KKR & Co.’s plan to wreck from the normal buyout type and dangle some bets by itself books for many years is being directed by way of a tight-knit team, together with co-founders Henry Kravis and George Roberts.

The other asset supervisor’s Strategic Holdings unit, introduced slightly over a 12 months in the past, is a key a part of KKR’s plan to greater than quadruple profits according to proportion over the following decade. The company sees a possibility to construct a portfolio that kicks off greater than $1 billion a 12 months in dividends.

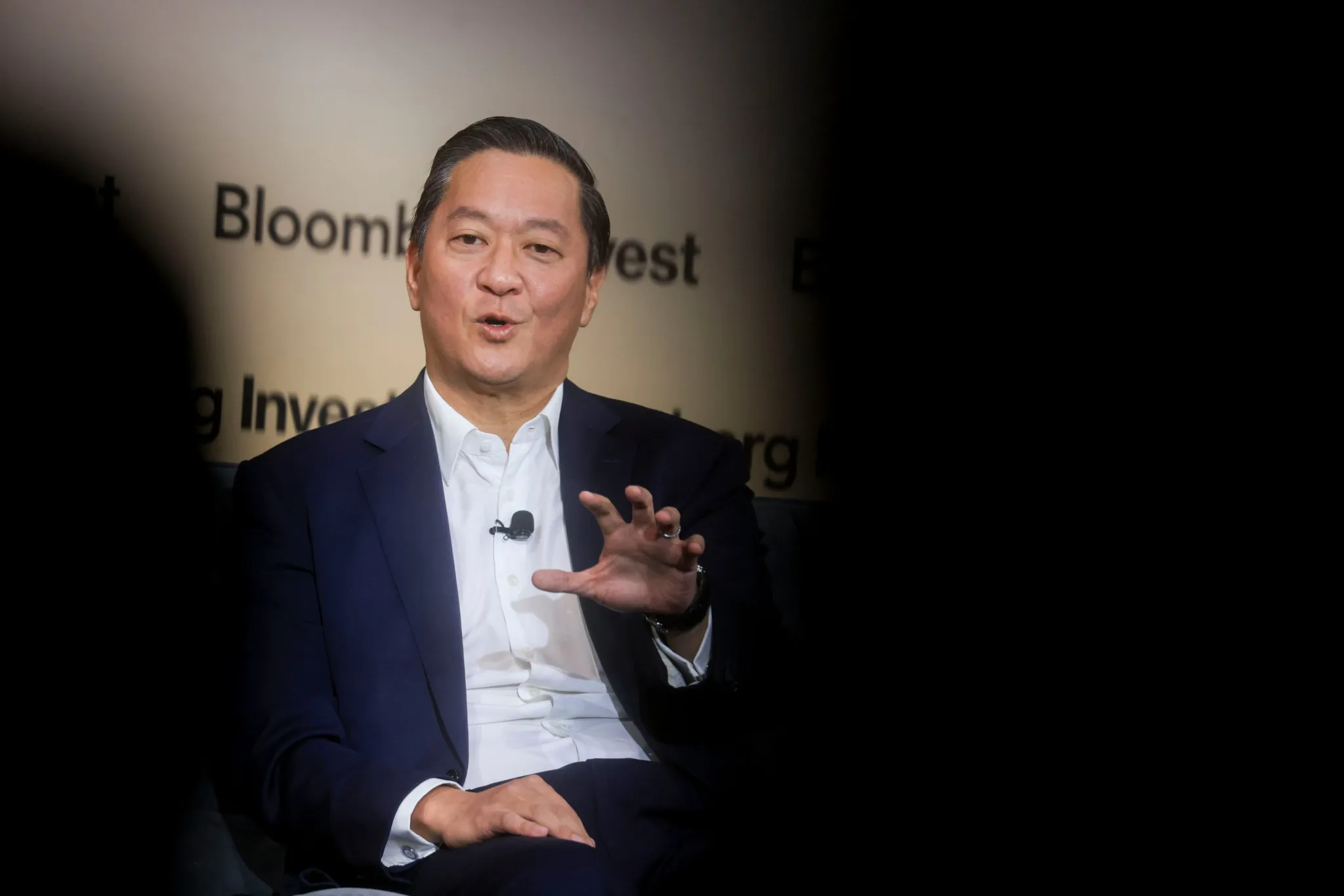

What the company is making an attempt to create “is in many ways a mini Berkshire Hathaway,” Co-Leader Government Officer Joe Bae stated on the Bloomberg Make investments convention in New York previous this month.

