Can Amazon nonetheless ship market-beating returns after hovering close to all-time highs on the finish of 2024?

E-commerce pioneer Amazon (AMZN -0.86%) belongs within the small handful of shares I might imagine purchasing at any time. On the identical time, grasp buyers like Warren Buffett insist that even nice firms will have to be purchased simplest at cheap costs.

As 2024 winds down, Amazon stocks have received greater than 46% this 12 months. The inventory trades simply 6% under its all-time prime, which was once set two weeks in the past. Is Amazon nonetheless a purchase at those hovering percentage costs, or will have to you let the inventory quiet down sooner than taking some other glance in 2025?

Is Amazon inventory overpriced?

Forestall me if you happen to’ve heard this sooner than: Amazon’s inventory seems dear.

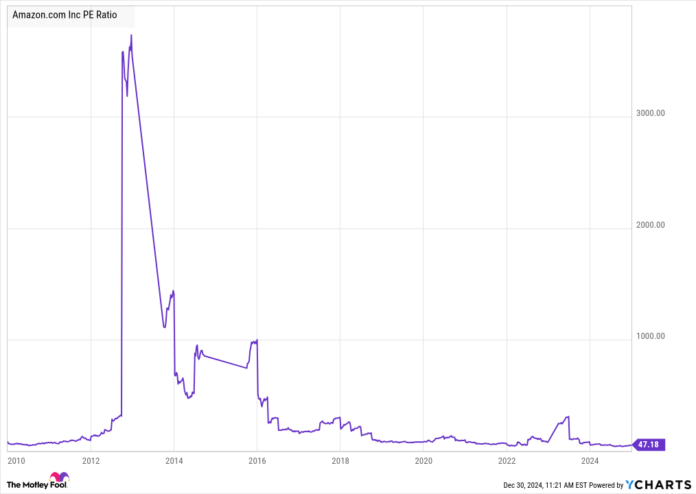

The web store and cloud computing innovator has certainly reached a lofty perch on Wall Boulevard. It is probably the most vaunted “Magnificent Seven” shares, with a $2.27 trillion marketplace cap. Stocks are converting fingers at 47 occasions income (P/E) and 53 occasions unfastened money go with the flow (P/FCF). There is simply no opposite direction to have a look at it — Amazon’s inventory is not reasonable at this time.

This market-beating inventory by no means seems reasonable

On the other hand, this inventory by no means turns out like a discount. It does not in point of fact topic what metrics you observe to the chart — Amazon stocks really feel dear more often than not.

The chunky price-to-earnings ratio is in regards to the lowest it is been within the ultimate 15 years:

AMZN PE Ratio information through YCharts

The money go with the flow ratio could also be low from a ancient viewpoint. On this view, Amazon inventory felt reasonably priced after the subprime meltdown of 2008-2009 and once more because the cloud computing section became winning within the mid-2010s, however Amazon additionally depleted its money income in 2013 and 2021. Information middle apparatus, world-class transport products and services, and upgraded headquarters can also be dear.

After all, Amazon’s reasonable P/FCF during the last decade and a part stands at 108:

AMZN Price to Free Cash Flow information through YCharts

And I in point of fact wouldn’t have to remind you that the inventory delivered outstanding returns anyway, proper? The S&P 500 (^GSPC -0.43%) rose 424% within the 15-year duration I have highlighted, however Amazon raced forward with a three,070% acquire:

AMZN information through YCharts

“Easiest timing” is an actual factor. No one is aware of how to reach it.

I agree that it makes a distinction whilst you nail the very best time to shop for any explicit inventory. In the event you grabbed Amazon stocks at the proper day in June 2009 as an alternative of six months later, you’ll have a 5,550% go back to your pocket as an alternative. That is a significantly better end result.

However no person is aware of how you can pinpoint the ones absolute best buy-in dates. Warren Buffett is the primary to confess that he can not see “what the inventory marketplace goes to do within the subsequent six months, or the following 12 months, or the following two.”

That uncertainty applies to the marketplace as an entire and to each and every person inventory. The most efficient any investor can do is pick out up stocks of serious firms when it kind of feels to make sense, then let the underlying trade ship winning expansion and shareholder returns ultimately. That is excellent sufficient for billionaires like Buffett, and greater than fantastic for me. You will have to imagine a identical means, too.

Sure, you’ll be able to purchase Amazon nowadays

Possibly this is not the most efficient time ever to shop for Amazon inventory. However additionally it is no longer a nasty time.

Having a look forward, Amazon will have to get pleasure from a more potent financial system, the continuing synthetic intelligence (AI) growth, and its not too long ago introduced drone supply device. I am speaking a few world-class innovator with a versatile marketing strategy, and the inventory might by no means appear reasonably priced however nonetheless supplies profitable returns through the years.

So you should not again up the truck, guess the farm, or put all your nest egg into Amazon inventory nowadays. Alternatively, chances are you’ll wish to get started a modest Amazon place if you have not but, the use of price-mitigating tactics corresponding to purchasing in thirds or operating an automatic dollar-cost averaging plan.

The street forward could also be bumpy, however you do not need to observe from the sidelines as Amazon assists in keeping treating its shareholders to market-beating returns within the lengthy haul.

John Mackey, former CEO of Entire Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Anders Bylund has positions in Amazon. The Motley Idiot has positions in and recommends Amazon. The Motley Idiot has a disclosure coverage.