It is been a chaotic week for buyers. The Dow Jones, the S&P 500, and the Nasdaq Composite all noticed one of the most worst multi-day stretches in years. This comes as a industry struggle escalated between the U.S. and its main industry companions, with China and the E.U. responding in sort to President Donald Trump’s steep, sweeping new levies on items from just about each and every nation on this planet. To mention markets have been fearful is a sarcasm. That is now given option to optimism after Trump decreased price lists on all companions save for China.

Amid the tumult, some buyers want to purchase shares at what is usually a cut price. May Tesla (TSLA -0.19%) be the best pick out? The electrical car (EV) pioneer’s inventory has slid greater than 6% since remaining Wednesday, when the price lists have been introduced, earlier than rebounding considerably. Nonetheless, Tesla inventory is down just about 45% from its top in January.

That is in spite of Tesla in truth getting cash — no longer one thing a lot of its EV competition can say — an innovator in self reliant riding and robotics, and its power garage trade rising swiftly. So, is Tesla the best alternative at this time?

Tesla is many stuff, however in the beginning, it is a carmaker

Whilst the corporate is operating on a number of leading edge applied sciences that might turn out transformative, the truth is, at this time, it’s basically a automobile producer. Of the $97.7 billion in general gross sales it reported remaining 12 months, greater than $77.1 billion got here from gross sales of its lineup of automobiles.

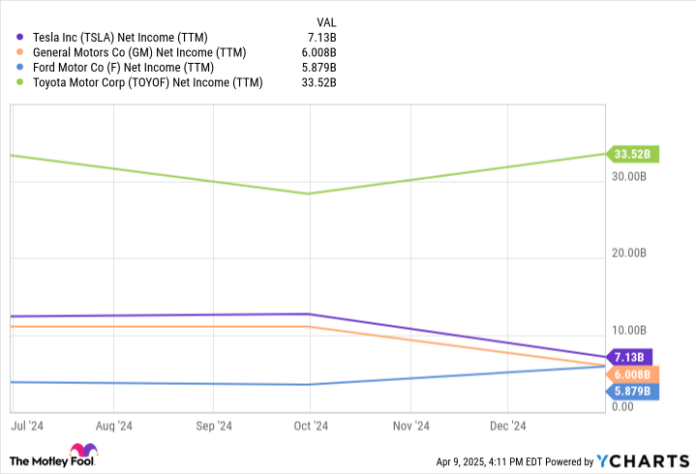

Whilst EV opponents Rivian and Lucid Team each battle to show a benefit, Tesla ranks as one of the most international’s peak 10 maximum successful car corporations. It is a a ways cry from the vastly successful Toyota, however Tesla’s base line beats out American manufacturers GM and Ford, amongst others.

TSLA Net Income (TTM) information by way of YCharts. TTM = trailing twelve months.

That is in spite of decrease gross sales. Tesla’s margins are upper than its home pageant, permitting the corporate to ship top-tier revenue in spite of general gross sales of more or less part that of GM and Ford. That suggests Tesla has important headroom to develop gross sales — just right information for buyers.

Gross sales are slipping

Here is the item: Tesla is not rising gross sales. If truth be told, its car gross sales are shrinking. The corporate’s newest supply file confirmed it had delivered simply 336,681 cars within the first quarter, making it the worst quarter for deliveries since 2022. We’re nonetheless a number of weeks out from Tesla’s revenue name, wherein extra main points will come to gentle, however as of Tesla’s 2024 file, the as soon as double-digit year-over-year (YOY) earnings enlargement the corporate loved is long gone. Its gross sales grew by way of not up to 1% from 2023 to 2024.

This pattern could also be accelerating. Focused stories from person markets around the world display Tesla’s automobile gross sales tanking whilst general EV gross sales jump. Tesla’s E.U. gross sales dropped 45% in January, whilst the EV marketplace rose 37% YOY. The corporate’s gross sales in China dropped 11.5% YOY in March, whilst gross sales in France hit their lowest stage since 2021.

Why? Whilst these types of developments are all the time multivariate, it is unattainable to forget about CEO Elon Musk’s foray into politics at house and in a foreign country. Over the past 12 months, the Tesla leader has turn out to be an an increasing number of polarizing determine. As the pinnacle of the newly created Division of Executive Potency (DOGE), Musk has overseen a marketing campaign of debatable cost-cutting at house whilst placing himself within the native politics of nations from Germany to the U.Okay.

His movements have led to, as JPMorgan Chase analyst Ryan Brinkman places it, “exceptional logo injury” which may be the main driving force in Tesla’s sliding gross sales. On the similar time, Tesla is dealing with more potent pageant from legacy producers and the Chinese language EV maker BYD. The lead it as soon as loved within the eyes of shoppers because the pioneer of the EV business has in large part evaporated.

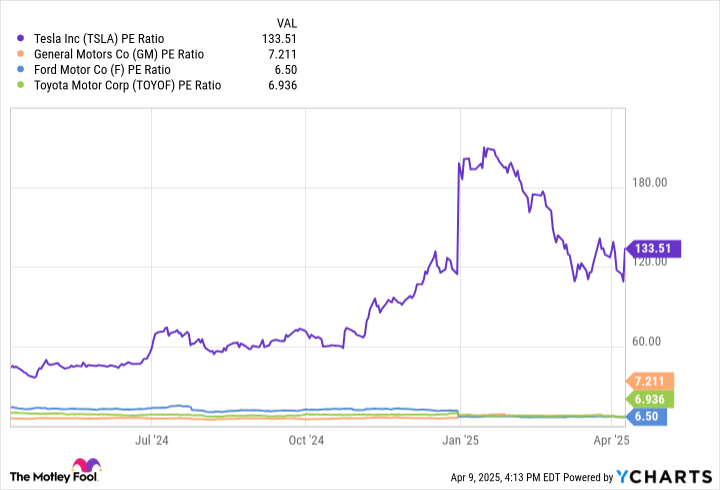

Tesla has a valuation factor

Even supposing gross sales were not suffering to the stage they’re, there’s a main factor with the inventory’s valuation. The corporate’s inventory trades at greater than 130 instances revenue. This is extraordinarily top for any roughly corporate — tech incorporated — let on my own a automobile producer. Take a look at how a lot upper Tesla’s price-to-earnings (P/E) ratio is than its pageant’s.

TSLA PE Ratio information by way of YCharts. PE Ratio = price-to-earnings ratio.

TSLA PE Ratio information by way of YCharts. PE Ratio = price-to-earnings ratio.

Now, I freely admit that there’s extra to Tesla than just making automobiles — its power garage trade is rising at a wholesome clip at the present time. The corporate is operating to ship self-driving capability to its shoppers. Musk touts a long term crammed along with his corporate’s robotaxis and private robots. The corporate has its hand in lots of pies that, at some point, might be very profitable. This does not trade that, at the present time and for the foreseeable long term, Tesla is a automobile corporate. The majority of its earnings comes from promoting the automobiles it produces.

The promise of long term transformative applied sciences can distract from this easy truth. So, if you select to spend money on Tesla, know that you’re purchasing a long term this is a ways from assured. The inventory payment is a ways too top for what’s basically a automobile corporate, particularly one seeing its gross sales enlargement stagnate. I’ve critical doubts that Tesla will ship on Musk’s guarantees in any roughly significant time period or, for that topic, in any respect. Tesla inventory isn’t a purchase now.

Johnny Rice has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot recommends BYD Corporate and Basic Motors. The Motley Idiot has a disclosure coverage.