Quantum computing may well be the following frontier for computer systems and cloud-based services and products. Whilst conventional computer systems nonetheless retailer information in binary bits of zeros and ones, quantum computer systems retailer zeros and ones concurrently in qubits. That distinction permits quantum computer systems to procedure a lot higher quantities of knowledge than binary computer systems.

Alternatively, quantum computer systems are nonetheless a lot higher, pricier, and generate extra mistakes than conventional computer systems. However from 2024 to 2032, the worldwide quantum computing marketplace may extend at a compound annual expansion charge (CAGR) of 34.8%, in line with Fortune Industry Insights, as the ones applied sciences enhance. If you wish to take advantage of that secular pattern, you must imagine purchasing those 3 shares: IonQ (IONQ 0.28%), D-Wave Quantum (QBTS -1.50%), and IBM (IBM 0.71%).

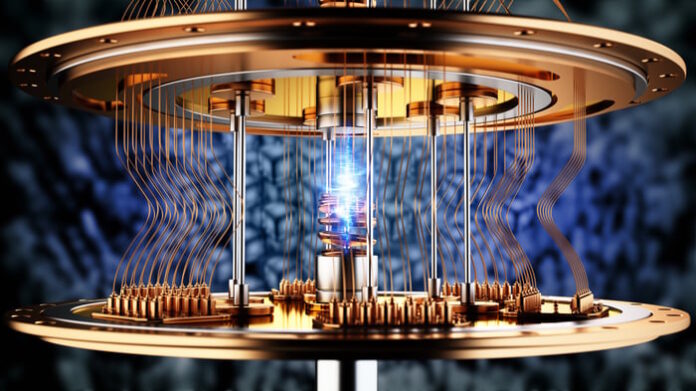

Symbol supply: Getty Photographs.

IonQ

IonQ sells 3 tiers of quantum computer systems: its top-tier Aria device, its business Strong point device, and its on-premise Strong point Endeavor device. It plans to release its fourth device, the Pace, for its business and undertaking consumers later this 12 months. It additionally operates Unity, a cloud-based platform for growing quantum packages.

IonQ expects to scale up its overall quantum computing energy, which it measures in algorithmic qubits (AQ), from 64 AQ this 12 months to at least one,024 AQ in 2028. It additionally expects its gate constancy (error detection charge) to enhance from 99.9% in 2024 to 99.95% in 2028.

It is also been growing a “trapped ion” era to shrink the common width of a quantum computing unit (QPU) from a couple of ft to only a few inches. IonQ principally sells its services to the U.S. Air Drive Analysis Lab, different executive businesses, and main universities.

In 2024, its income just about doubled to $43.1 million, however its web loss greater than doubled to $331.6 million. However by way of 2027, analysts be expecting its income to surge to $289.8 million because it narrows its web loss to $236.8 million. With a marketplace cap of $6.2 billion, IonQ trades at 21 occasions the 2027 gross sales estimate. Numerous expansion is baked into that frothy valuation, however its early mover’s merit and impressive roadmap for the long run may make it a height play at the nascent quantum computing marketplace.

D-Wave Quantum

D-Wave Quantum develops quantum annealing equipment, which assist organizations optimize their schedules, workflows, provide chains, and logistics networks. It does that by way of processing huge quantities of knowledge thru its methods to seek out the answers which require the least computing energy. It bundles in combination its personal {hardware} and cloud-based services and products in its Soar platform, which can also be built-in into higher public cloud infrastructure platforms.

It is also constantly upgrading its {hardware}. Its next-gen 4,400-qubit Advantage2 processor, which it effectively calibrated final November, can resolve complicated three-D lattice issues more or less 25,000 sooner than its current-gen Merit processor.

D-Wave already serves large purchasers like Deloitte, Mastercard, Lockheed Martin, and Accenture, and its focal point on the use of quantum equipment for more effective functions may draw in much more consumers.

In 2024, D-Wave’s income rose simply 1% 12 months over 12 months to $8.8 million as its web loss widened from $82.7 million to $143.9 million. However by way of 2027, analysts be expecting its income to surge to $72.1 million because it narrows its annual web loss to $52.4 million.

With a marketplace cap of $2.1 billion, D-Wave’s inventory is not reasonable at 29 occasions its 2027 gross sales estimate. However in case you are on the lookout for a long-term play on more effective packages for quantum computer systems, D-Wave may well be a just right speculative funding at this time.

IBM

If IonQ and D-Wave appear too scorching to care for, IBM may well be a sensible solution to acquire publicity to the quantum computing marketplace with out taking over an excessive amount of possibility. IBM deployed the sector’s first cloud-based quantum computing device in 2016, and it due to this fact deployed greater than 80 quantum methods that are used to run over 3 trillion techniques day by day.

IBM claims its fleet of 127+ qubit quantum computer systems is the “quickest on the earth” with a “transparent trail to 100,000 qubits and past.” IBM does not expose its quantum income one by one, however it supplies its methods and services and products as extensions of its cloud-based ecosystem. Its consumers principally come with universities and analysis establishments.

IBM’s quantum industry may not turn out to be its core expansion engine anytime quickly. For now, traders must take note of its hybrid cloud and AI companies, that are riding its near-term expansion and offsetting the slower expansion of its legacy device and {hardware} companies. As a substitute of going head-to-head in opposition to larger cloud firms, IBM is increasing its open-source device subsidiary Crimson Hat to wedge extra AI-driven hybrid cloud services and products between the private and non-private clouds.

From 2024 to 2027, analysts be expecting IBM’s income and EPS to develop at a CAGR of four% and 18%, respectively. It is nonetheless relatively valued at 25 occasions subsequent 12 months’s profits estimate, will pay a ahead yield of two.8%, and may well be the least annoying solution to take advantage of the long-term expansion of the quantum, cloud, and AI markets on this turbulent marketplace.