Two of the freshest names within the eating place trade combat it out on your hard earned funding bucks.

Dutch Bros (BROS -1.27%) and Cava (CAVA 0.61%) are amongst the freshest client shares. Each firms are emerging stars with room to increase throughout the USA. Dutch Bros is disrupting a aggressive espresso panorama with its drive-through shop fashion, whilst Cava Workforce is setting up its logo because the chief in Mediterranean meals.

Each shares have outperformed the wider marketplace over the last 19 months, however that is historical past. Which inventory is the simpler purchase presently?

I did the homework on every and when put next their industry fashions, funds, and valuations to resolve which inventory makes extra sense for traders lately.

Here’s what you wish to have to understand.

Dutch Bros could have extra growth doable, however Cava’s industry efficiency shines brighter

Each firms perform in the similar trade however have massively other industry fashions. Dutch Bros essentially sells espresso and effort beverages, which individuals steadily seize and pass. The corporate emphasizes small drive-through retail outlets that may procedure orders briefly. You’ll be able to seize a meal from a Cava shop at the run, however meals is inherently slower to organize, and folks steadily sit down and devour. Eating places additionally require kitchens, so they could want extra sq. photos and price extra to open.

Dutch Bros these days has 950 retail outlets in comparison to Cava’s 352. Each firms may just open new retail outlets for years, however because of its drive-through shop fashion, I feel Dutch Bros will in the long run open extra places. Alternatively, Cava shines on the person shop stage. The corporate has grown same-store gross sales at a double-digit fee in 4 of the previous 5 quarters. In the meantime, Dutch Bros has normally produced low to mid-single-digit same-store gross sales enlargement over the last two years. In different phrases, Dutch Bros is rising extra from opening new retail outlets than Cava, which has loved a spice up from sturdy same-store efficiency.

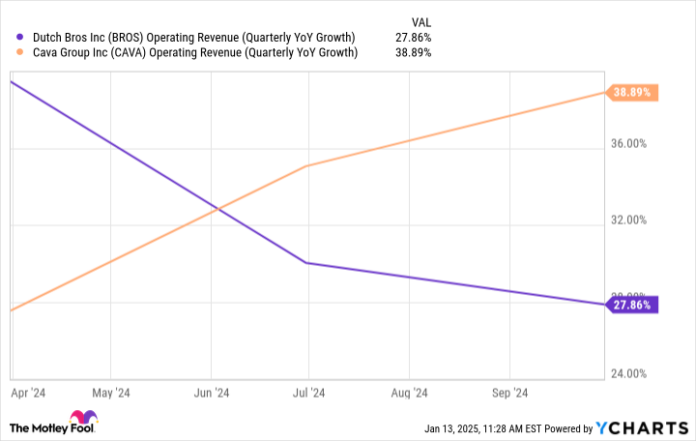

Cava’s earnings enlargement has speeded up in fresh quarters whilst Dutch Bros’ has slowed:

BROS Operating Revenue (Quarterly YoY Growth) knowledge by means of YCharts

Lengthy-term traders would possibly hope Dutch Bros follows a trajectory like Starbucks. The espresso large has over 18,000 retail outlets lately in North The us. In the meantime, Cava resembles a fellow area of interest meals eating place logo in Chipotle Mexican Grill. Chipotle hopes to sooner or later perform 7,000 retail outlets throughout North The us, a way smaller footprint.

The excellent news is that each can paintings. Starbucks and Chipotle have enriched traders through the years.

Cava’s financials may just result in eventual proportion repurchases

The natural same-store enlargement has additionally helped Cava’s financials. The industry is already money flow-positive with $43 million in loose money circulation over the last 4 quarters on $913 million in earnings. Dutch Bros has generated virtually $1.2 billion in earnings however has burned $10 million in money.

The good factor for Cava is that it might fund new places organically. It owns all of its retail outlets — and bears the prices to open and perform them. The money circulation indicators the industry is successful regardless of the ones enlargement investments, and the money circulation provides to a powerful stability sheet with $367 million in money and no debt. Dutch Bros has numerous money on its stability sheet ($281 million) but additionally already has $240 million in long-term debt.

Cava may just start proportion repurchases within the subsequent couple of years (some other Chipotle transfer), investment its shop growth whilst the use of extra money to decrease its proportion rely and power revenue according to proportion (and the inventory charge) upper through the years.

Alternatively, Cava’s competitive valuation complicates the realization

All else equivalent, Cava is these days the simpler industry. It has awesome same-store gross sales enlargement, numerous room for growth, sturdy money circulation, and a good stability sheet.

However valuation issues, and Cava has been on an absolute heater for the reason that inventory went public. As of late, Cava trades at a price-to-earnings ratio of 240. In the meantime, analysts estimate the corporate will develop revenue by means of a median of 30% once a year over the long run. Dutch Bros is not affordable, both; the inventory has a P/E of 172, with analysts calling for 35% annualized long-term revenue enlargement.

Should you use the PEG ratio to check every inventory’s valuation to its enlargement fee, traders will have to pay way more for Cava’s enlargement (8.0 PEG ratio) than Dutch Bros’ (4.9).

Cava is an exceptional industry, however Dutch Bros isn’t any slouch. As of late, Dutch Bros is the simpler purchase. If Cava’s valuation sinks to a extra affordable stage, traders can be sensible to leap on it. Till then, even nice firms can also be deficient shares if the associated fee is simply too excessive.

Justin Pope has no place in any of the shares discussed. The Motley Idiot has positions in and recommends Chipotle Mexican Grill and Starbucks. The Motley Idiot recommends Cava Workforce and Dutch Bros and recommends the next choices: quick December 2024 $54 places on Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.