to look the re-release of Interstellar on IMAX. The theatre used to be complete on a weeknight and we noticed ten mins of Fortune 500 corporations put it on the market with NCMI, which integrated Amazon, Google and Allstate.

The field place of job will enhance once more in 2025 however in reality begins to develop into attention-grabbing in 2026, with an overly forged film slate already introduced, the place we expect the chances are top that the field place of job for the yr can get again to pre-pandemic gross sales ranges of $11.4 billion in 2019. Every other facet of the tale is that all of the pre-Covid advertisers have now not but returned with the loss of high quality motion pictures now not being what we traditionally had. That adjustments in 2025 and 2026. With the investments control has made in generation and monitoring ROAS (go back on advert spend) we expect advertisers will shift advert spend again to the flicks.

The usage of pre-pandemic field place of job numbers and nonetheless the use of conservative estimates on promoting inputs, we estimate gross sales north of ~$350million in 2026 (vs. $445 million in 2019). This considerably outperforms what wall boulevard is forecasting. The usage of a 30% EBITDA margin (in 2019 it used to be 45%), NCMI produces $105mil of EBITDA which most commonly converts to loose money go with the flow on account of minimum want for CapEx. With an endeavor worth of ~$560mil as of late, NCMI is valued at more or less 5.3x EBITDA and we imagine our estimate is conservative.

Over the following two years, we imagine they’ll generate with reference to 100 million bucks every yr in loose money go with the flow. This is more or less a 17 p.c loose money go with the flow yield in keeping with yr without a debt, and we imagine attendance is not off course.

Whilst any surprise and awe may just permeate during the economic system we really feel assured that the film business shall be reasonably insulated and the one “Surprise and Awe” for NCMI could be a re-release of the 2017 film starring Woody Harrelson, Rob Reiner, and Tommy Lee Jones. It best receives 28% on Rotten Tomatoe’s Tomatometer so in doubt it sees a reappearance like Interstellar which earned 72%.

Positioning for Small-Cap Luck Amid Marketplace Uncertainty

As we navigate the complexities of 2025, we stay steadfast in our trust that small-cap corporations, like Nationwide CineMedia, be offering compelling alternatives for enlargement. Their skill to evolve, innovate, and thrive in a dynamic financial setting underscores the worth of making an investment in fine quality companies with sustainable aggressive benefits.

Whilst marketplace uncertainty is inevitable, our disciplined way to figuring out resilient corporations positions us to ship robust effects for our purchasers. We look ahead to the approaching yr with optimism and dedication to our venture of creating the arena a greater position by means of rising wealth via sustainable making an investment.

Wishing you a wealthy and pleasing 2025!

Sincerely,

The Riverwater Small Cap Crew

The tips contained herein represents the opinion of Riverwater and will have to now not be construed as personalised or individualized funding recommendation. Research and opinion expressed on this record are topic to switch with out realize. The securities known and described don’t constitute the entire securities bought, offered or beneficial for shopper accounts. The reader will have to now not think that an funding within the securities known used to be or shall be successful.

Click on to amplify

Editor’s Be aware: The abstract bullets for this newsletter have been selected by means of In the hunt for Alpha editors.