Two of the most important names in synthetic intelligence (AI) making an investment are Nvidia (NVDA -8.69%) and Broadcom (AVGO -6.05%). Each firms’ companies receive advantages considerably from the AI palms race, which is why traders are so all for them.

Then again, traders could also be torn as to which one is the simpler inventory to shop for presently. So, if you are taking a look so as to add to this kind of large winners, which one must you select?

Nvidia and Broadcom are competing for computing {hardware} marketplace percentage

First, let’s check out what each and every corporate does perfect.

Nvidia makes graphics processing gadgets (GPUs) and more than a few {hardware} and device to toughen their use. Whilst GPUs were given their get started in gaming graphics, they are able to even be used to mine cryptocurrencies, procedure engineering simulations, and assist self reliant automobiles navigate. Those are massive use circumstances however are dwarfed via the large call for for GPUs from the AI sector.

GPUs are standard as a result of they are able to procedure a couple of calculations in parallel and be hooked up in clusters to additional magnify this impact. Nvidia is the highest GPU manufacturer, and its inventory efficiency backs up that observation.

Broadcom is a much wider industry than Nvidia. It has merchandise starting from mainframe computer systems and device to cybersecurity answers and digital desktop device. Then again, the 2 product strains that excite AI-focused traders are its customized accelerators and connectivity switches.

Broadcom’s connectivity switches assist direct site visitors in information facilities and are an important a part of making environment friendly methods. Its customized AI accelerators are a right away competitor to Nvidia’s GPUs and are designed via Broadcom and its tech massive companions (like Alphabet (GOOG -2.07%) (GOOGL -1.92%)) to higher maintain AI workloads. However those customized accelerators won’t dethrone GPUs, as they’re best a more sensible choice when a workload is in particular configured to be run thru a Broadcom-designed accelerator.

Broadcom sees an enormous marketplace for those customized accelerators and believes it is going to be within the vary of $60 billion to $90 billion via 2027. For the reason that Broadcom’s AI earnings base was once $12.2 billion in fiscal 12 months 2024 (which contains its connectivity switches and customized accelerators), this could constitute large enlargement. It might additionally most likely take marketplace percentage clear of Nvidia, which posted information middle earnings of $115 billion in fiscal 12 months 2025 (finishing Jan. 26).

Whilst I am not going to discuss whether or not GPUs or customized accelerators would be the approach of the long run, you will need to watch a few of Nvidia’s largest shoppers to look if they start discussing the usage of their proprietary designs only or proceed to reserve mountains of Nvidia GPUs.

Whilst it is unattainable to understand how this may play out, one inventory obviously seems like a greater purchase presently.

Nvidia’s inventory is a ways inexpensive than Broadcom’s

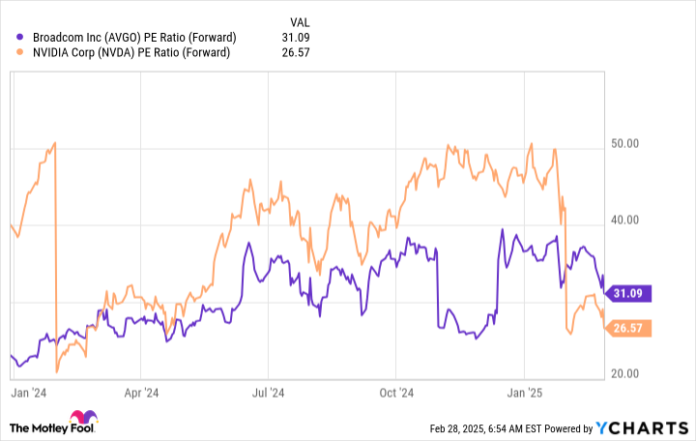

When evaluating those two shares’ valuations, the usage of a trailing income metric is unattainable as a result of Broadcom has a one-time impact that throws this metric out of whack. As a substitute, I’m going to use the ahead price-to-earnings (P/E) ratio to evaluate each and every inventory’s valuation.

AVGO PE Ratio (Forward) information via YCharts

At 27 instances ahead income, Nvidia’s inventory is a good bit inexpensive than Broadcom’s. That is noteworthy, as Nvidia is rising a ways sooner than Broadcom.

Whilst traders are desirous about the potentialities of Broadcom’s AI {hardware}, the truth is that it best makes up a fragment of the corporate’s overall earnings. In 2024, its AI-related earnings was once $12.2 billion, about 24% of overall earnings. Whilst those segments have been rising briefly, they have been drowned out via their total industry.

At face worth, Broadcom appeared love it grew 44% 12 months over 12 months, however Broadcom’s VMware acquisition closely influenced that. With out that acquire, Broadcom’s earnings best grew 9% organically. Distinction that with Nvidia’s fiscal 12 months 2025 enlargement of $130.5 billion, up 114% 12 months over 12 months, and it is transparent that Nvidia is the simpler inventory to shop for.

Whilst Broadcom could also be a darling available in the market’s eyes, it is transparent that Nvidia remains to be the simpler inventory to shop for presently. With Nvidia’s inventory somewhat vulnerable following income, traders must use this chance to scoop up stocks of this dominant AI participant.

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Alphabet and Nvidia. The Motley Idiot has positions in and recommends Alphabet and Nvidia. The Motley Idiot recommends Broadcom. The Motley Idiot has a disclosure coverage.