SoundHound AI (SOUN -5.62%) is having a horrible 2025 as far as stocks of the voice synthetic intelligence (AI) answers supplier have dropped greater than 57% as of February 25, and the inventory won its newest jolt after it emerged that semiconductor bellwether Nvidia has offered its stake within the corporate.

It’s value noting that SoundHound sprung into the limelight in February 2024 after it emerged that Nvidia had a small stake within the corporate value $3.7 million. Since then, stocks of SoundHound have witnessed a roller-coaster experience available on the market, emerging remarkably within the fourth quarter of 2024. So, the inside track that Nvidia has offered its SoundHound stake for a pleasing benefit led many buyers to press the panic button.

On the other hand, is the newest drop a chance to shop for this fast-growing AI corporate? Let’s in finding out.

Nvidia’s sale of its SoundHound place is not a large deal

SoundHound’s marketplace cap lately stands at simply over $4 billion. So, Nvidia’s stake within the corporate wasn’t so large that it warranted a pointy sell-off. In fact, some might wonder whether Nvidia’s go out means that it wasn’t anticipating extra upside from SoundHound, particularly taking into account its valuation. That can be true to an extent as SoundHound has been buying and selling at pricey ranges up to now 12 months due to the massive soar in its inventory charge.

What is value noting is that SoundHound remains to be buying and selling at a pricey 47 instances gross sales following its sharp pullback in 2025. On the other hand, that is not up to the inventory’s price-to-sales ratio of 90 on the finish of 2024. So, buyers are getting their fingers in this progress inventory at a somewhat less expensive valuation presently. Extra importantly, the tempo at which SoundHound has been increasing may assist it justify its pricey valuation.

Does this imply growth-oriented buyers having a look so as to add an AI inventory to their portfolios must imagine purchasing SoundHound presently?

The corporate’s terrific progress is about to proceed

SoundHound will unencumber its fourth-quarter 2024 effects on Feb. 27. The corporate’s steering for 2025 signifies that its best line is on the right track to extend 82% from the former 12 months. That might be a pointy growth over the 47% earnings progress the corporate clocked in 2023.

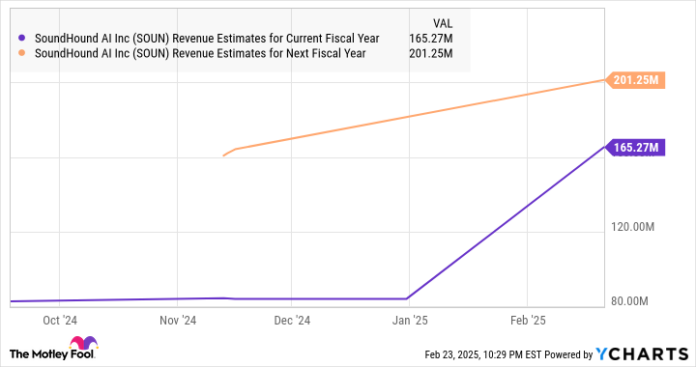

Even higher, the midpoint of SoundHound’s 2025 earnings steering stands at $165 million, which might be just about double its 2024 earnings. Analysts expect a slowdown within the corporate’s progress price in 2026, as proven within the chart beneath.

SOUN Revenue Estimates for Current Fiscal Year information by way of YCharts

On the other hand, SoundHound might really well outpace Wall Boulevard’s progress expectancies subsequent 12 months. That is since the corporate issues out that it has a blended order backlog of greater than $1 billion after taking into consideration its fresh acquisition of undertaking AI device supplier Amelia. That is a lot upper than the blended earnings that the corporate is on the right track to reach in 2024 and 2025, and in addition exceeds the earnings that analysts expect it to record subsequent 12 months.

Additionally, SoundHound AI’s voice AI answers are gaining wholesome traction out there. It has constructed a forged buyer base within the car and eating place verticals. Additionally, the corporate is having a look to push the envelope by way of bringing extra consumers on board and diversifying into new spaces following its Amelia acquisition.

A more in-depth have a look at fresh press releases means that the adoption of SoundHound’s choices stays wholesome, with the likes of Lucid Motors and Kia integrating its answers of their automobiles. Additionally, SoundHound is working in a multibillion-dollar voice AI marketplace that is anticipated to leap just about 20x in dimension between 2024 and 2034, producing just about $48 billion in annual earnings after a decade.

So, buyers who’re keen to pay a top rate for the exceptional progress that SoundHound is turning in might be rewarded with powerful upside ultimately, making the new pullback a chance to shop for it prior to a probably forged profits record sends it upper.

On the other hand, they wish to remember that SoundHound inventory has been susceptible to volatility up to now 12 months, and its pricey valuation leaves open the potential for large swings within the inventory charge.

Harsh Chauhan has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.