The calories sector had a moderately pedestrian 12 months in 2024. The typical calories inventory within the S&P 500 won simplest 2% at the 12 months, as measured through the go back of the Power Make a selection SPDR ETF, neatly beneath the S&P 500’s acquire of greater than 23%.

On the other hand, whilst calories shares have been down final 12 months, the sphere’s long run stays vivid, given the predicted surge in calories call for within the coming years from catalysts like synthetic intelligence (AI) information facilities. That is why traders will have to imagine retaining no less than one calories inventory of their portfolio.

For the ones with room for just one, Brookfield Renewable (BEPC -0.99%) (BEP 0.07%), Endeavor Merchandise Companions (EPD 1.92%), and NextEra Power (NEE 1.07%) stand out to a couple of Idiot.com participants as the highest ones to imagine purchasing now.

Brookfield Renewable is a one-stop blank calories give up

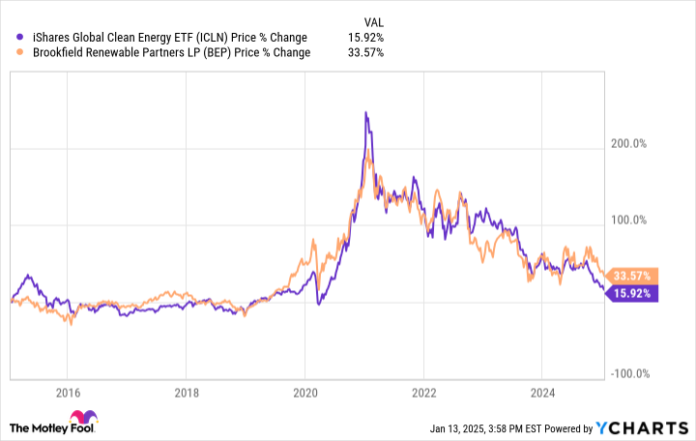

Reuben Gregg Brewer (Brookfield Renewable): The fast-term reason why to shop for blank energy-focused Brookfield Renewable is that the marketplace has cooled at the renewable energy area. After a stunning and speedy value building up that began in 2019, Brookfield Renewable has fallen again to Earth at the side of the remainder of the blank calories sector.

ICLN information through YCharts.

Having misplaced greater than part its price, Brookfield Renewable is providing a 6.3% yield for its partnership magnificence and a 5.2% yield for its company magnificence. The 2 categories are in large part equivalent, with the decrease yield for the company stocks bobbing up from greater investor call for (some huge traders, like pension price range, are barred from proudly owning partnerships).

The ones yields are sponsored through dividends that experience grown steadily through the years, and there is no reason why to consider Brookfield Renewable would possibly not proceed to hit its goal of five% to 9% annual distribution expansion. All in, Brookfield Renewable looks as if a dividend expansion inventory lately on sale.

The longer-term reason why to love Brookfield Renewable is its blank calories focal point, the place call for is predicted to develop for many years. However it’s the breadth of Brookfield Renewable’s portfolio this is so engaging. It performs within the hydroelectric, sun, wind, garage, and nuclear areas. And its portfolio is globally different.

Principally, it could actually make investments opportunistically around the blank calories spectrum. That matches completely with its lively portfolio method, as control likes to shop for property when they’re reasonable, building up their price thru funding and astute control, after which promote if a excellent value is obtainable.

In case you are making an allowance for blank calories investments, Brookfield Renewable is the only I might pick out. (In reality, I did pick out it, purchasing LP gadgets myself in overdue 2024.)

Source of revenue and visual expansion coming down the pipeline

Matt DiLallo (Endeavor Merchandise Companions): Endeavor Merchandise Companions did not waste any time extending its distribution expansion streak through every other 12 months. The grasp restricted partnership (MLP) greater its quarterly distribution through 1.9% in comparison to its prior fee degree previous this month (and three.9% above the year-ago degree). As a result of that, 2025 will mark its twenty seventh immediately 12 months of accelerating its distribution. With that lift, the midstream massive now yields 6.4%. That gives traders with a really nice base go back.

Along with that profitable source of revenue circulation, Endeavor Merchandise Companions provides very strong expansion possibilities. The MLP closed its extremely accretive acquisition of Pinon Midstream overdue final 12 months. The $950 million deal will upload about $0.03 consistent with unit to its distributable coins movement this 12 months prior to factoring in any get pleasure from industrial and running synergies.

On best of that, the pipeline corporate will get pleasure from the final touch of enlargement initiatives. Ultimate 12 months, the MLP finished two fuel pipeline vegetation: its Texas Western Merchandise Gadget and the primary segment of its Morgan’s Level Flex Enlargement.

In the meantime, CEO Jim Teague famous within the third-quarter profits liberate that it is “heading in the right direction to finish building on two Permian processing vegetation, the Bahia pipeline, Fractionator 14, Segment 1 of our Neches River NGL Export Terminal and the final segment of our Morgan’s Level Terminal Flex Enlargement in 2025.” He added that “those initiatives supply visibility to new resources of money movement for the partnership.”

The MLP is operating to protected further enlargement initiatives that may improve and lengthen its long-term expansion outlook. It is creating a big offshore oil port challenge, a carbon dioxide transportation answer, and different initiatives, together with further fuel pipeline capability to enhance AI information facilities. In the meantime, Endeavor Merchandise Companions has considerable monetary flexibility to proceed making accretive acquisitions as alternatives rise up.

With a high-yielding, regularly rising distribution and considerable profits expansion coming down the pipeline, Endeavor Merchandise Companions stands proud as one of the vital best calories shares to imagine purchasing this 12 months.

Tough expansion drivers

Neha Chamaria (NextEra Power): Stocks of NextEra Power ended 2024 with 18% good points even supposing they misplaced just about 15% in price within the final quarter of the 12 months. The drop gave the impression unwarranted, given the corporate’s numbers and outlook thru 2027, which is why NextEra Power is amongst my best calories choices for 2025.

NextEra grew its adjusted profits consistent with proportion (EPS) through 9% all the way through the primary 9 months of 2024. Stable capital spending on its application trade, Florida Energy & Mild Corporate (FPL), continues to repay thru common base fee will increase and better earnings.

Its renewable calories arm, in the meantime, is regularly rising its backlog. Via the tip of the 1/3 quarter, NextEra Power’s renewables and effort garage backlog had grown to just about 24 gigawatts (GW). For point of view, the corporate used to be then running round 36 GW of capability.

NextEra Power estimates that its doable renewable capability in operation may just develop to greater than 46 GW through 2027. This expansion and controlled returns from FPL will have to spice up NextEra Power’s adjusted EPS through 6% to eight% between 2023 and 2027. Control may be assured about expanding the once a year dividend consistent with proportion through round 10% thru 2026.

A rising dividend sponsored through profits and cash-flow expansion will have to be mirrored in NextEra Power’s inventory value. NextEra has a strong dividend observe file, having grown its dividend consistent with proportion through a compound annual expansion fee of just about 10% between 2003 and 2023.

Prior to now 10 years by myself, the inventory has generated just about 240% in general returns (together with reinvested dividends). I consider NextEra Power will have to proceed to praise shareholders and is a rock-solid inventory to shop for in 2025 for the longer term.