Whilst Warren Buffett’s $1 trillion conglomerate has drawn many imitators, KKR’s gambit is a destroy from its closest competitors, who’ve prioritized secure charges over direct bets.

A small team of executives overseeing KKR’s stability sheet come to a decision which investments make the lower, in line with an individual with wisdom of the subject. It comprises Kravis and Roberts, Bae and co-CEO Scott Nuttall, Leader Monetary Officer Rob Lewin and stability sheet Leader Funding Officer Henry McVey, stated the individual, who requested to not be recognized discussing confidential data.

The unit lately holds stakes in 18 long-term investments which might be anticipated to compound through the years as a substitute of being flipped for a fast benefit. Bae stated this month that the company intends so as to add infrastructure and actual belongings to the combination.

KKR says the upside for affected person buyers might be large. The company has identified that Berkshire is price nearly up to the entire publicly traded asset managers on the earth mixed. But it surely’s a long-term guess that can require capital now. KKR lower its proportion buybacks to 0 final 12 months and paid out a decrease portion of its profits as dividends than any of its main competition.

It additionally makes the company a distinct funding case than a lot of its competitors, that have pitched themselves to shareholders as asset-light. KKR has greater than $100 billion of investments on its stability sheet, no longer together with its insurance coverage unit. Apollo had $6 billion outdoor its insurance coverage department, and Carlyle had lower than $11 billion throughout its entire company. Brookfield Corp. spun out its fund unit in 2022 to split the companies of keeping belongings and incomes control charges.

Strategic Holdings is “a singular, one-off technique to long-term possession of top quality belongings to power stability sheet compounding,” Mike Brown, a Wells Fargo & Co. analyst who follows KKR, stated in an interview. The unit “introduces a brand new profits engine.”

A consultant for KKR declined to remark.

Buyout DNA

KKR stands proud for leaning into buyouts at a time when others are pulling again. Personal fairness has been careworn in recent times by way of upper rates of interest, that have ended in fewer offers getting accomplished and not more capital being returned to buyers. However at KKR, non-public fairness tied with infrastructure to generate the most productive returns — 14% — of the company’s more than a few asset categories final 12 months.

The tactic has been enabled, partly, by way of its large stability sheet. Paying out fewer dividends and purchasing again fewer stocks allowed it to hoard coins, reinvest positive factors and seed more than a few companies.

Strategic Holdings strains its roots to 2017, when a small workforce operating below Lewin used KKR’s stability sheet to make strategic acquisitions and spend money on core non-public fairness offers with companions that might produce double-digit returns over the longer term. The first bet was once on USI Insurance coverage Services and products, a consulting and brokerage company, led by way of spouse Chris Harrington.

KKR therefore introduced its first Core Personal Fairness fund to collect outdoor capital from those that sought after to take a position along it. The industry is now overseen by way of an funding committee together with non-public fairness co-heads Pete Stavros and Nate Taylor and seeks out lower-risk, cash-flowing corporations that don’t essentially make sense in a standard closed-end non-public fairness fund. Webster Chua, an Americas non-public fairness spouse, works intently with key Core Personal fairness purchasers whilst originating some offers.

For now, Core Personal Fairness and Strategic Holdings are necessarily synonymous. Its present lineup of 18 investments comprises lens store 1-800 Contacts, cybersecurity corporate Barracuda Networks and Australian snack meals producer Arnott’s Staff.

“It is a phase for us that’s truly an unconstrained addressable marketplace,” Lewin stated at a monetary services and products convention final month. The company owns a median 20% stake within the 18 companies, representing $3.7 billion of earnings and $900 million of adjusted profits, he stated.

KKR has advised buyers the advent of Strategic Holdings represents no significant further prices as it’s run fully by way of present personnel.

However there may be a minimum of one obtrusive distinction between choice asset managers and Buffett’s 60-year-old conglomerate: charges and carried passion. Strategic Holdings can pay control charges and a proportion of positive factors to execs who paintings at the offers, in line with the company’s filings.

For now, Strategic Holdings represents a small proportion of KKR’s working profits, even supposing it predicts it’ll generate $1.1 billion by way of 2030. How the company will fund that expansion stays a significant query for buyers.

When KKR issued just about $2.6 billion in necessary most well-liked convertible fairness this month to fund further funding in 3 long-term holdings, the marketplace was once stuck off guard, in line with Smartly’s Fargo’s Brown. The transfer will dilute present shareholders and lower right into a projected building up in profits from the brand new investments.

“The marketplace was once indisputably no longer able or ready for that,” Brown stated.

This tale was once initially featured on Fortune.com