Each chipmakers are heading in the right direction to ship exceptional enlargement because of the tough call for for AI chips.

The semiconductor {industry} is anticipated to generate $611 billion in income this yr as in step with International Semiconductor Industry Statistics (WSTS), which might be a soar of 16% from remaining yr’s ranges, and the nice phase is that the expansion is ready to proceed in 2025 as smartly with an estimated building up of 12.5% in income subsequent yr.

Synthetic intelligence (AI) has became out to be one of the crucial key causes at the back of the wholesome enlargement of the semiconductor {industry}. The proliferation of this era has pushed an building up in call for for more than one kinds of chips starting from application-specific built-in circuits (ASICs) to processors to reminiscence.

Corporations corresponding to Nvidia (NVDA -3.26%) and Micron Era (MU -2.86%) have became out to be large beneficiaries of the expansion in AI-fueled semiconductor call for. Nvidia’s dominant place in AI graphics processing devices (GPUs) has ended in eye-popping enlargement in its income and profits in fresh quarters, with stocks of the corporate up 193% this yr.

Micron, alternatively, has additionally stepped at the gasoline of overdue, despite the fact that its inventory worth soar of 27% pales compared to Nvidia’s. On this article, we can take a better have a look at the possibilities and the valuation of each corporations to determine which this type of two is the simpler AI inventory to shop for at the moment.

The case for Nvidia

The call for for information heart GPUs has merely taken off up to now couple of years because the race to coach and deploy AI fashions has intensified. Nvidia has became out to be the go-to provider of knowledge heart GPUs, controlling an estimated 98% of this marketplace in 2023. The corporate bought an estimated 3.76 million information heart GPUs remaining yr, an building up of 42% from the previous yr.

The excellent news for Nvidia buyers is that the call for for AI GPUs stays tough. International Marketplace Insights estimates that the knowledge heart GPU marketplace may just clock an annual enlargement price of 28% thru 2032. Given Nvidia’s dominant place on this marketplace, it’s simple to peer why the corporate’s GPU shipments are anticipated to go upper in 2025.

As an example, marketplace analysis company TrendForce forecasts a 55% building up in shipments of Nvidia’s high-end GPUs subsequent yr, pushed via the arriving of the corporate’s new Blackwell chips. There’s a risk that Nvidia could possibly generate information heart income of $200 billion subsequent yr, which might be just about double the present fiscal yr’s income run price of $98 billion (Nvidia reported $49 billion in information heart income within the first six months of the present fiscal yr).

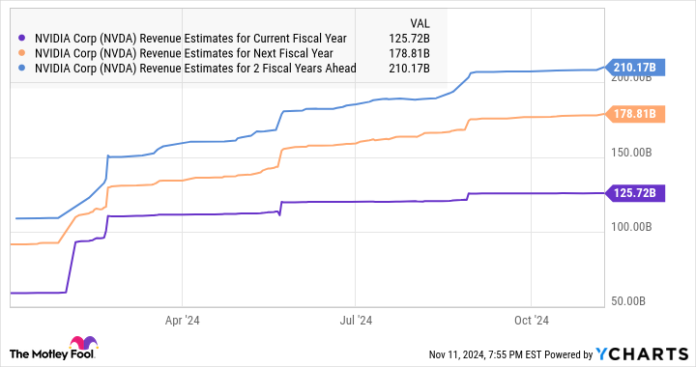

If that is certainly the case, Nvidia may just simply overwhelm Wall Side road’s income expectancies within the subsequent fiscal yr. The corporate is anticipated to complete its ongoing fiscal yr 2025 with just below $126 billion in income, which might be greater than double the $60.9 billion it delivered within the earlier fiscal yr.

NVDA Revenue Estimates for Current Fiscal Year information via YCharts

Because the chart above tells us, analysts expect Nvidia’s income to extend every other 42% within the subsequent fiscal yr, adopted via a 17% building up in fiscal 2027. Alternatively, there’s a sturdy probability that Nvidia could possibly exceed those estimates because of the expansion it’s clocking in nascent however fast-growing niches corresponding to information heart networking, sovereign AI, and undertaking AI device.

Those numerous catalysts counsel that Nvidia is heading in the right direction to stay a most sensible AI inventory going ahead since it’s taking a look to enlarge its succeed in into markets past simply information heart GPUs.

The case for Micron Era

The call for for reminiscence chips which might be utilized by the likes of Nvidia of their AI GPUs has shot up large time, main to an enormous turnaround within the fortunes of Micron Era. The reminiscence specialist completed fiscal 2024 (which ended on Aug. 29) with a 61% spike in income to $25.1 billion and posted a benefit of $1.30 in step with proportion as in comparison to a lack of $4.45 in step with proportion in the similar quarter remaining yr.

Micron control identified in its fresh profits unencumber that “tough AI call for drove a powerful ramp of our information heart DRAM merchandise and our industry-leading excessive bandwidth reminiscence.” The great phase is that the reminiscence {industry} is anticipated to maintain its terrific momentum in 2025 as smartly. Consistent with TrendForce, the dynamic random get right of entry to reminiscence (DRAM) marketplace may just witness a 51% building up in income subsequent yr to $136.5 billion, pushed via the rising intake of high-bandwidth reminiscence (HBM) that is deployed in AI chips.

For the reason that DRAM accounted for 70% of Micron’s overall income within the earlier fiscal yr, the wholesome possibilities of this marketplace bode smartly for the chipmaker. Even higher, the NAND flash garage marketplace (which produces the remainder of Micron’s income) is anticipated to extend via 29% in 2025 and generate $87 billion in income.

Those sunny end-market possibilities point out why Micron’s steering for the present quarter is terribly forged. The corporate is expecting $8.7 billion in income within the first quarter of fiscal 2025, along side non-GAAP (adjusted) profits of $1.74 in step with proportion. The highest-line estimate issues towards an 84% building up from the similar length remaining yr, suggesting that Micron is heading in the right direction to ship even more potent enlargement within the present fiscal yr.

Consensus estimates compiled via Yahoo! Finance are forecasting Micron’s income to extend 52% on this fiscal yr to $38.2 billion, adopted via a 20% building up in fiscal 2026 to $45.7 billion. The ground-line enlargement is anticipated to stay tough as smartly when in comparison to remaining fiscal yr’s studying of $1.30 in step with proportion.

MU EPS Estimates for Current Fiscal Year information via YCharts

So, similar to Nvidia, Micron looks as if a forged AI inventory. However if you happen to had to make a choice from this type of two names, which one must you be purchasing?

The decision

The above dialogue tells us that each Micron and Nvidia are heading in the right direction to ship spectacular ranges of enlargement because of AI-driven call for for his or her chips. Alternatively, if you are taking a look to make a choice from those two semiconductor corporations to capitalize at the AI growth, a better have a look at their valuations will make the selection more straightforward.

Because the chart underneath tells us, Micron is considerably inexpensive than Nvidia.

NVDA PE Ratio (Forward) information via YCharts

After all, Nvidia turns out deserving of a top class valuation because of its spectacular proportion of the AI chip marketplace, however the tempo at which Micron is rising can’t be overlooked, both. So, buyers on the lookout for a mixture of price and enlargement can imagine purchasing stocks of Micron Era at the moment as a result of its valuation and strong profits enlargement possibilities that would lend a hand this tech inventory maintain its newly discovered momentum and soar upper.