Vici Houses (VICI -3.44%) is an actual property funding consider (REIT) this is fascinated about proudly owning casinos. That is a sexy particular area of interest however person who has confirmed, thus far anyway, to be quite sexy. Here is why this slightly younger REIT and its 5.3% dividend yield is value being attentive to lately.

What does Vici Houses do?

On the most simple stage, Vici Houses is a landlord, proudly owning bodily homes that it rentals out to tenants. What units it except for different REITs is its center of attention on experiential homes, which lately in large part approach casinos. Those are large property that include gaming, inns, retail, eating, and conference companies inside them. You’ll be able to argue that this gives numerous diversification. However it’s a must to juxtapose that towards the truth that not one of the different companies within the assets would most likely be viable with out the gaming part.

Symbol supply: Getty Pictures.

Along with the gaming center of attention, Vici Houses additionally makes use of a web hire type. Which means that the REIT’s tenants are answerable for lots of the prices of the valuables. That is a just right factor for each events. Vici Houses reduces its prices and the chance it could face from emerging running prices. Its on line casino tenants successfully retain operational keep an eye on of what’s a very important asset inside their companies.

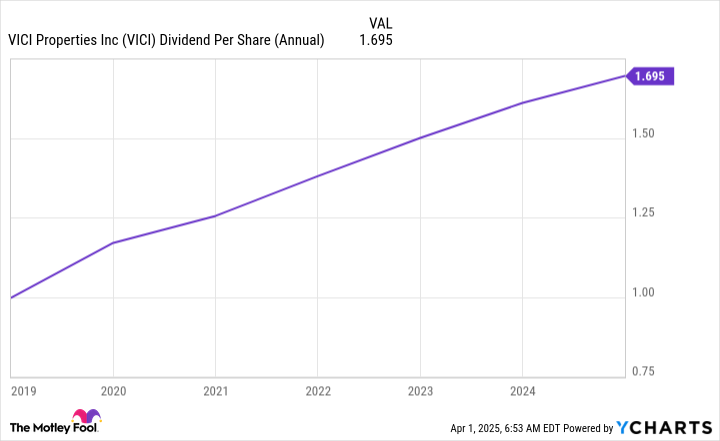

Vici Houses held its preliminary public providing (IPO) in early 2018. So this can be a quite younger corporate. Then again, it has grown from round 20 homes on the time of its IPO to 93 property on the finish of 2024. Of that 93, 54 are gaming homes with the remaining being categorised as “different experiential homes.” That “different” class makes up round 2% of rents, so it’s the a lot greater gaming homes that stay an important industry for Vici Houses. Nonetheless, the REIT has grown briefly and produced spectacular effects.

Information by way of YCharts.

Vici Houses handed the large take a look at

From the start, Vici Houses fascinated about generating constant effects subsidized by way of long-term rentals. When the coronavirus pandemic hit, alternatively, the corporate’s tenants have been in large part close down as a result of they were not crucial companies. This used to be a serious take a look at of Vici Houses’ industry type. It did not skip a beat and, in reality, higher its dividend in 2020 regardless of the pandemic.

However that result in reality is smart. A on line casino operator must handle get entry to to its on line casino homes if it desires to stay in industry. So paying the hire even all the way through tricky sessions is a need. However this is not the one sure factor that has taken form as Vici Houses has matured.

Vici Houses has very lengthy rentals. Its reasonable hire duration is a large 40 years — maximum web hire REITs are lovely satisfied to have one thing round 10 years. The issue is that lengthy rentals reveal Vici Houses to the chance that inflation eats away the worth of its hire roll.

Vici Houses is not ignoring this chance. At the moment 42% of its hire is safe by way of inflation-linked hire escalators. That is not dangerous, but it surely leaves numerous the hire roll nonetheless uncovered to inflation. Which is why it’s so thrilling that Vici Houses has created contracts that may an increasing number of become inflation-linked hire constructions. By way of 2035 the corporate believes a minimum of 90% of its rentals will probably be inflation-linked.

There are many years of sluggish and stable enlargement forward for Vici Houses

To be honest, there are best such a lot of casinos Vici Houses should buy. One day, it’ll achieve a prohibit the place it has no selection however to center of attention most commonly on non-casino property. However the expanding position of inflation-linked rentals within the core on line casino assets section is a precious basis. The hire roll from casinos would possibly not develop briefly, however it’ll develop reliably 12 months in and 12 months out. And that implies dividend traders have an extended runway for dividend enlargement forward of them with Vici Houses. This REIT is getting higher and higher with age, and that does not seem more likely to forestall anytime quickly.