Equities Weekly Evaluate: Demanding situations and Anticipations

Regardless of a powerful restoration at the ultimate buying and selling day, the Dow Jones Business Moderate concluded the week down just about 2%, marking its most vital weekly downturn for the reason that earlier October. Marketplace sentiment has been suffering from heightened warning, stemming from feedback through Federal Reserve officers, together with Chair Jerome Powell, emphasizing the desire for endurance prior to any discounts in rates of interest. This stance is influenced through the powerful efficiency of america economic system and emerging inflation figures. Moreover, escalating geopolitical tensions have adversely impacted investor self belief.

The approaching week guarantees heightened volatility, probably disrupting the fad of 5 consecutive months of beneficial properties. This shift may well be pushed through approaching US inflation information, the discharge of the Federal Open Marketplace Committee (FOMC) assembly mins from March, and the graduation of america income season.

The primary quarter (Q1) income season starts with experiences from key banks equivalent to JP Morgan, Wells Fargo, and Citibank scheduled for Friday.

Profits Season Evaluate: A Nearer Take a look at Expectancies

Factset anticipates a three.1% year-over-year build up in S&P 500 income for Q1 2025, with revenues anticipated to upward push through 3.5% in comparison to the similar duration ultimate yr. This projection marks the 3rd consecutive quarter of year-on-year income enlargement, even if the tempo of enlargement seems to be moderating following a 6.7% build up in income all through This autumn 2023, accompanied through 3.9% income enlargement.

Financial institution Profits Outlook for Q1: Balancing Elements

The panorama for primary banks is intricate, with each sure and detrimental components at play. Fresh non-farm payroll experiences and macroeconomic information spotlight a resilient economic system and full of life financial job, reaping rewards the banking sector. On the other hand, tempered expectancies for rate of interest cuts, which had in the past buoyed the banking sector and broader marketplace, at the moment are adjusting. Power inflation poses demanding situations, as traders overview the possible affects of putting up with upper rates of interest on web pastime source of revenue. Indicators of restoration in deal-making and preliminary public choices (IPOs), exemplified through Reddit’s a success public providing, supply some optimism. Nevertheless, issues persist referring to actual property loans.

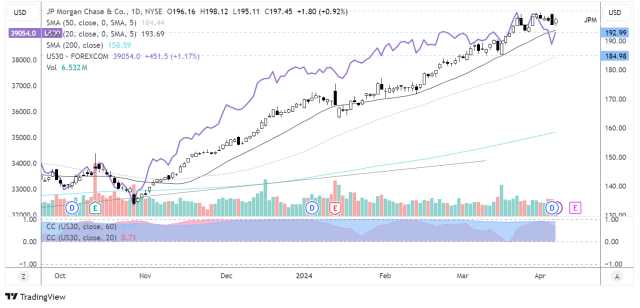

JP Morgan: A Centered Research

Supply: Foprex.com by way of TradingView

As the most important US financial institution, boasting $39 trillion in belongings through the tip of 2023, JP Morgan approaches its income announcement buying and selling close to all-time highs. The financial institution has prominent itself, reaching document earnings in 2023.

Robust web pastime source of revenue (NII) is expected, supported through enlargement within the mortgage portfolio, which is anticipated to counterbalance the affects of margin pressures from top rates of interest that get advantages deposit holders.

The financial institution’s assorted operations be offering a aggressive edge, particularly towards regional banks. Provisions for dangerous loans can be scrutinized, providing insights into the wider US financial well being.

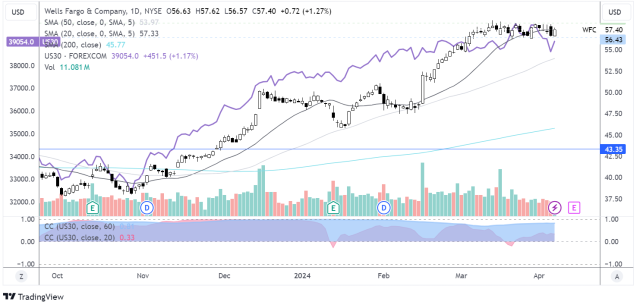

Wells Fargo: Efficiency and Possibilities

Wells Fargo has observed its percentage worth build up through 15% over the quarter, surpassing broader marketplace efficiency. This enlargement follows the lifting of restrictions imposed at the financial institution because of previous scandals.

Regardless of a disappointing This autumn 2023 document, with a 6% decline in earnings and a modest 2% income build up, expectancies for 2025 stay cautiously constructive. The financial institution has indicated doable demanding situations with web pastime margins, with adjusted earnings and revenues projected to say no.

Provisions for dangerous loans, which larger considerably within the earlier quarter, stay a point of interest, in particular given the financial institution’s really extensive publicity to business actual property.

Delta Airways: Expected Profits File

Delta Airways is ready to document income, spotlighted as a best select through Morgan Stanley amid a restoration section for the airline business. Regardless of spectacular year-to-date and annual enlargement, the inventory has but to succeed in pre-pandemic heights.

Key efficiency signs equivalent to load issue are the most important, as they sign whether or not call for is coming near pre-pandemic ranges. The industrial and employment panorama helps call for resilience, regardless of the demanding situations of emerging rates of interest and tightening monetary prerequisites.

On the other hand, an important quarter-over-quarter build up in oil costs poses further drive on profitability.