Oracle (ORCL 0.07%) has been a gradual performer at the inventory marketplace during the last 5 years, turning in decent positive aspects of 230% to buyers and outperforming the Nasdaq Composite’s 143% bounce by way of a good-looking margin. However the generation massive has been underneath power this yr.

Stocks of the corporate that is identified for offering database control and cloud services and products have dropped 7% in 2025 as of this writing, more or less in step with the Nasdaq’s transfer. Oracle’s just lately reported effects for the 3rd quarter of fiscal 2025 (ended on Feb. 28) did not assist issues; the inventory dropped following the discharge of its file on March 10, however has since recovered.

The corporate’s anemic enlargement wasn’t just right sufficient to satisfy Wall Boulevard’s expectancies, whilst deficient steerage added to the gloom. However savvy buyers can believe the use of the pullback as a purchasing alternative since there are transparent indicators that the corporate is ready to step at the fuel sooner or later. The large alternative within the cloud infrastructure marketplace may ship Oracle’s inventory hovering over the following 5 years.

Traders mustn’t omit the beautiful enlargement in Oracle’s backlog

Traders have been fast to press the panic button following the corporate’s newest effects because the 8% year-over-year build up in income and four% bounce in adjusted profits were not sufficient to satisfy consensus estimates.

Additionally, control’s forecast of a 9% build up in income within the present quarter on the midpoint is moderately less than the 11% that analysts have been anticipating.

However specializing in Oracle’s near-term efficiency and overlooking its long-term forecast is like lacking the wooded area for the timber. The exceptional call for for the corporate’s cloud infrastructure for synthetic intelligence (AI) coaching and inference is resulting in extra special enlargement in its backlog.

That is obvious from the 62% year-over-year build up in Oracle’s closing efficiency duties (RPO) ultimate quarter to $130 billion. The metric refers back to the general price of an organization’s contracts which are but to be fulfilled, and it’s price noting that this metric grew at a far sooner tempo than the corporate’s best line ultimate quarter.

Oracle control identified on the newest convention name with analysts that the quarter was once its most powerful ever relating to bookings. The corporate added $48 billion price of latest contracts to its backlog. On the identical time, Oracle is constrained by way of capability. The call for for the corporate’s cloud infrastructure is exceeding provide as extra firms are turning towards Oracle’s choices to coach and deploy AI fashions and packages.

Control provides that its cloud infrastructure is “sooner and, due to this fact, less expensive than our competition.” The great phase is that the call for for Oracle’s cloud infrastructure may continue to grow at an excellent tempo throughout the finish of the last decade. Goldman Sachs is estimating the cloud infrastructure-as-a-service (IaaS) marketplace will generate $580 billion in annual income by way of 2030.

The tempo of enlargement in Oracle’s RPO and the spectacular charge at which it’s signing new contracts recommend that the corporate is certainly on its solution to cornering a lion’s proportion of the large addressable alternative. Importantly, the booming dimension of Oracle’s RPO is ready to translate into more potent enlargement for the corporate within the coming years.

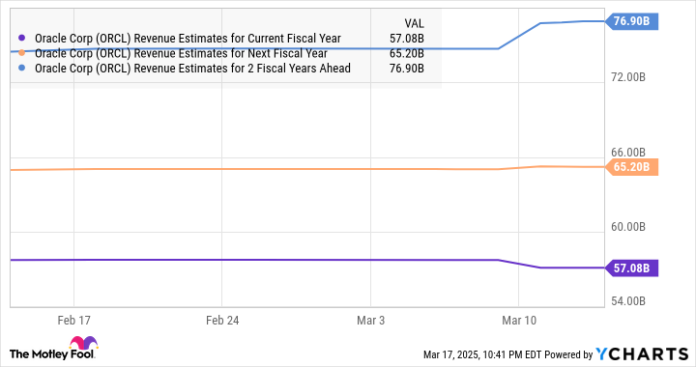

Oracle is anticipating its income enlargement within the subsequent fiscal yr to boost up to fifteen%, adopted by way of a more potent bounce of 20% in fiscal 2027. Each those numbers are upper than what the corporate was once prior to now expecting. Oracle had guided for $65 billion in fiscal 2026 income in September ultimate yr, but it surely now believes that it might probably hit $66 billion in income within the upcoming fiscal yr.

In the meantime, a 20% build up in its income in fiscal 2027 would ship its best line to greater than $79 billion. That is upper than what analysts expect.

ORCL Revenue Estimates for Current Fiscal Year knowledge by way of YCharts

Traders would do smartly to notice that Oracle may finally end up exceeding its personal expectancies ultimately making an allowance for the terrific tempo at which it’s expanding its knowledge heart capability to satisfy call for. Control goes to double the capability of its knowledge facilities within the present fiscal yr, and it plans to triple the similar by way of the top of the following fiscal yr.

So, it’s simple to peer why Oracle is anticipating an acceleration in its income enlargement, as upper knowledge heart capability will permit it to satisfy extra of its RPO. That, in flip, must preferably result in sturdy enlargement within the corporate’s base line.

Spectacular benefit enlargement alerts wholesome inventory positive aspects over the following 5 years

In September ultimate yr, Oracle projected that its profits may build up at an annual charge of greater than 20% thru fiscal 2029. Alternatively, control’s feedback on the newest profits convention name recommend that it will do higher.

Assuming Oracle can clock a 25% annual profits enlargement charge over the following 5 years, its base line may bounce to $18.31 in keeping with proportion by way of fiscal 2030 (the use of its projected fiscal 2025 profits of $6.00 in keeping with proportion as the bottom). Oracle is lately buying and selling at 21 instances ahead profits, a bargain to the tech-laden Nasdaq-100 index’s ahead profits more than one of 25.

If the marketplace makes a decision to place the next valuation on Oracle and it trades at 25 instances profits in 5 years, that may put its inventory worth at $458. That might be a 197% bounce from the inventory worth as I write this.

Traders must believe including this AI inventory to their portfolios following its contemporary drop. It’s not simply attractively valued presently; it has the possible to ship wholesome positive aspects ultimately.

Harsh Chauhan has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Goldman Sachs Staff and Oracle. The Motley Idiot has a disclosure coverage.