Berkshire Hathaway (BRK.A 1.99%) (BRK.B 1.76%) has beaten the S&P 500 (^GSPC 1.47%) during the last 60 years thank you partly to savvy funding choices about long-held shares like American Categorical and Coca-Cola — and extra just lately Apple. However Berkshire’s stakes in public firms would possibly not be the motive force in the back of its luck.

On Would possibly 3 Berkshire printed its first-quarter effects, which integrated a brand new document place in money, money equivalents, and investments in U.S. Treasury expenses of $342.39 billion. As of Would possibly 2, the worth of Berkshire’s public fairness portfolio used to be $277.41 billion, or kind of 1 / 4 its marketplace cap of $1.16 trillion. The remainder of Berkshire’s price comes from its subsidiaries.

Berkshire has a lot of precious wholly-owned companies, from the BNSF railroad to software large Berkshire Hathaway Power. However via some distance crucial class is its assets and casualty (P&C) insurance coverage companies. At Berkshire’s annual shareholder assembly on Saturday, traders had a lot of questions on the way forward for the P&C companies: from how they’re going to fare within the face of an onslaught of personal fairness funding to the converting panorama of insurance coverage within the self sustaining age.

Are doable adjustments in P&C insurance coverage sufficient to derail the Berkshire Hathaway funding thesis? Listed below are key takeaways from what Warren Buffett and Berkshire’s vice president of insurance coverage operations, Ajit Jain, mentioned throughout the once a year assembly.

Symbol supply: Getty Photographs.

A converting sport

In Q1, source of revenue from insurance coverage underwriting and insurance coverage funding mixed used to be $4.23 billion, or a whopping 43.9% of overall running income.

As insurance coverage has grown, it has transform a larger matter at Berkshire’s annual conferences. And for just right reason why, making an allowance for its affect on running income.

Berkshire has maintained its center of attention at the P&C aspect of the insurance coverage business — distancing itself from the existence insurance coverage industry, now ruled via non-public fairness. Throughout the once a year assembly, Buffett and Jain mentioned that personal fairness corporations could make some huge cash in that house, however that the leverage and credit score threat are not interesting to Berkshire anymore from a risk-management viewpoint.

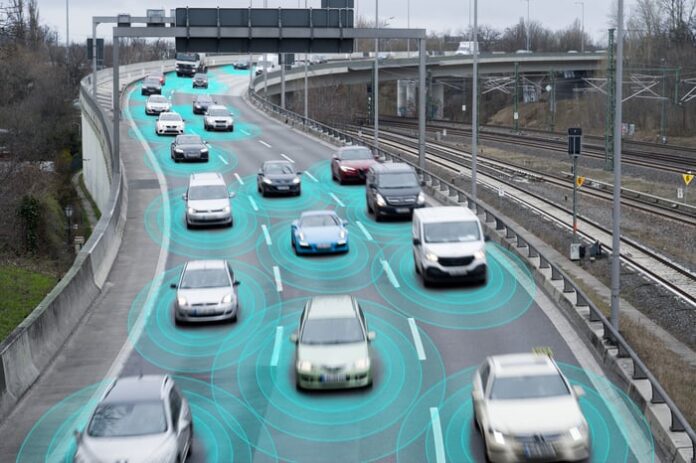

Some other alternate to the insurance coverage industry has been the upward push of self sustaining cars. An target market member requested if this upward thrust would alternate the underwriting necessities of the insurance coverage industry. Buffett replied, “We think alternate in all of our concepts,” welcoming adjustments within the auto insurance coverage business. He additionally mentioned that an annual auto insurance plans from GEICO within the Nineteen Fifties may just value as low as $40, while lately, it would not be out of the peculiar to have a $2,000 annual coverage. Whilst the price of insurance coverage is up some 50-fold, Buffett mentioned that injuries have fallen via greater than 80%. So the chance of self sustaining cars decreasing injuries additional does not essentially jeopardize the insurance coverage funding alternative.

Jain mentioned that complete automobile autonomy may just change into the automobile insurance coverage industry from concentrating at the dangers of operator error to as a substitute center of attention at the automaker’s mistakes and omissions in growing self sustaining automobile riding features, which might necessarily transform a product legal responsibility factor. Buffett adopted up via reaffirming his self belief that the automobile industry has been an enormous expansion business, pronouncing “We do have extraordinary benefits within the insurance coverage industry that cannot be replicated via the contest.”

It is value noting that we are a ways clear of complete autonomy on U.S. roadways. As self sustaining cars make up a bigger percentage of the automobile combine and encounters between self sustaining cars and human-driven cars upward thrust, it would not be sudden if insurance coverage turns into an much more successful industry — both thru insurance policies managed via house owners of self sustaining cars, or perhaps via the automobile producers together with a coverage with the sale of the automobile as a value-added possibility.

Tesla (NASDAQ: TSLA), as an example, has gotten into the insurance coverage industry thru Tesla Actual-Time Insurance coverage, which measures a security ranking and provides reductions in keeping with whether or not its “Complete Self-Riding” function is used a minimum of 50% of the time. Then again, insuring absolutely self sustaining cars is a distinct animal.

That specialize in the longer term

Fashionable adoption of self sustaining cars could be a sport changer for the P&C industry, however it is an adjustment that the entire business should adapt to — no longer simply Berkshire. Nonetheless, insurance coverage has transform a an important component of Berkshire Hathaway’s funding thesis, so you could wish to track how generation developments affect underwriting standards and Berkshire’s running income.

When taking a look at Berkshire (as with every corporate), it is best to concentrate on the place it’s going to be a number of years from now, as a substitute of having too stuck up in adjustments to quarterly or annual effects. As Buffett mentioned throughout Saturday’s annual shareholder assembly, “We do not do anything else in keeping with its affect on quarterly or annual income.”

Staying true to this philosophy will most probably give Berkshire Hathaway a bonus in navigating automobile autonomy. The long-term mindset may just even lead it to achieve marketplace percentage within the business, particularly if its competition are extra curious about creating wealth temporarily than construction lasting companies.

American Categorical is an promoting spouse of Motley Idiot Cash. Daniel Foelber has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Apple, Berkshire Hathaway, and Tesla. The Motley Idiot has a disclosure coverage.