From time to time, the fitting corporate is in the fitting position on the proper time with the fitting product.

If you are like maximum traders, you are no longer beginning out with a ton of cash. If you are going to succeed in the dream of changing into a millionaire, then you are going to want to do it just a bit at a time, the usage of just a little of your source of revenue that’s not ate up by way of lifestyles’s extraordinary bills.

You additionally most definitely know that making an investment in shares is the one approach to meaningfully and reliably outpace the have an effect on of inflation; the S&P 500’s common annual go back is within the ballpark of 10%.

What if, then again, it’s essential to additionally supercharge your portfolio with a enlargement inventory that has the possible to overcome the large marketplace for an extended whilst? Those names clearly convey extra possibility to the desk with their higher doable for praise. However occasionally, that further possibility is worthwhile.

A synthetic intelligence (AI) era corporate referred to as SoundHound AI (SOUN 17.48%) is one such inventory, made much more horny by way of the 60% pullback from its December height.

What is SoundHound AI?

By no means heard of SoundHound? It would not be sudden for those who hadn’t. It is neither as giant nor as high-profile as AI tech titans like Nvidia or Microsoft. SoundHound’s marketplace capitalization is a a lot more modest $3.8 billion at this time. It simply does not flip many heads. There is a excellent probability, then again, that you have used its era with out even figuring out it.

SoundHound’s most sensible ability is popping the spoken phrase into computerized and actionable virtual data. It simplifies and hurries up (and improves) rapid meals drive-thru ordering, permits cars to just accept drivers’ voice-activated instructions, and will flip a space into a real good house, operated by way of the resident’s spoken directions.

Honda, rapid meals chain White Fortress, and streaming tune platform Pandora are simply probably the most names lately using SoundHound’s era. Extra are becoming a member of the fold regularly, too.

It is admittedly no longer precisely a brand-new concept. Speech-recognition telephony has been round and quite commonplace because the ’90s. However it is been clunky at easiest, and downright unnecessary at its worst. It required the appearance of huge language model-based synthetic intelligence for the theory to reside as much as the preliminary dream.

However make no mistake — it’s residing as much as the dream now. Marketplace analysis outfit Straits Analysis believes the worldwide voice and speech reputation era marketplace is poised to develop at a mean annual tempo of 17% thru 2033.

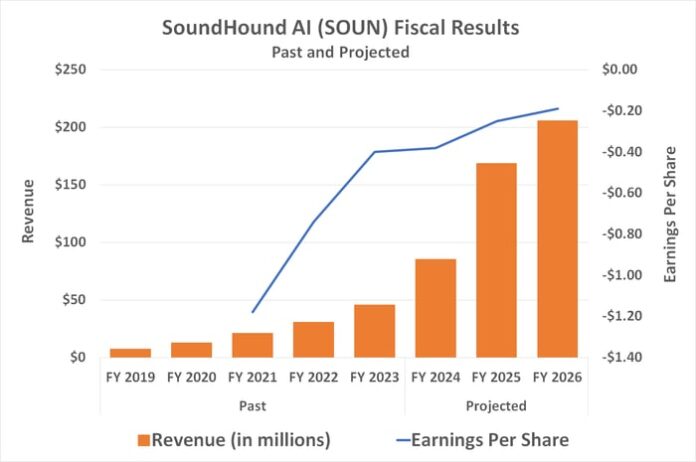

For its section, we realized past due Thursday that SoundHound’s most sensible line grew an improbable 85% to $84.7 million in 2024, en path to what the corporate expects to more or less be two times that quantity this 12 months. The expansion tempo must decelerate from there, however most effective as a result of that is when SoundHound’s capability to ship will in any case meet up with call for.

Knowledge supply: StockAnalysis.com. Chart by way of creator.

Given the power of its era, this corporate appears to be like situated to seize greater than its justifiable share of the trade’s enlargement.

Glance previous the noise to realize the correct standpoint

This backdrop begs the query: If SoundHound’s tale is so bullish, why are its stocks down at the order of 60% from their contemporary document excessive reached in December?

To completely perceive this sell-off, you in truth want to return to October of ultimate 12 months, ahead of this inventory started a meteoric run-up. That is when traders had been first finding this most commonly unknown gem, and temporarily falling in love with the basis. SoundHound additionally become one thing of a meme inventory round that point, fanning the bullish flames.

As is so frequently the case, in fact, the overextended red-hot rally imploded. Then simply ultimate week, Nvidia disclosed that it had bought its personal place in SoundHound’s inventory, additional damn the corporate’s already-nervous shareholders. Now, the sell-off turns out to have taken on a lifetime of its personal, possibly additional fueled by way of fears that Thursday night’s unencumber of its fourth-quarter numbers would end up problematic. (Spoiler alert: They did not.)

This is the object. Not anything about this upward push and fall is especially abnormal. SoundHound is hardly ever the arena’s first pre-profit tech inventory to jump on hype and FOMO — the worry of lacking out — after which plunge when truth units in.

The excellent news is, this type of sweeping swing typically most effective has to occur as soon as to a tale inventory like this one. This is to mention, despite the fact that SoundHound stocks will most probably stay extra unstable than the standard ticker going ahead, it is not going we’re going to see traders lose standpoint with this corporate once more, which is what allowed the inventory to upward push and fall because it has over the process simply the previous few months. From right here, stocks must get started being priced with a minimum of somewhat extra sensical acknowledgement of the corporate’s present and projected effects.

It might even be naive to consider Nvidia wasn’t a minimum of somewhat bit incentivized to fasten in giant income on its SoundHound industry. However for what it is value, the analyst group has remained steadfast in its bullish stance in spite of stocks’ contemporary bearishness. Maximum of them believe this inventory a purchase, whilst none charge it less than a grasp. They are additionally keeping up a consensus worth goal of $14.06, which is greater than 50% above the inventory’s provide worth.

Buckle up for volatility

Positive, the inventory’s giant bounce following Thursday night’s unencumber of its fourth quarter effects gifts one thing of a conundrum. Any investor would moderately pay a cheaper price for a inventory, however this actual ticker would possibly by no means revisit its pre-report worth.

Simply do not main within the minors. This is to mention, for traders at the hunt for a high-powered long-term keeping, it may not in reality topic for those who purchased in as little as you perhaps may just or possibly paid just a little of a top rate for it. The one factor Thursday’s pre-close weak spot adopted by way of the inventory’s post-close surge proves is that SoundHound’s stocks are unstable. However, we already knew that used to be the case.

Base line? If you are keen to tackle just a little extra possibility to possess a inventory with the opportunity of above-average good points, believe a stake in SoundHound AI.