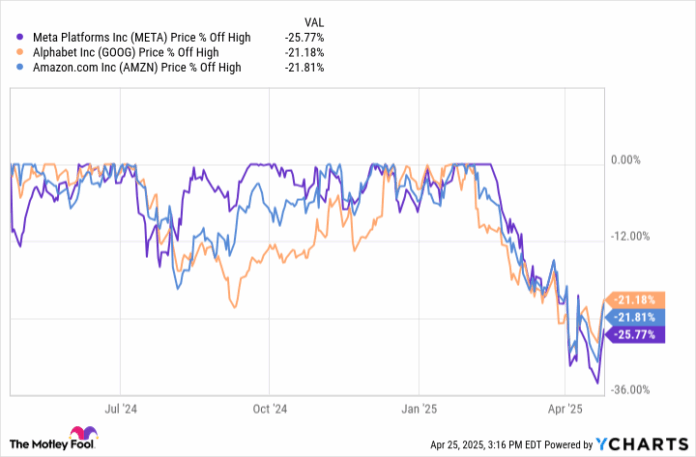

Although the inventory marketplace has rebounded since “Liberation Day” 3 weeks in the past, it has no longer been a a laugh 12 months for generation traders. A number of “Magnificent Seven” shares are nonetheless down over 20% from all-time highs, together with Amazon (AMZN -0.59%), Alphabet (GOOG -0.81%) (GOOGL -0.73%), and Meta Platforms (META 0.61%). Wall Side road is involved in price lists and their affect to 2025 income.

This short-sighted considering could be a purchasing alternative for traders fascinated by extra than simply the following few quarters. This is why those 3 are best possible shares to shop for the dip on throughout this marketplace volatility.

Meta’s dominant marketplace place

Meta Platforms owns 3 of the biggest social media platforms on the earth: Fb, Instagram, and WhatsApp. Remaining quarter, 3.35 billion other people used a Meta provider each day. Apart from China — the place Meta does no longer function — this is over part of the arena’s inhabitants the usage of a Meta product day-to-day. That improbable world scale is rivaled handiest via its different generation peer in Alphabet.

Although different social media platforms like Snapchat or Pinterest have loads of thousands and thousands of customers, no different utility but even so TikTok has the time spent and promoting experience to get with reference to Meta’s scale. Remaining quarter, Meta Platforms’ earnings grew 21% 12 months over 12 months to $48 billion, with running margin increasing from 41% to 48%. The mathematics works out to a 43% year-over-year build up in running source of revenue within the quarter, one of the crucial quickest expansion charges of any huge generation corporate on the earth.

Operating closely on synthetic intelligence (AI), digital fact, and different analysis tasks, Meta isn’t resting simple as the following generation paradigms come its approach. Founder and CEO Mark Zuckerberg is lifeless set on successful marketplace proportion in AI and with its combined fact {hardware} headsets, spending tens of billions of bucks a 12 months to get forward of the contest. Even with all this analysis spending, Meta has a 48% running margin. Discuss an improbable industry style.

Down 26% from all-time highs as of this writing, Meta’s trailing price-to-earnings ratio (P/E) has fallen to 22. Even though 2025 is tough because of tariff uncertainty, Meta is a brilliant inventory to possess these days because of its rock-solid industry style and founder-led center of attention on technological innovation.

Alphabet’s multipronged expansion

The one corporate that may be able to argue it has extra day-to-day customers throughout its quite a lot of shopper products and services is Alphabet, despite the fact that it does not expose this determine. The landlord of Google Seek, different Google houses, YouTube, Google Cloud, Waymo, and extra is down 21% from all-time highs even after you have a bump from a robust income unlock this week.

Regardless of worries about competition in AI, Alphabet’s industry continues to polish. Google Seek (and different phase) earnings grew 10% 12 months over 12 months in its Q1 to $51 billion, YouTube promoting earnings grew 10% to $8.9 billion, and Google Cloud grew 28% to $12.3 billion. Even higher, at expanding scale Alphabet’s running margin helps to keep increasing, hitting 34% remaining quarter in comparison to 32% in the similar quarter a 12 months in the past.

There’s a lot to love about Alphabet’s long term, too. Its Gemini AI equipment continue to grow and its self-driving robotaxi community Waymo not too long ago hit 250,000 weekly rides, up 5x from a 12 months in the past. At a cheap-looking P/E ratio of 20, Alphabet inventory is an implausible generation industry to shop for and dangle for a few years into the long run.

An Amazon benefit inflection

Finally, we have now Amazon becoming a member of the combo of generation giants down 20% from highs. On the other hand, not like Alphabet and Meta Platforms, Amazon does no longer generate sky-high benefit margins these days, however is perhaps occurring a adventure of benefit growth over the following 5 years. Because of this its P/E ratio appears to be like reasonably excessive at 34, despite the fact that its true income attainable must be discovered in the following few years.

Amazon’s e-commerce market has advanced within the remaining decade. As a substitute of creating wealth via taking over stock and promoting items itself, Amazon’s industry revolves round managing transactions for third-party dealers. It additionally has a high-margin promoting industry doing $56 billion in earnings and subscription earnings hitting $44 billion a 12 months. Which means that Amazon’s e-commerce industry has a lot upper margin attainable than 10 or two decades in the past, which is slowly getting mirrored in its benefit margins. North American retail margins had been simply 6.4% in 2024, with room to develop considerably upper than 10% over the following few years.

Even higher is Amazon Internet Services and products (AWS), the cloud infrastructure large that does over $100 billion in earnings. It had a 37% running margin in 2024. Mixed with the emerging margins in e-commerce, I feel that Amazon’s consolidated benefit margins have room to develop from 11% remaining 12 months to fifteen% and even 20% inside of the following few years.

As earnings helps to keep emerging at the side of this benefit margin growth, Amazon’s income must inflect upper. At $750 billion in long term earnings — earnings was once $638 billion remaining 12 months — that equates to $150 billion in annual source of revenue on a 20% benefit margin. These days, Amazon’s marketplace cap is $2 trillion, so $150 billion in income would convey the P/E ratio right down to 13.3 in accordance with these days’s inventory fee. I consider that makes Amazon inventory reasonably-priced for the ones shopping to shop for at the moment and dangle for a few years.

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of marketplace building and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Marketplace, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Brett Schafer has positions in Alphabet and Amazon. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, and Pinterest. The Motley Idiot has a disclosure coverage.