It’s been slightly the roller-coaster journey for Palantir (PLTR) shareholders prior to now few years. After going public in 2021, the inventory skilled an 80% drawdown within the 2022 undergo marketplace. Since then, it has clawed its long ago with a vengeance. Stocks have risen on the subject of 500% prior to now 3 years, making Palantir some of the best-performing shares out there.

Why? Two phrases: synthetic intelligence (AI). Palantir is a device and products and services supplier of AI equipment to the federal government, army, and large trade. Everybody loves AI shares at the moment, and it is seeing expanding adoption and contract wins which might be using the inventory upper. However are traders who purchase in 2025 too overdue to the birthday celebration? Let’s dive into Palantir inventory and spot if it is a purchase in your portfolio this calendar yr.

AI for nationwide safety (and companies)

Palantir’s device makes use of AI and different analytical equipment to lend a hand massive organizations garner insights from their knowledge. Its customized answers are catered to organizational wishes. As an example, it has contracts with the U.S. army, CIA, and different govt businesses. Remaining quarter on my own, U.S. govt income used to be $320 million and increasing 40% yr over yr.

It seems like this enlargement is about to proceed as the corporate is signing massive federal contracts. One instance is a contemporary $618 million care for the U.S. Military for a duration of as much as 4 years. The U.S. govt — some of the biggest organizations on this planet — has a sprawling set of information assets that may be difficult to regulate, and it is keen to pay Palantir a lovely penny to arrange and analyze it.

To increase its addressable marketplace, Palantir has shifted its center of attention to promoting its AI equipment to very large enterprises as smartly. The usage of the federal government’s self assurance in Palantir as a promoting level, control has made inroads advertising and marketing its products and services to very large firms. U.S. industrial income used to be Palantir’s fastest-growing phase ultimate quarter, up 54% yr over yr to $179 million.

Huge enlargement possibilities and room for benefit margin growth

With lower than $200 million in quarterly income from its U.S. industrial phase, Palantir has a protracted runway of enlargement on this marketplace. Remaining quarter on my own, it closed 104 offers price over $1 million and grew its buyer rely 39% yr over yr. Instrument and analytical equipment are sticky and in most cases see increasing spend from shoppers through the years. As Palantir wins new shoppers, its enlargement must boost up and lend a hand consolidated income march upper over the following 5 years.

At the profitability entrance, Palantir has numerous room for growth. Over the past twelve months, its running margin used to be best 13%. To be truthful, this can be a large growth from years previous and is low because of Palantir’s reinvestment for enlargement, however it is nonetheless not up to maximum device companies. With a gross margin constantly above 75%, I be expecting Palantir’s running margin to increase previous 20% and sooner or later 30% within the subsequent 5 years. This will likely lend a hand its bottom-line earnings jump as soon as this trade begins maturing.

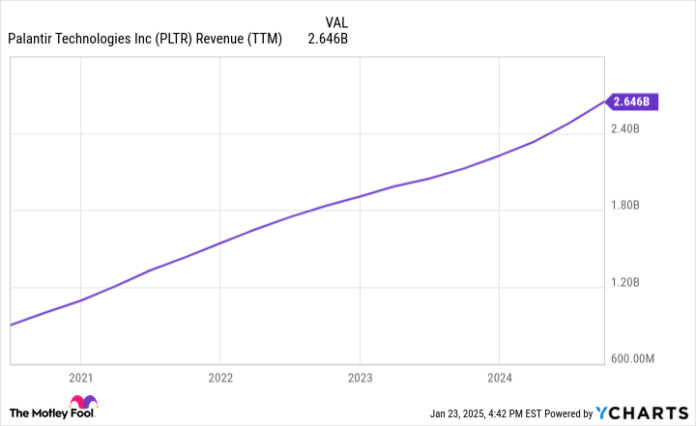

Knowledge by way of YCharts.

Is it too overdue to shop for Palantir inventory?

Because of its fresh positive factors, Palantir sports activities a marketplace cap of $180 billion, making it some of the 100 biggest firms on this planet. It is surprising whilst you absolutely believe how a device corporate with simply $2.6 billion in trailing-12-month income is without doubt one of the largest firms on earth, a minimum of by way of marketplace capitalization. Like its proportion fee, its price-to-sales ratio has soared to 72, making it essentially the most expense inventory within the S&P 500 by way of that metric.

That is why it is certainly too overdue to shop for Palantir inventory in 2025. If the corporate grows its income 40% yearly over the following 5 years, its income will hit $15 billion in 2029. Assuming its internet source of revenue margin can increase to 30% by way of that point, the corporate would generate $4.5 billion in annual revenue. It is a very constructive situation, one I believe is not going to even happen (even though that does not imply Palantir would possibly not develop revenue over the following 5 years).

However even in accordance with this bullish outlook for revenue of $4.5 billion as opposed to its present marketplace cap of $180 billion, Palantir trades at a ahead price-to-earnings (P/E) ratio of 40. Put merely, despite the fact that Palantir places up 40% annual enlargement thru 2029 and expands its benefit to 30%, it nonetheless trades at a top rate to the huge marketplace in accordance with that outlook. Expectancies are sky top for the inventory, and value issues when making an investment. The hype round Palantir is simply too a lot, and traders must keep away, a minimum of for now.

Brett Schafer has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a disclosure coverage.