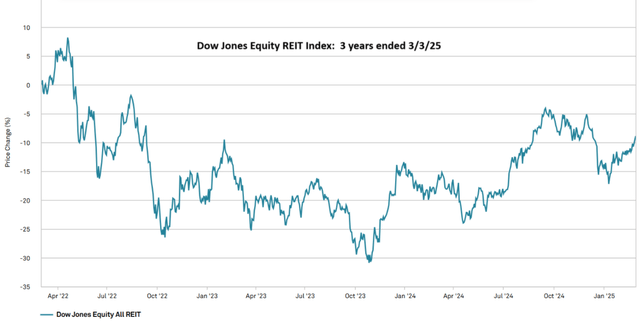

As a REIT specialist, I steadily come upon readers inquiring in regards to the dismal worth efficiency of REITs during the last 3 years.

S&P International Marketplace Intelligence

The inventory worth of REITs has fallen considerably, resulting in a sense of stagnation and even concern for the way forward for the field.

Whilst I proportion the disappointment, research of the underlying drivers unearths a special outlook. In particular, there were 2 key adjustments:

Long run price of REITs has larger Slope larger considerably

Upper anticipated returns (marketplace demanded) have larger the slope between provide price and long run price to such an extent that the marketplace worth dropped regardless of the upper long run price.

Moderately a couple of ideas are concerned on this speculation, so let’s spoil them down.

Long run Price and Slope (Marketplace Demanded Go back)

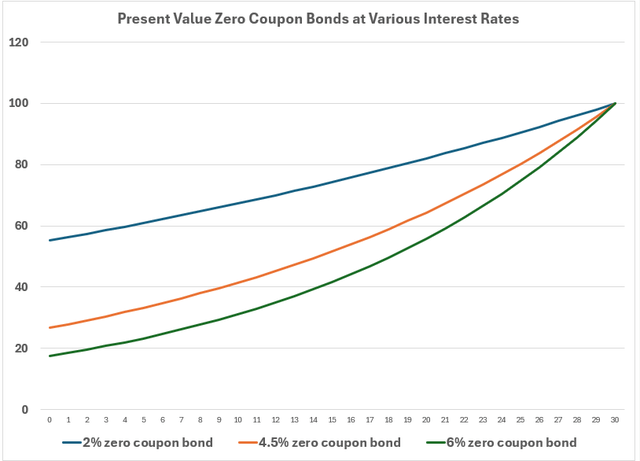

Equities are advanced, which obfuscates the finance math. The idea that of slope adjustment may also be noticed with extra readability the usage of a more practical software. So, for this situation, we will be able to use 30-year zero-coupon treasury bonds.

0-coupon bonds, after all, pay not anything till adulthood, at which level the investor receives the face price.

For simplicity of math, believe a zero-coupon bond that will pay $100 in 30 years.

The long run price (FV) is $100 and that can be paid in 30 years. Those are each outlined by way of the phrases and warranted by way of the U.S. executive, so the FV is about in stone.

Regardless of sure bet of the payout quantity, the marketplace worth, or provide price (PV) can range considerably. If the marketplace demanded annual go back CAGR is 6%, $100 of long run price would business at $17.41. If the marketplace demanded go back is two%, $100 of long run price would business at $55.20. Now we have plotted the worth of those bonds at quite a lot of go back hurdles.

Writer calculations in Excel

Because of compounding, the traces at the graph are curved, however the visible nonetheless kind of presentations a slope. This slope is largely the marketplace demanded price of go back.

The purpose of this visualization is that the marketplace worth or provide price of the bonds can transfer greatly regardless of the long run price being locked in stone. Any worth fluctuations on an software like this are slope changes.

Because the slope will get steeper, the present worth drops and vice versa.

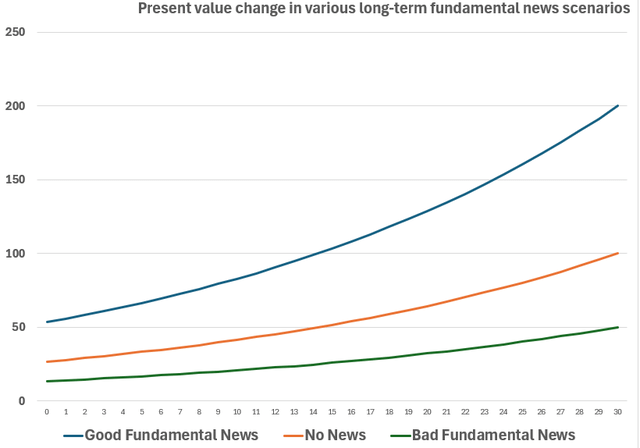

Long run Price Trade

REITs are running corporations. Their long run price is decided by way of the set of cashflows that their present and long run houses will generate.

