Quantum computing is speedy turning into the following giant alternative within the synthetic intelligence (AI) panorama.

By means of now, I am certain you know that synthetic intelligence (AI) is by means of some distance the most important alternative fueling the generation sector. Beneath the AI umbrella, semiconductor shares were probably the most greatest beneficiaries. This is smart, as chipware serves a crucial function within the construction of myriad generative AI packages.

Then again, over the previous few months a space referred to as quantum computing has emerged as the newest glossy object within the AI realm.

Underneath, I’m going to discover how quantum computing shares were transferring lately and later divulge my most sensible pick out for which corporate is paving the best way for this new and thrilling generation.

Are quantum computing shares the brand new darlings of AI?

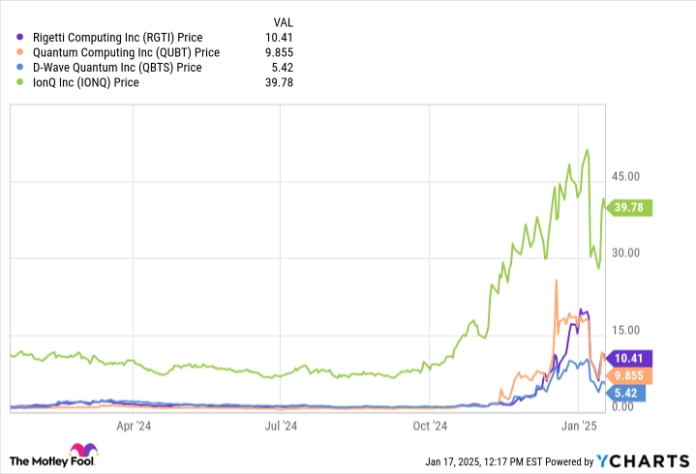

Quantum computing represents an exhilarating new bankruptcy within the AI narrative. Unsurprisingly, traders were chomping on the bit to determine tactics to put money into quantum computing. Take a look at the developments within the chart beneath:

RGTI information by means of YCharts

Towards the tip of 2024, stocks of quantum computing shares comparable to IonQ, D-Wave Quantum, Quantum Computing, and Rigetti Computing all skilled important run-ups. Apparently, every of those firms was once a penny inventory initially of 2024 — handiest to peer its valuation jump neatly into the billions all the way through a moderately brief period of time.

Whilst the strikes above may counsel that those shares are the “subsequent giant factor” in AI, I would warning from following the herd mentality. Each and every of the firms above are construction degree companies. This implies none is producing important income, and they all are persistently burning coins. In different phrases, the exponential positive aspects illustrated within the chart above are options of meme shares and no longer that of sound, prudent funding alternatives.

Despite the fact that the percentage costs above might suggest those shares are reasonable, valuation multiples point out that none of them is deserving of a lofty worth level.

With all of this stated, there are many more secure alternatives in relation to quantum computing.

Symbol supply: Getty Photographs.

That is my most sensible pick out for traders in search of quantum computing publicity

A commonplace trade concept means that the individuals who become maximum wealthy all the way through the Gold Rush had been the distributors who bought choices and shovels, no longer the diggers looking for gold. The underlying concept here’s that every time a brand new theme emerges on the earth of making an investment, it is continuously a good suggestion to spot the firms promoting the metaphorical choices and shovels.

Relating to quantum computing, I see Nvidia (NVDA 3.10%) as the highest alternative.

All over a contemporary interview on the CES business display in Las Vegas, Nvidia CEO Jensen Huang stated that he thinks quantum computing may not in reality be scaled for some other two decades or so. I see execs and cons to this outlook.

For corporations comparable to IonQ, Rigetti Computing, D-Wave, and Quantum Computing, Huang’s feedback counsel that there is nonetheless numerous paintings to be carried out sooner than any of those companies revel in important expansion. In the intervening time, that most probably manner every of those firms will proceed spending significant capital on analysis and construction (R&D) and stay cash-burning operations.

Whilst that is not a perfect state of affairs for the ones firms, it may be a just right alternative for Nvidia. Creating quantum computing calls for heavy funding in more than a few AI infrastructure, together with graphics processing gadgets (GPU), information facilities, and instrument. Nvidia provides all 3 of those merchandise, making the corporate a crucial piece of the quantum computing motion.

To me, Nvidia is the “pick out and shovel” element of quantum computing construction. In many ways, Nvidia has the luxurious of being agnostic as to which firms in reality make breakthroughs in quantum mechanics and which don’t. Regardless, Nvidia’s {hardware} and instrument goes to be concerned.

Making an allowance for quantum computing is most probably a long time clear of achieving scale, this implies that Nvidia has quite a lot of upside as extra firms start to discover this new space of the AI panorama. Even supposing there are many causes to be bullish on Nvidia in 2025 and past, I see quantum computing as but some other tailwind that is not even starting to be priced into the corporate’s long-term attainable. I believe Nvidia is a profitable alternative to shop for and hang for plenty of extra years, particularly for expansion traders or the ones in search of deep publicity to AI packages.