Few shares have taken traders on extra of a roller-coaster journey in one 12 months than Tremendous Micro Pc (SMCI 0.52%). At one level, the inventory was once up through up to 318% from the place it all started 2024. Only a month in the past, it was once down through 36% 12 months so far. Now, on the time of this writing, it is up once more through round 45% for the 12 months.

The explanations at the back of the ones huge actions in fact had been sound, taking into account what traders knew on the time. However now, traders need to know if Supermicro can regain the $118 excessive it reached previous this 12 months.

Accusations of accounting fraud ended in Supermicro’s inventory tumble

Tremendous Micro Pc has turn into a sizzling inventory during the last few years on account of its industry. Very similar to longtime synthetic intelligence (AI) winner Nvidia (NASDAQ: NVDA), Supermicro makes elements that move into robust computing servers that teach AI fashions. Supermicro additionally makes the elements that let a server to serve as, such because the bodily racks and cooling infrastructure.

Whilst now not as high-margin as Nvidia’s GPUs, those are nonetheless vital merchandise, and Supermicro noticed large call for initially of the 12 months. This call for propelled its inventory to lofty heights in March when it completed the $118 in step with percentage inventory worth. Then again, this enthusiasm was once too excessive, and Supermicro progressively bought off all over the 12 months as traders took earnings.

The inventory was once nonetheless having a a hit 12 months till overdue August when Hindenburg Analysis printed a brief file alleging that Supermicro was once enticing in some stage of accounting fraud. To make issues worse, the next day to come, Supermicro introduced it was once delaying submitting its end-of-year 10-Okay report back to assess the “design and running effectiveness of its inner controls over monetary reporting.”

This kicked off the inventory’s tumble, and extra occasions — together with the Division of Justice opening an investigation into the corporate and its auditor, Ernst & Younger, resigning — made it appear to be the inventory was once doomed. Then again, new knowledge has led to the inventory to recuperate considerably.

A different committee that integrated a member of Supermicro’s board, a prison group, and a forensic accounting group from Secretariat Advisors discovered no wrongdoing in accounting practices, even if it did counsel changing Supermicro’s CFO (a procedure this is these days ongoing). This information unwound mainly all the problems that drove Supermicro’s tumble during the last few months, however the inventory continues to be smartly off its top.

Traders hope for a extra dull 2025 that is ruled only through industry information, now not allegations. So, is the inventory price purchasing now that it seems to be within the transparent?

Initial fiscal Q1 effects neglected expectancies through a large margin

After Ernst & Younger resigned, Supermicro introduced on BDO, a best accounting company. BDO nonetheless hasn’t qualified Supermicro’s effects from its fiscal 2025 first quarter, which ended Sept. 30, however it most probably will achieve this quickly.

Till then, we will must depend on control’s initial effects, which sadly are not just right.

Supermicro have been guiding for fiscal Q1 income of $6 billion to $7 billion, however its initial effects level to income in fact touchdown between $5.9 billion and $6 billion. Then again, its initial EPS figures are close to the center of its steering levels, so the corporate’s benefit image continues to be intact.

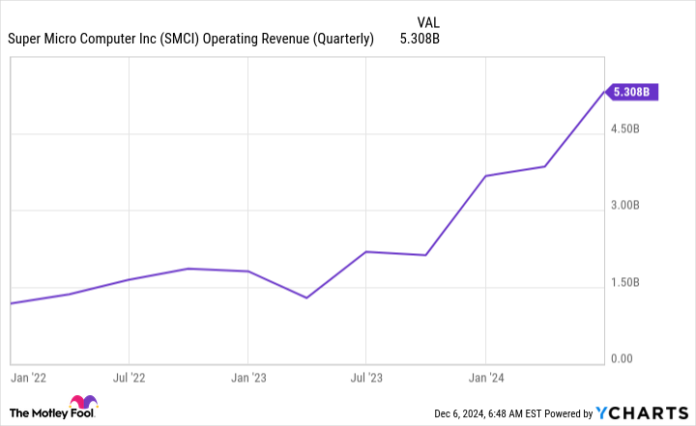

SMCI Operating Revenue (Quarterly) information through YCharts.

For fiscal Q2, gross sales are anticipated to land between $5.5 billion and $6.1 billion. That will be a quarter-over-quarter decline, one thing that should not be taking place taking into account that the AI marketplace continues to be booming. One drawback may well be that Nvidia is allegedly transferring some orders for server {hardware} for its next-generation Blackwell GPUs clear of Supermicro. That’s not a just right signal.

So, must traders open new positions in Supermicro in any case that has long past on? I would say no.

Even supposing control has taken the precise steps to transparent itself of accounting wrongdoing, there is simply no agree with within the corporate. Moreover, with its revenues underperforming its steering, there may well be different turmoil inside the corporate this is being overshadowed through the more than a few ongoing investigations. (The Justice Division continues to be finishing its probe.)

Because of this, I am heading off the inventory. There are a ways too many different just right AI investments available in the market to waste my time with person who I will not agree with.