As such, their long run price adjustments regularly with any elementary information merchandise. If call for for a given assets kind rises, the ones houses will generate extra cashflow going ahead. Within the following symbol we graph what occurs to provide price when long run price strikes to both $50, $100, or $200.

Writer calculations in Excel

Equities are extra advanced than treasuries in that present marketplace worth may also be impacted by way of both adjustments to slope or adjustments to long run price. It will get specifically advanced when the similar information merchandise affects thru each strategies.

REITs And Inflation

Actual property is a herbal inflation hedge. Your home will increase in price when CPI rises. But REITs, regardless of consisting nearly fully of actual property, have offered off within the final 3 years every time inflation reared its unsightly head.

Any time there was once a scorching CPI file, REITs would drop 1% or so and if inflation confirmed indicators of cooling, REITs would upward thrust. Smartly, there are 2 results happening right here.

Long run price will increase with inflation for the reason that houses get extra precious, and the apartment streams develop. Slope will increase as a result of upper inflation way a extra hawkish Federal Reserve and not more cuts, which has a tendency to make treasury yields upward thrust. When treasury yields upward thrust, the marketplace calls for a better anticipated go back from REITs.

The slope alternate has ruled long run price build up, leading to an total drop in worth on scorching inflation information.

Newsflow Has Overwhelmingly Been Towards Upper Long run Price

Elementary information has been superb for REITs throughout with reference to each sector.

We get into the weeds of each and every particular person assets kind in different articles so be at liberty to test the archive, however for the needs of this subject we will be able to talk about the huge macro adjustments that have an effect on REITs as an entire.

Condominium charges are up considerably, attaining all-time highs Value of development is up, expanding the worth of current structures Competing provide is declining from rampant to subdued

Those adjustments have massive implications for the leasing dynamics as top quality actual property turns into scarce relative to call for. A landlord-favorable setting will build up profits expansion charges throughout maximum REIT subsectors.

With all this excellent information, why have REITs traded down over the past 3 years?

Newsflow Has Overwhelmingly Been Towards Upper Slope

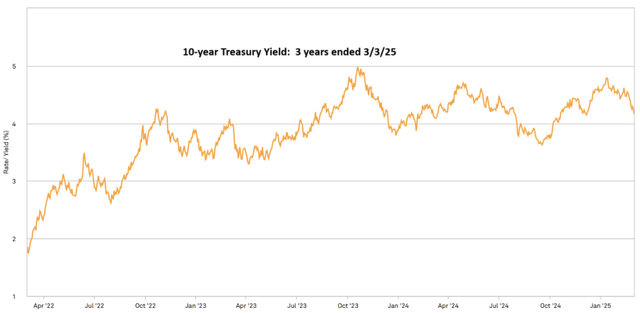

I think you recognize what has took place with rates of interest.

S&P International Marketplace Intelligence

Whilst this had some pertaining to the price of capital for REITs, larger pastime expense was once greater than made up for by way of the upper apartment charges. FFO and Cashflow are up for REITs since 2022.

As a substitute, the upper rates of interest impacted the slope.

3 years in the past, REITs had been priced for a ahead anticipated go back of about 6%. Lately, REITs are priced for a ahead anticipated go back of about 10%.

So despite the fact that the long run price is upper, the decrease marketplace worth at which REITs business these days is needed to get that 10% marketplace demanded go back CAGR.

Why All Of This Issues For Present Funding Selections

The etiology of a value drop issues on account of its implications for long run returns.

If marketplace worth drops as a result of long run price is impaired, which may be a price lure.

If marketplace worth drops for the reason that marketplace makes a decision it now calls for a ten% go back as an alternative of a 6% go back, that may be a purchasing alternative.

The ones smartly versed in monetary academia know that the 10-year Treasury is regularly used as a proxy for the “risk-free” price. The chance-free price is an element of the cut price price through which all monetary tools are regularly valued.

As such, it makes entire sense that after the 10-year Treasury yield spiked up to it has, that the marketplace would now call for a better ahead go back from REITs simply because it does from treasuries and company bonds.

The true anomaly these days is that the marketplace come what may isn’t difficult a top ahead go back from the S&P 500 which is buying and selling at traditionally top multiples.

To me, this makes the verdict transparent.

I might a lot relatively spend money on REITs that have sturdy basics and at a sector stage are priced for a kind of 10% annual go back. Person shares inside the sector are valued much more attractively.

The S&P could also be sturdy essentially, however priced at a valuation that means beneath historic reasonable returns.