The S&P 500 has risen about 20% during the last three hundred and sixty five days, which is an overly sturdy efficiency. Cava Team’s (CAVA -9.00%) inventory charge has rallied 160% over the similar span. There is a lot to digest about that eye-popping proportion charge advance while you imagine the purchase, promote, or dangle name in this upstart eating place thought.

Purchase Cava Team

Let’s get started with the excellent news: Cava is a Mediterranean-themed eating place that makes use of an meeting line-style preparation machine. It chefs the meals in a kitchen at the back of the counter, so shoppers are aware of it is freshly made. And the meeting line lets in shoppers to fine-tune their option to their explicit style personal tastes.

That is, mainly, what Chipotle Mexican Grill does, too, most effective with a Mexican theme. Chipotle has grown hugely over time and, in spite of some fresh charge weak spot, has been an enormous winner for traders.

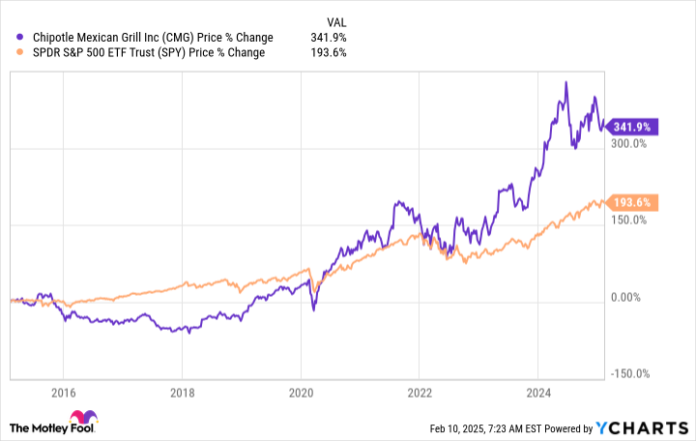

To place a host on that, Chipotle’s stocks have risen 340% during the last decade, whilst the S&P 500 index has risen round 190%. Buyers are having a bet that Cava is the following Chipotle. And there is excellent reason why to suppose that, for the reason that Cava most effective operated round 350 eating places on the finish of the 3rd quarter of 2024.

Chipotle operates greater than 3,700 eating places. If Cava’s thought stays sexy to shoppers, there is usually a massive expansion alternative forward. With same-store gross sales of 18% within the 3rd quarter of 2024, the concept that does, certainly, seem to be highly regarded presently.

So the rationale to shop for Cava is that you simply consider it may possibly proceed to extend aggressively, most likely attaining an identical long-term effects to Chipotle.

Promote (or steer clear of) Cava

The issue here’s that traders are already pricing numerous excellent information into Cava’s inventory charge. That vast charge advance during the last three hundred and sixty five days is the primary indication of this truth, however there is additionally the price-to-earnings ratio.

Chipotle has a P/E of more or less 50x. That is very prime, however it in fact pales compared to Cava’s over 300x P/E ratio. For comparability, the S&P 500’s moderate P/E is 23.

It’s solely conceivable that Cava will keep growing its industry at a breakneck tempo. However even the slightest signal of weak spot may just lead traders to offload the inventory, given the lofty valuation. If truth be told, the corporate may just proceed to accomplish strongly, and the inventory may just nonetheless fall if momentum-driven traders make a decision to transport directly to any other tale inventory.

If valuation issues to you, you will not wish to purchase Cava. And should you personal it, you may wish to imagine taking some earnings. It’s odd for shares to have P/Es as prime as Cava’s for lengthy sessions of time, with inventory charge declines a widespread reason why for the P/E falling again to decrease ranges.

Grasp Cava

That mentioned, should you personal Cava, it could be laborious to justify promoting it. Whilst the inventory is pricey, the chance stays tough. And control is executing rather well presently, aggressively opening new places whilst, on the identical time, maintaining gross sales at current places prime. If the eating place chain can proceed to resonate with shoppers, there is no reason why to consider it may not develop into that lofty P/E ratio.

If making a decision to stay it out, then again, be sure you monitor same-store gross sales carefully. It’s not going that Cava will be capable to maintain 18% eternally. However even though it may possibly set up to reach part that stage, it’s going to be a standout efficiency in an business the place low unmarried digits are thought to be a forged end result. The large takeaway, then again, is that you could wish to react briefly if the tale adjustments, given the excellent news that traders have already priced into the stocks.

Or it’s essential simply dangle on and no longer do the rest. Because the chart displays, Chipotle has suffered thru a couple of large drawdowns even because it has helped traders construct wealth over the longer term. It might have taken an iron abdomen to sit down thru a couple of 50%-plus inventory charge declines, however such drops don’t seem to be unusual when you’re having a look at younger, fast-growing firms. To stay it out with Cava thru this sort of volatility, then again, you will want to make sure to in reality (in reality!) consider within the power of its meals thought.

Cava is for competitive expansion traders

Price traders may not like Cava, given its lofty valuation. Source of revenue traders may not like Cava because it does not pay a dividend. Enlargement traders are the gang that can like this inventory. However even then, there is the valuation to cope with, which is excessive via as regards to any measure.

So in reality, Cava is maximum suitable for competitive expansion traders. Or even then there is a little bit of purchaser beware, because the marketplace is obviously extremely passionate about the inventory as of late. Proportion charge turbulence is extremely most likely.