As iciness begins to wrap up and we head into March, something is apparent: Synthetic intelligence (AI) making an investment will nonetheless be a big theme in 2025. In consequence, traders wish to be certain that their portfolios are correctly located to benefit from this large funding development.

I’ve 4 shares that appear to be top-notch buys in March. They may be able to be divided into two classes: AI facilitators and AI {hardware} suppliers.

AI facilitators: Alphabet and Meta Platforms

Alphabet (GOOG 1.18%) (GOOGL 1.06%) and Meta Platforms (META 1.51%) are two key corporations facilitating the AI palms race. Each have generative AI fashions to provide attainable customers, with Alphabet’s Gemini and Meta’s Llama fashions. How those two fashions are arrange and applied is totally other, however each and every has a robust consumer base.

By way of facilitating the AI palms race, each and every is locking in a possible consumer base, which is able to repay over the longer term. As a result of Meta’s style is unfastened to make use of, it does no longer get pleasure from a subscription price. As a substitute, it is the usage of the entire information it will get from being a free-to-use platform to coach long run fashions. Gemini is to be had as a unfastened providing, however a top rate subscription unlocks additional features. Alternatively, Alphabet has additionally woven its Gemini style into its number one industry: Google Seek.

AI has a big impact on each corporations, and each and every is closely making an investment in its AI features to be sure that the call for is met. Moreover, each and every inventory bought off considerably over the last week, because the vast tech marketplace weak spot hit each. This opens up a possible funding alternative, as each and every is somewhat priced, bearing in mind their enlargement ranges.

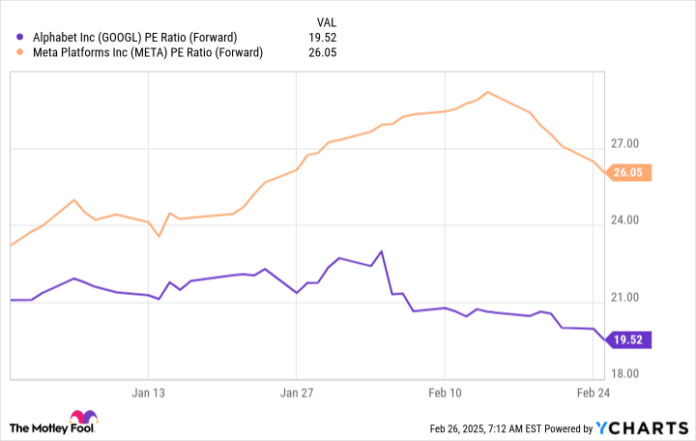

GOOGL PE Ratio (Forward) information by way of YCharts. PE Ratio = price-to-earnings ratio.

At 26 instances ahead revenue (Meta) and 19.5 instances ahead revenue (Alphabet), each and every inventory seems like an excessively robust purchase, bearing in mind how a lot they get pleasure from the AI development. I believe each and every is a smart purchase in March, and traders must use this near-term weak spot to their merit.

AI {hardware}: Taiwan Semiconductor and ASML

None of those AI inventions can be conceivable with out chip producers and providers’ apparatus, which is why Taiwan Semiconductor (TSM -0.31%) and ASML (ASML 1.63%) made this record.

Taiwan Semiconductor is the arena’s biggest contract chip producer, making chips for most of the global’s maximum complicated tech corporations. It is seeing a large increase on its AI chip aspect, with control anticipating round a forty five% compounded annual enlargement price (CAGR) over the following 5 years for its AI-related chips. That is a large enlargement price, and it presentations the top call for for {hardware} to energy the entire AI inventions.

Alternatively, Taiwan Semi has to shop for machines to satisfy this capability, which is the place ASML is available in.

ASML is the one corporate on the planet that makes excessive ultraviolet lithography machines, which lay microscopic lines on a chip. The chip generation we revel in these days would not be not possible with out its machines. Moreover, ASML’s technological monopoly is safe by way of many years of study and billions of funding bucks, so it is going to be nearly not possible to unseat it from its management place.

Each ASML and Taiwan Semi are key beneficiaries of the AI palms race but in addition get pleasure from the overall proliferation of chip utilization. Thankfully for traders, each and every inventory could also be priced at a ravishing access level.

ASML PE Ratio (Forward) information by way of YCharts. PE Ratio = price-to-earnings ratio.

Either one of those costs for TSMC’s and ASML’s inventory are affordable, bearing in mind their marketplace management positions of their respective industries. Those shares appear to be improbable buys in March, and traders must use any weak spot to load up on them. Because of the AI palms race, they must be long-term marketplace winners.

Randi Zuckerberg, a former director of marketplace construction and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in ASML, Alphabet, and Taiwan Semiconductor Production. The Motley Idiot has positions in and recommends ASML, Alphabet, Meta Platforms, and Taiwan Semiconductor Production. The Motley Idiot has a disclosure coverage.